Since the year 2016, P2P Lending has grown by leaps and bounds. This is evidenced with the presence of 4500 plus P2P loan platforms worldwide. China recorded to have 4000 plus platforms serving multitudes with the need for credit. Many have benefited from this new model as the loan processing periods are drastically reduced, collateral is sometimes not needed and the rates of payment including fees are favorable and transparent as compared to bankers.

Retail investors and institutional investors have been attracted to P2P lending arena. P2P lending had grown to $114 billion in 2017. A meaty attraction for investors. There are multiple applicants, freedom to choose any based on a credit score and the return on investment is high. The middleman (bankers) is cut off and thus the lender and applicant can interact directly and choose terms that are favorable for each other.

The performance has been good and the promise very attractive but there are pains that the participants face. P2P lending is let down by transparency and reputation. Loan platforms have been recorded to wound up due to defaults from untrustworthy loan applicants. Similarly some investors have been duped by fraud loan platforms that disappear with funds to be used for on-lending.

P2P Lending is booming in the consumer, invoice discounting, mortgage and business lending segments. The clientele includes students, corporate, small businesses and individuals. The promise is even larger considering commodities markets, equities, debt, cryptocurrency and crypto assets segments have not been fully brought on. So imagine all these segments having different loan platforms and the investor needs to monitor all. Log in to multiple platforms to see how returns are coming in. Manage all these funds that he/she has invested. This can be in the hundreds of platforms!

P2P Lending investments need not be restricted to a known jurisdiction or nations. Investors wish to be able to increase their holding and thus potential of gains with loan books from other countries.

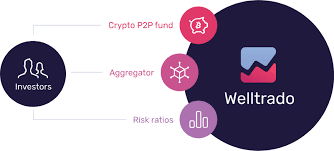

Enter Welltrado. An already operating scalable blockchain based platform that seeks to enable investors to buy and sell loans from thousands of different loan providers globally.

The pains have been solved through;

• A Cross platform loan aggregator with ratings and blockchain

• Welltrado P2P fund for global and cross-border investors

• Portfolio management of loans across platforms in a single dashboard.

The benefits to investors;

• Up to 10 times higher returns owing to the potential of cross-border opportunities.

• Up to 7 times faster access to all platforms with one click and reduced verification lead times.

• More than 10 million in loans from different platforms

• A digital lending platform, where algorithms and extensive data collection allows for real-time risk-score assessments of borrowers, as well as fast underwriting of loans. This significantly reduces the time spent to a matter of hours or days, as opposed to the long process of the traditional lending institutions.

The benefits to lending platforms;

• 10 times faster administration process as all the investors have been registered on Welltrado

• Up to 20% more investments

• 100 plus different deposit options for platforms to receive funding.

The team at Welltrado is solid with notably 3 members having experience in investment banking, analyzing and investing in equity, business development, ICO marketing, P2P lending, process development, web development, functional programming and data collection, asset management, negotiation and sales. The platform also has a very good support base of advisors.

Look them up at http://www.welltrado.io

Token Sale

• Token exchange rate: 1 ETH = 1000 WTL tokens

• Hard cap: 65,000 ETH

• Total tokens for sale: Maximum 65 Million WTL Tokens

• Bonus: Tiered in descending order every week up to June 4th

• Accepted currencies: ETH

• All unsold tokens will be burnt and there will be no token creation after the ICO.

• Token sale starts on 9th of April.

which is why your credit report is crucial I guess, more like your reputation when it comes to accessing loans.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes. With peer to peer, you need a good reputation. Trustworthiness will stand the times with no need of middlemen.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit