How to build a real estate portfolio

Following on from our last post stocks vs Real Estate, we come to a conclusion that real estate is the better investment for many reasons. Today we are going to cover how to build a real estate portfolio, now there are many different type of real estate investment I'm going to cover the simply one (adding value)

So, you want to buy an investment property but your new to the game and don't know where to start. My advice to you is to do your research really get to know where you want to buy the middle prices of the other house of the street. You can never do too much research as this could be one of the biggest investment in your life, so you don't want to muck it up.

I choose to buy a house under value and try to increase its value by doing renovation or upgrades. Key part that need fixing are kitchen and the bathroom. These parts of the house often drag in the extra dollars when it comes to sale day.

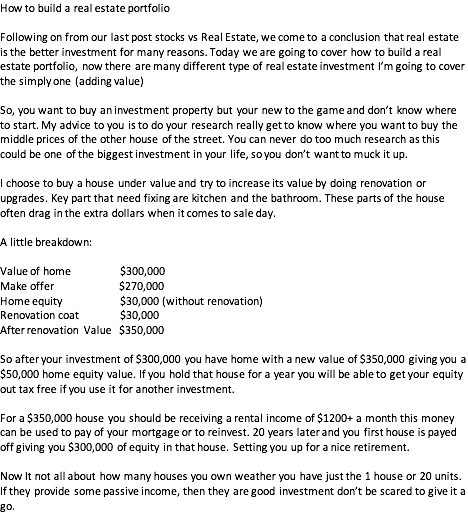

A little breakdown:

Value of home $300,000

Make offer $270,000

Home equity $30,000 (without renovation)

Renovation coat $30,000

After renovation Value $350,000

So after your investment of $300,000 you have home with a new value of $350,000 giving you a $50,000 home equity value. If you hold that house for a year you will be able to get your equity out tax free if you use it for another investment.

For a $350,000 house you should be receiving a rental income of $1200+ a month this money can be used to pay of your mortgage or to reinvest. 20 years later and you first house is payed off giving you $300,000 of equity in that house. Setting you up for a nice retirement.

Now It not all about how many houses you own weather you have just the 1 house or 20 units. If they provide some passive income, then they are good investment don't be scared to give it a go.