No one ever said that the cryptocurrency markets weren't volatile, and the vast majority of investors know what they're getting into. Still, the volatility that began near the beginning of June and lasted until just a few days ago, got everyone's attention.

(This article originally appeared on Crush The Street -- https://crushthestreet.com/articles/breaking-news/litecoin-proves-worth-stable-cryptocurrency)

The CrushTheStreet Staff Is Consistently Researching The Most Important Investment Research. Our Goal Is To Magnify Your Financial Education At These Critical Times. Gain Immediate Access To Our Wide-Range of Top-Conviction Reports HERE!

From a session high just short of hitting $3,000, the king of cryptos bitcoin saw its market value hemorrhage by 38% over a month-long period. Fears of an upcoming soft fork, and the inability among bitcoin adherents to come to an agreement regarding the crypto's scaling problem, sent all other cryptocurrency assets tanking.

The one notable exception was litecoin. Charles Lee initially engineered litecoin to be the silver to bitcoin's gold. The irony, of course, is that silver tends to be a far more volatile commodity than gold. Nevertheless, it was litecoin that provided much-needed confidence for those long the cryptos.

When bitcoin began its descent from June 13 onwards, litecoin actually increased in market value. For example, between the 13th until the end of the month, bitcoin lost nearly 9%. During that same timeframe, litecoin gained 31.7%! In fact, while other blockchain assets were succumbing to almost-catastrophic volatility, litecoin went on to claim all-time records.

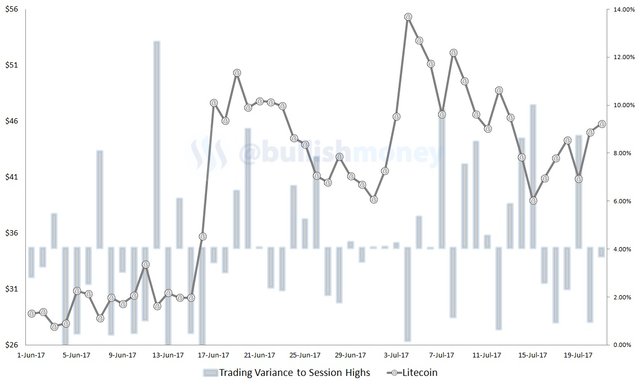

Interestingly, the "silver of the cryptos" has a trading variance between the "close" of the session and the highs of 4% since June 1. Compare that to bitcoin's trading variance, which stands at 3.35%. Essentially, the variance tells us that more investors are bullish on bitcoin at any given time than they are on litecoin.

However, the biggest variance for litecoin is 12.6%, registered on June 12. This compares favorably to bitcoin, where max variance is nearly 16%. Also, the king of cryptos incurred four separate incidents of double-digit variance. In contrast, litecoin only incurred two.

This tells me that while average trading in the litecoin market is slightly less bullish than its cryptocurrency competitors, it's much more stable. Generally speaking, you're not seeing wild speculation as you would in other blockchain assets.

So while bitcoin grabs the headlines and garners the most attention, litecoin may actually be the most appropriate investment for those unfamiliar with the cryptos. It may not move like its brethren, but it holds its value remarkably well.

BTC 33%

ETH 33%

LTC 33%

Franks "thirds rule strategy"

Resteem...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

These days any crypto coin is a pleasure to use except BTC and it's fees!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I hedged Bitcoin with my whole trading stash into Litecoin - it's solid crytpo.

Also - I just published a book on Amazon, called "Welcome to the F*cking Show: Bitcoin and Your Future With Money". If you have any new friends in crypto tell them to check it out, it's the quickest cutting of the crypto learning curve out there (I know, I've read all the Bitcoin books out there).

Cheers to crypto my friend

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very nice. I like how Litecoin transaction fees are very low compared to bitcoin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

not to mention it takes about 20 seconds to go from Coinbase to Exodus.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Готовтесь,Друзья...))...скоро ltc бабахнет ракетой..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit