The concept of liquidity has many facets, and that they influence the worth of Bitcoin. a method of defining liquidity is that the ability of an asset to be converted to cash on demand. Another view is that liquidity is decided by the bid-ask spread, and an investment with a lower bid-ask spread has higher liquidity. Liquidity thus means there aren’t discounts or premiums attached to an asset during buying or selling, and it's easy to enter and exit the market.

The market usually becomes more competitive as more of an item is bought and sold. the power to charge a premium or get a reduction diminishes. Such an asset typically trades near the market value . The forex market is usually viewed because the most liquid market. consistent with the Bank for International Settlements (BIS), the typical turnover within the forex market was about $6.6 trillion daily as of April 2019.1 On the opposite hand, land may be a classic example of an illiquid asset. Buying and selling land often involves months of labor , negotiations, filling out tedious forms, and paying substantial commissions.

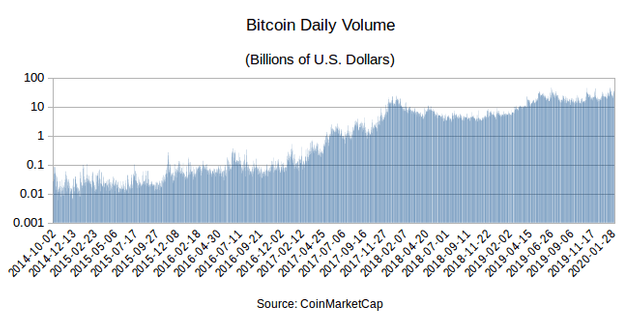

Bitcoin Daily Volume

Liquidity is important for any tradable asset, which includes the cryptocurrency Bitcoin. Liquid markets are deeper and smoother, while an illiquid market can put traders in positions that are difficult to exit. The graph above depicts Bitcoin's daily trading volume. Bitcoins have seen significant growth within the last five years, such a lot in order that the graph had to be done on a scale .

The daily volume of Bitcoin was under $100 million per day in 2014, and sometimes it fell below $10 million. By early 2018, that number had grown to over $20 billion. However, the cryptocurrency has witnessed episodes of illiquidity. After the Bitcoin price crashed, volume often fell below $5 billion per day. However, Bitcoin's daily volume routinely exceeded $20 billion again by early 2020. Let’s take a glance at the most factors that influence the liquidity of Bitcoin.

Exchanges

The increase within the number of trusted Bitcoin exchanges will provide a chance for more people to trade their coins. the rise in frequency and volume of trading helps to reinforce liquidity. Some people are holding their bitcoins outside of exchanges. As popular exchanges become safer , more of those holders are willing to trade their bitcoins, which adds buyers and sellers.

Acceptance

The increased acceptance of Bitcoin at brick and mortar stores, online shops, and other businesses can help to spice up its usability and reduce its volatility. The more it's used as a medium of exchange, the more liquid Bitcoin becomes. There was a growing trend in acceptance by retailers, but high speculative demand ate into the availability available for commerce. Then, the utilization of Bitcoin in retail transactions suffered from negative publicity associated with the 2017-2018 price crash and cryptocurrency scams. 2 3 the longer term of cryptocurrencies as a medium of exchange looks brighter in 2020 than it did two years ago, but it remains uncertain.

ATMs & Payment Cards

The network of cryptocurrency ATMs has continued to grow fairly steadily whilst prices fluctuated wildly. The Bitcoin ATMs are of great importance for wider acceptance, as they also facilitate the buying of bitcoins. many of us aren't comfortable with online exchange transactions, so these ATMs are an excellent resource in such cases. However, this mode of creating purchases is far more costly than online exchanges.4

In addition to ATMs, debit cards and credit cards are increasingly important within the cryptocurrency world. These cards make it easier to hold out transactions and purchases. The launch of Bitcoin-to-cash payment cards and ATMs boost the usability and acceptance of Bitcoin. They facilitate purchases and withdrawals at the market value and help to extend liquidity while maintaining security. that would mean more ways to earn bitcoins.

Regulations

Regulations, directly and indirectly, have an important role to play. The stance of nations on Bitcoin is as different because the countries themselves. it's banned during a few, allowed in some, and disputed everywhere else. Authorities in many countries are observing things , and lots of are even performing on the regulations.

Despite the anomaly on this front, the virtual currency is growing at a quick pace. there's an increasing presence of Bitcoin within the sort of ATMs, exchanges, transactions in shops, casinos, et al. . a transparent stand by authorities on issues like consumer protection and taxation could bring more people out into the hospitable trade Bitcoin, which might affect its liquidity.

Awareness

Many people may have heard the word “Bitcoin” but are unaware of what the cryptocurrency is or how it works. Many prospective buyers, investors, and traders are among these people. Limited knowledge and lack of clear guidelines by authorities limited cryptocurrencies to enthusiasts during their first decade. because the cryptocurrency world expands, more people will study it and check out it out.

The Bottom Line

If we glance at Bitcoin as an asset, it produced lucrative returns for early investors. Bitcoin has its issues, and price volatility is one among them. The liquidity problem is one among many factors that cause sudden movements within the Bitcoin price. Thus, improved liquidity can help to scale back the risks of Bitcoin. The way forward for this currency is tough to predict, but its foothold is increasing with time.

Compete harmless with $100,000 in Virtual Cash

Put your trading skills to the test with our FREE Stock Simulator. Compete with thousands of Investopedia traders and trade your thanks to the top! Submit trades during a virtual environment before you begin risking your own money. Practice trading strategies in order that when you're able to enter the important market, you've had the practice you would like . Try our Stock Simulator today >>