The world of finance is continuously changing, and the most recent breakthrough is bound to make waves in both traditional and cryptocurrency markets. The London Stock Exchange (LSE) has announced the launch of Bitcoin and Ethereum Exchange-Traded Notes (ETNs), a significant step toward the integration of digital assets into mainstream investing platforms.

The LSE's move underlines the growing acceptance and adoption of cryptocurrencies by institutional investors and established financial institutions. Bitcoin and Ethereum, the two most valuable cryptocurrencies by market capitalization, have long been sought after by investors due to their ability to provide diversification and hedge against traditional market risks.

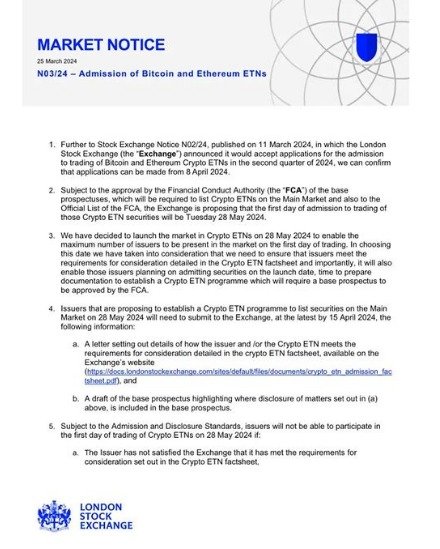

ETNs are financial products that track the performance of a specific asset or index, in this instance Bitcoin and Ethereum. By issuing ETNs for various cryptocurrencies, the LSE provides investors with a regulated and familiar way to obtain exposure to the digital asset market without actually possessing the assets.

One of the primary benefits of ETNs is their accessibility to a diverse spectrum of investors, including institutional players, retail investors, and even pension funds. This accessibility is critical for expanding the investor base and creating liquidity in the bitcoin market, hence contributing to its maturity and stability.

Furthermore, the introduction of Bitcoin and Ethereum ETNs on the London Stock Exchange lends respectability to the cryptocurrency industry. As a highly regulated and recognized exchange, the LSE's support for these digital assets demonstrates confidence in their long-term viability and potential as investment vehicles.

Investors can now trade Bitcoin and Ethereum ETNs alongside traditional equities, bonds, and other financial products, increasing portfolio flexibility and diversity. This incorporation of digital assets into traditional financial platforms reduces the distinction between traditional and crypto markets, paving the road for widespread adoption.

However, it is critical to understand that investing in cryptocurrencies, like any other asset type, entails inherent risks. The cryptocurrency market's volatility and regulatory uncertainty can cause considerable price movements and potential losses for investors. As a result, anyone considering investing in Bitcoin and Ethereum ETNs, as well as any other digital assets, must conduct extensive research and minimize risks.