Contract clauses and financial models illustrating how proceeds are distributed among different shareholders at exit are frequently referred to as waterfalls. They can be very complicated.

It seems that the VC funding market cooled off a little after reaching a peak in 2015. In colder markets, investors have a stronger tendency to get creative on terms, especially if not much competitive pressure is felt around a deal. One of the the things investors like getting creative about is liquidation preferences. In this post I will outline why I think you should try to push back hard on complicated and aggressive liquidation preferences during your financing round.

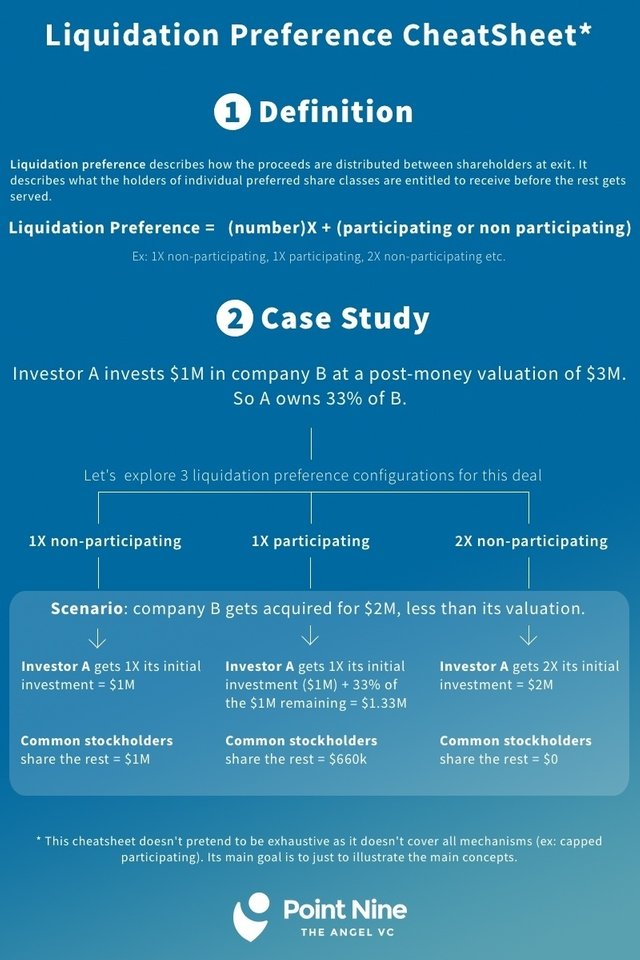

A lot has been written about liquidation preferences and you can check out this post by Brad Feld for a good intro. In short, the liquidation preference language describes how the proceeds are distributed between shareholders at exit. It describes what the holders of individual preferred share classes are entitled to receive before the rest gets served.

It typically has two components, (1) a minimum multiple or interest relating to the original investment amount and (2) a participation or lack thereof which describes whether the preference represents a minimum return threshold after which everyone gets served pro-rata or whether it comes ‘on top’.

A simple (1x) non-participating liquidation preference ensures that, at an exit event, investors get the money they invested into a company returned to them first, before proceeds are distributed to everyone else according to ownership %-tages. I do believe that a simple 1x non-participating liquidation preference is absolutely the right thing in early stage VC deals. Fred Wilson outlines nicely why in this post. Anything beyond that for the investors, however, is tricky, not always fair and full with potential for unintended consequences.

We believe, and our experience and industry statistics prove it, that in early stage venture investments money is not made with contracts. You typically either make a lot with an investment, lose all or most of it, or make very little. In a bigger picture, even if liquidation preferences at exit come into effect in a way that benefits the investor, this does not increase his or her overall returns materially.

Yet, many investors will ask for liquidation preferences, because, in theory, a liquidation preference sounds great. After all, it reads like a guarantee to lock in returns. An investor might think: let's ask for a participating liquidation preference and I’ll make quite some return even if the valuation does not increase. Or, even better, let’s ask for a participating liquidation preference with an interest. How about 8% per year? After all, this is my hurdle rate (minimum fund return below which no profit participation is paid to fund managers), so I need to make at least that much in every deal.

Sometimes entrepreneurs may be happy to agree to a participating, growing or multiple liquidation preferences, typically in exchange for a higher headline valuation. Here are five reasons why I think that such structures are a bad thing, especially in early stage VC deals (Seed, A, B):

By design, every liquidation preference skews the distribution of exit proceeds away from ownership %-tages. I think this works OK in case of 1x non-participating liquidation preferences, which are irrelevant if the exit price is above the entry price of a negotiated funding round. Multiple and / or participating liquidation preferences can skew distributions much more heavily, even at higher outcomes. This leads to sometimes very different financial incentives for investors vs founders or ESOP holders and in consequence is likely to result in conflicts. An example could be a discussion around a proposed sale of a company at a price that will allow investors to make a nice return, but due to the liquidation preference structure not much would be left on the table for common shareholders. Since we believe that the VC game is all about aligning interests, everything that misaligns them should be avoided.

Early deal structures frequently create a precedent for later stage financings. Later stage investors often ask for (at least) the terms that the early investors got...and add some things on top. So if you create a multiple / growing liquidation preference as part of your early financing you can expect that all future money will come-in at these terms, or worse. Thus, if considered long term, aggressive terms are not only disadvantageous to the founders, but can also be disadvantageous to the very early stage investors that ask for them in the first place.

The terms around a liquidation preference are frequently a heavily negotiated topic. Entrepreneurs may struggle with understanding the idea when confronted with it for the first time. It just makes negotiations and contracts longer, more complicated and more emotional.

Modelling liquidation preference waterfalls :-) in the contracts and later in Excel can become extremely complex, time consuming and very prone to misunderstandings.

If too much money goes into a company with aggressive liquidation preferences attached to them, it can become very demotivating to the founders and team members owning stock, thus hurting the company overall or triggering a discussion around increasing or restructuring the ESOP, e.g. through carving it out from the liquidation preference stack (have fun modeling that!).

The above are just some of the issues that come to mind when you think about the impact of aggressive liquidation preferences. In the past we made a few investments where we got participating liquidation preferences ourselves, but because of all these issues we stopped asking for them a few years ago.

If you ended up with an aggressive liquidation preference stack at your company, you might still be able to negotiate it away in your next financing round, if your position is strong enough. Or if you cannot get rid of it, you might manage to introduce a cap or minimum return threshold after which it disappears. We have seen and supported such restructurings in the past - they can sometimes be achieved, frequently to the benefit of everyone involved.

I would recommend to any venture funded entrepreneur to try to keep the liquidation preference stack as simple (ideally 1x non-participating) as long as possible. Even if it should be at the cost of a lower valuation. It will pay off in the long term.

If you are not sure you understood the concept of a liquidation preference well enough you might wanna check out the cheatsheet below prepared by Clement. He reviewed a version of this post and thought a cheatsheet will do a better job at explaining the basic concept of the liquidation preference than my text :-) Thanks Clement, and Christoph, for reviewing this post.

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

To get off this list, please chat with us in the #steemitabuse-appeals channel in steemit.chat.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit