In futures, limit orders are futures bought/sold in the market at the price designated by traders, while market orders are futures executed according to the market prices of existing buyers or sellers.

When you set a limit order, there are two order types you can choose: limit order and stop-limit order, just as the market order and stop-market order are available when you create a market order.

Limit Order

- What is a limit order?

Limit orders are bought/sold at the price designated by traders. In other words, these orders are executed when the market prices reach the preset figure. There are four Execution Types when creating a limit order: - Always Valid;

- IOC (Immediate or Cancel);

- FOK (Fill or Kill);

- Post Only.

- How to create a limit order when trading futures?

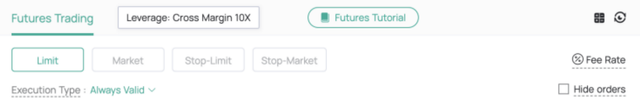

In the case of the BTC/USDT futures market, suppose User A bought (longed) BTC with USDT, he would need to go through the steps below:

Set the margin and leverage ratio (Cross Margin 10X in this case);

Select [Limit] and the default Execution Type is [Always Valid];

Set the [Price] to 50,000 and the [Amount] to 0.1;

Check and confirm the [Execution Value] and click on [Buy BTC].

Once the limit order is created, it will be sent to the market, and the order will be executed when the market price of BTC reaches 50,000 BTC.

Stop-Limit Order

What is a stop-limit order?

In a stop-limit order, the stop price and the price & amount are all pre-determined. The system will execute the order at the preset price and amount when the latest market price reaches the stop price.How to create a stop-limit order?

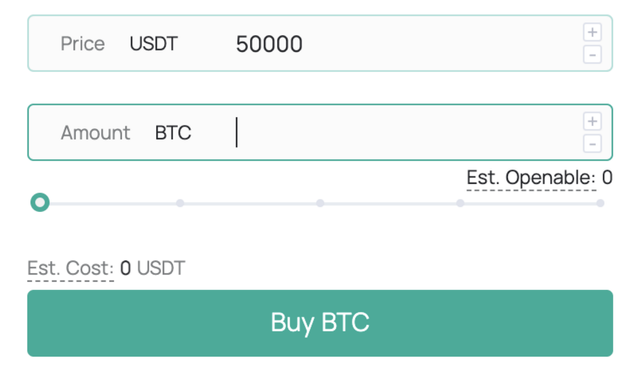

In the case of the BTC/USDT futures market, suppose User A believes that BTC will peak at 53,000 USDT, he could sell his BTC holding by creating a stop-limit order, which roughly involves the steps below:

Set the margin and leverage ratio (Cross Margin 10X), and select [Stop-Limit];

Set [Stop] to 53,000;

Set [Price] to 53,000;

Set [Amount] to 0.1;

Click on [Sell BTC].

Once the stop-limit order is created, it will not be immediately sent to the market; the system will send the order (sell 0.1 BTC at 53,000 USDT) into the market if it is triggered when the latest market price reaches 53,000 USDT.

Market Order

What is a market order?

A market order is executed sequentially at the current market prices of existing buyers or sellers according to the buying/selling amount. If the market has insufficient opponents, those orders that cannot be executed will be canceled. If the market has no opponents at all, the order cannot be submitted.How create a market order?

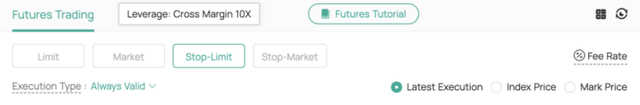

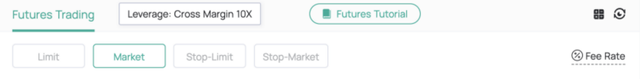

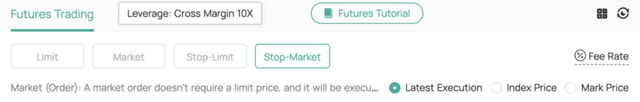

In the case of the BTC/USDT futures market, suppose User A plans to buy (long) BTC by creating a market order, he would need to go through the steps below:

Observe the market depth of existing sell orders;

Set the margin and leverage ratio (Cross Margin 10X), and select [Market];

Set the [Amount] to 0.1;

Click on [Buy BTC].

Stop-Market Order

- What is a stop-market order?

In a stop-market order, the stop price and amount are both pre-determined. The system will execute the order at the market price and the preset amount when the latest market price reaches the stop price. - How to create a stop-market order?

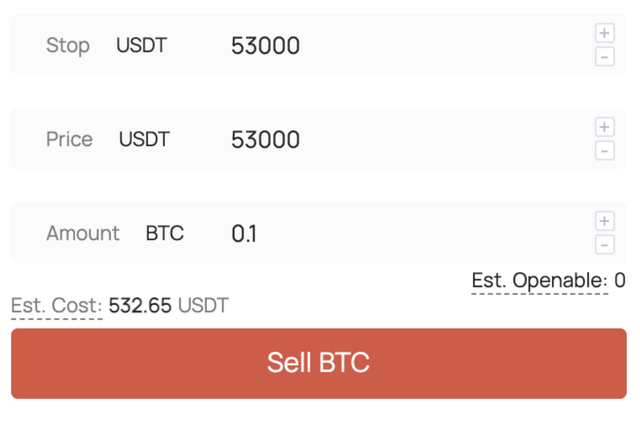

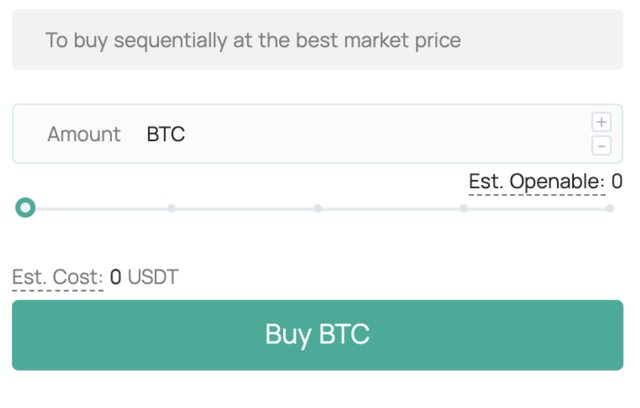

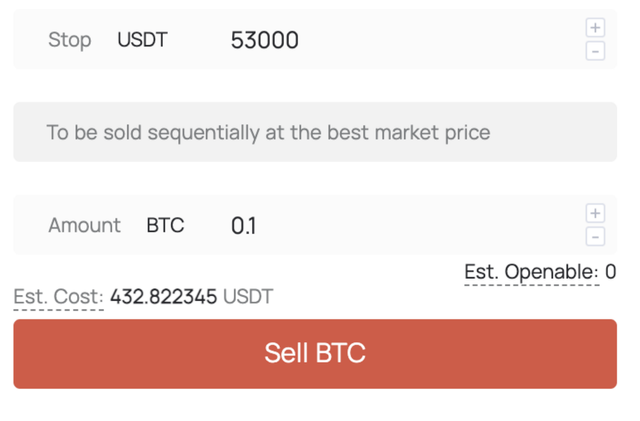

In the case of the BTC/USDT futures market, suppose User A believes that BTC will peak at 53,000 USDT, he could sell his BTC holding by creating a stop-market order, which roughly involves the steps below:

Set the margin and leverage ratio (Cross Margin 10X), and select [Stop-Market];

Set [Stop] to 53,000;

Set [Amount] to 0.1;

Click on [Sell BTC].

Once the stop-market order is created, it will not be immediately sent to the market; the system will sell the order (sell 0.1 BTC at market price) at the best market prices sequentially until the order has been completely executed.