This article is intended as a basic overview as to the reasoning behind changing Loki’s emission curve. To this purpose we have largely simplified the factors and influences at play; for a more in depth understanding, please refer to our paper Loki Cryptoeconomics: Alterations to the Staking Requirements and the Emission Curve.

DISCLAIMER

This article contains charts and figures which include examples of return of investments and prices for the Loki cryptographic coin. These prices are examples only and are not a prediction, forecast, or representation as to any actual likelihood of price movement of the Loki cryptographic coin. The payments shown in the examples below are general in nature and will only take effect if the planned hardfork occurs. Factors outside the control of Loki could impact what actual payments are made to Service Nodes. Those parties not operating a Service Node should not rely on these examples when deciding whether or not to participate in the Loki project. This article should be read together with the Loki whitepaper and full Loki Cryptoeconomic report.

The main goals in changing the Loki emission curve are to:

Maintain Loki’s Sybil attack resistance, by

Ensuring that enough Service Nodes are incentivised to run, by

Aiming to keep the return on investment (ROI) for running a Service Node at an acceptable level.

The current emission curve is problematic because an excess of Loki is being produced which could lead to a large number of Service Nodes in the early years. While this doesn’t sound like a bad thing, considering our commitment to a decentralised network and Sybil resistance, it will become an issue when the Service Node rewards are split between too many Service Nodes.

While the price of Loki fluctuates with the cryptocurrency market, real world costs in running a Service Node exist, and the reward each Service Node receives for running must be greater than the real world cost of running. In other words, Service Node operators must be making an acceptable profit, or there won’t be incentive for them to run.

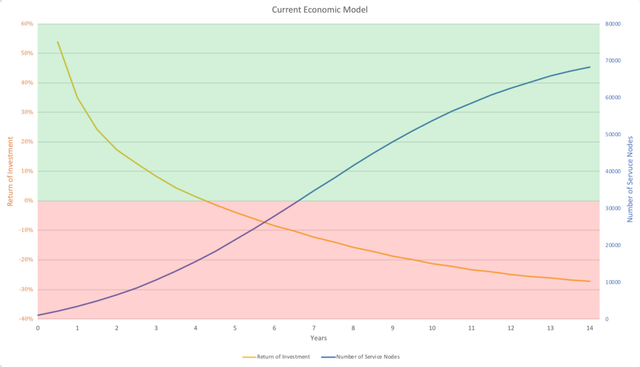

Chart 1

Chart 1 demonstrates that our current emission curve will result in many Service Nodes entering the network in the first few years, with the return on investment (ROI) quickly dropping below 0%. If too many Services Nodes run, the rewards are not worthwhile, and Services Nodes will leave resulting in a more centralised network.

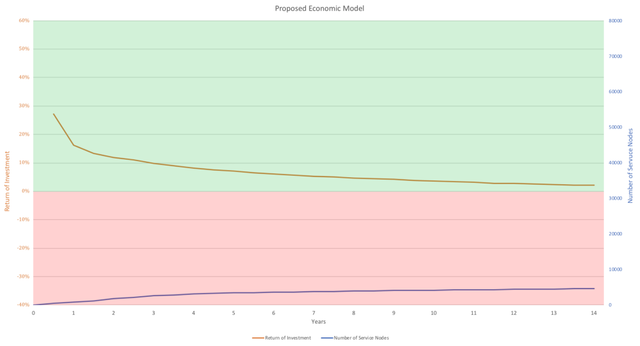

Chart 2

Chart 2 depicts the effects of Loki’s proposed new emission curve, where there are less Service Nodes from the outset, but the return on investment (ROI) remains positive. This is better for the network in the long term because these Service Nodes will be continually incentivised to run (providing market-based Sybil resistance), while retaining a decentralised network.

For further information regarding Loki Service Node game theory, and Loki Cryptoeconomics, please refer to the following reports:

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://coinlib.io/news/LOKI

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit