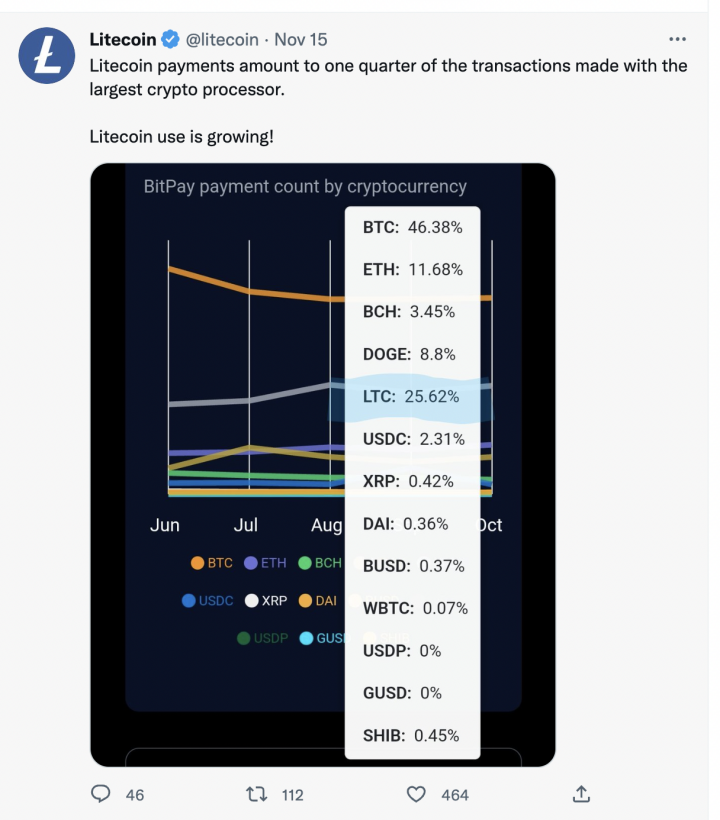

Recently, attention has been drawn to a series of sensational events, including the battle between Binance CEO CZ and SBF (Sam Bankman-Fried), the collapse of FTX and the worsening Genesis crisis. Except for those loyal followers and miners, only a few may have noticed that Litecoin (LTC) is bucking the bearish market trend and has become a top-performing cryptocurrency.

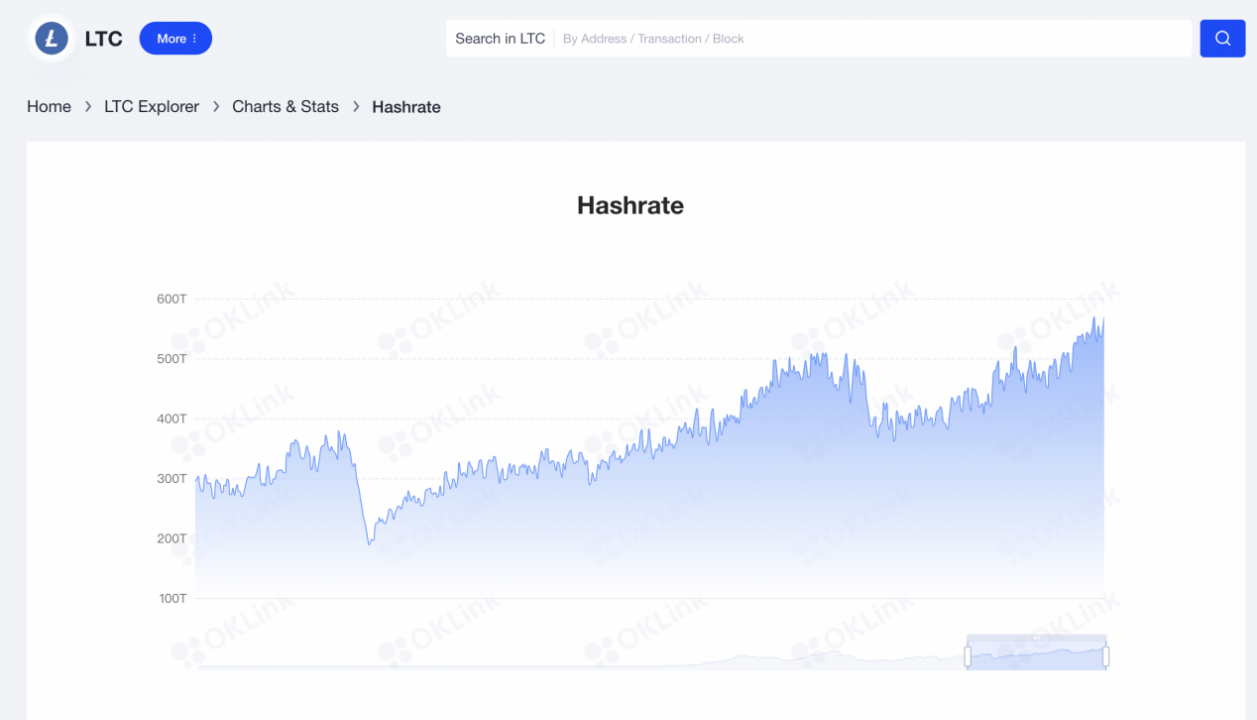

According to CoinGecko, LTC’s price rose as much as 49.4% in the past 30 days and increased 27.5% in 24 hours. LTC has successfully surpassed Solana (SOL) and Shiba Inu (SHIB), ranking 12th with a market cap of $5.76 billion. Over the past 11 months, LTC has gained 45 million new addresses (outpacing both BTC and ETH). Moreover, LTC’s average hashrate has recently exceeded 600 TH/s for the first time and kept rising to the current level of 605.9 TH/s (data as of 23 November).

As shown by the data above, LTC has outperformed most other cryptocurrencies despite the downturn in the crypto market. The impressive performance of LTC is mainly attributed to its stability and halving effect.

LTC’s stability

Cryptocurrencies have gone through 13 years of ups and downs since the genesis block of Bitcoin (BTC) was mined. For 11 years during the crypto history, LTC has sustained its presence. As one of the oldest cryptocurrencies on the market, LTC has relied on its advantages and stability to survive the increasingly fiercer competition. Amid a series of crypto “black swan” events including the collapse of FTX and the plunge of SOL price, investors become eager for stability, or rather, the stable long-term returns of LTC.

With a growing inflow of miners on the network, LTC’s hashrate increases dramatically. The increase in hashrate means that the LTC network will become more secure, stabler, and more decentralized. Some insiders also view the soaring hashrate as a signal of the rising LTC price. Another positive indicator is the increase in the on-chain trading volume, which implies an active trading market and a high level of investor confidence in LTC.

The increased trading volume will bring in more transaction fees every day, which attracts more miners to LTC. With enthusiastic miners, growing hashrate and bullish investors, the price of the crypto will naturally rise, and in turn engage more miners, thus forming a virtuous circle.

Halving effect

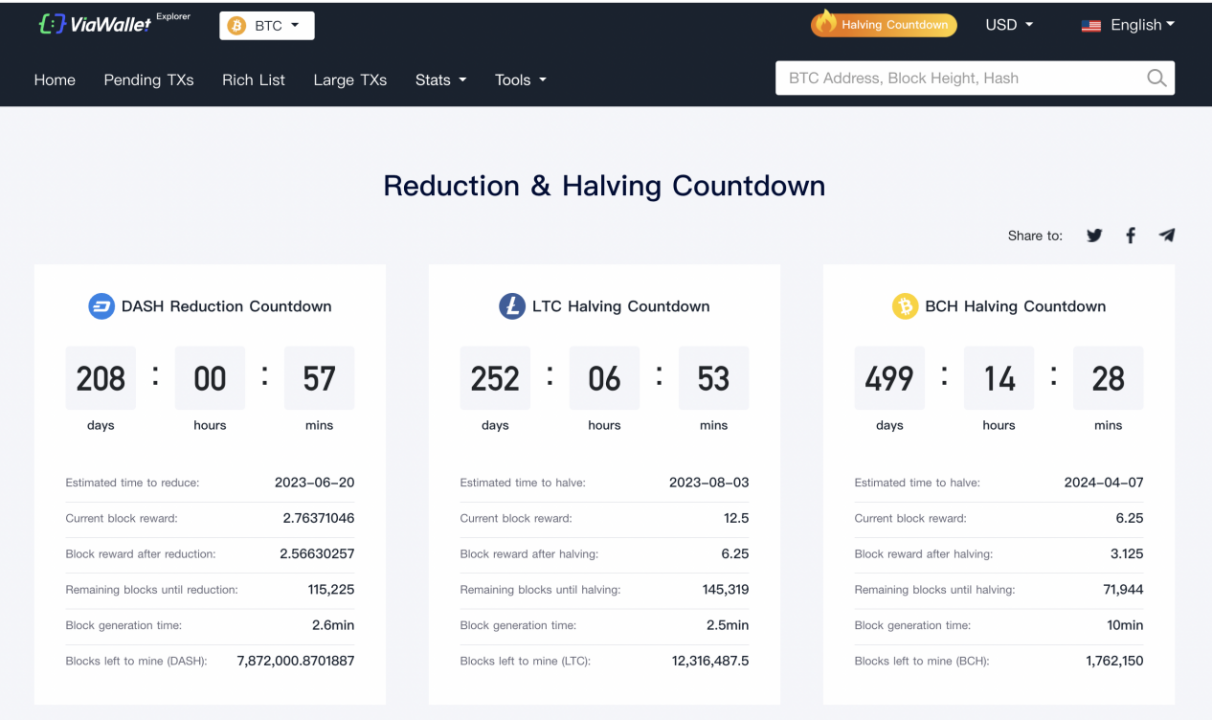

According to a well-known analyst of Coin Bureau, the recent rally behind LTC is partly associated with the “halving” which is due in 6 months. LTC is designed to reduce its mining rewards by 50% for every 840,000 blocks. The block production time on the LTC network is around 2.5 minutes, which means that halving occurs roughly every 4 years.

As shown by the latest data from ViaWallet, LTC is expected to experience its third halving on August 4, 2023 at the current rate. At present, miners get the block reward of 12.5 LTC, which will be halved to 6.25 LTC next year. If the market demand for LTC remains the same, the halved supply of LTC will push the price up.

For miners, it is a good time to get involved in LTC mining. In the crypto bear market, the price of mining machines has plummeted and the early-stage cost has been reduced. Sure enough, small miners still need to join a mining pool for steady mining profits.

As the world’s largest LTC mining pool, ViaBTC boasts 6 years of industry experience, diverse product functions, one-stop mining services, and a high reputation around the world. Empowered by ViaBTC, miners can enjoy a more efficient, convenient mining experience and maximized mining profits, with their assets well secured.

Should I continue to HODL LTC?

Historically, LTC’s price bottomed at $23 270 days before the halving, and then climbed all the way to $136. After the halving, the price fluctuated greatly for over 400 days and peaked in the bull market of 2021. Currently, the halving benefit of LTC seems to be rendered in advance. If history repeats itself, LTC’s price will hit a minor peak in January 2023. Then it may fall and enter a wobble until the next bull market.

*This article is for reference only and does not constitute investment suggestions.