Come and let me take you back eight years ago on a weekday, Monday to be exact, when Lehman Brothers filled Chapter 11 bankruptcy and many others followed suit. Why did they file? They operated under false pretense of the housing market's supply and demand--which they themselves engineered. Banks gave mortgage loans to risky investments, who then went off to sell those loans to investment banks; where the investment bank would repackage them into CDOs (collatorazied debt obligation), and sold it off to a sea of investors. The principal and the interest accrued would go to the investor, while assuring full repayment even if things went south. Essentially CDO's made it worth while to own debt because the principal would be payed no matter what. However, the synthetic demand crippled the value of the homes, and many were quick to file for bankruptcy. At that point the Banks and everyone else held worthless houses that no one could afford to buy. And the crisis of credit turned dark.

The tragedy ended, now the comedy begins: after the initial domino effect at Wall Street; many insurance companies and banks were beginning to settle acquisitions and mergers with other bigger companies, banks, and even nations. The Too Big Too Fail theme was sweeping the nation like wildfire. We must save the banks and the insurance companies, or impeding economic doom will surely be on its way, many in Wall Street and politicians would say. And they did. The kleptocrats of our governing body decided buy back their pathetic assets for pennies in the dollar. Forcing the People to drink from the poisoned chalice. And for the next eight years: stock buybacks, acquisition and mergers, layoffs, and money pump to the top 1% of the top 1% saw their earnings skyrocket.

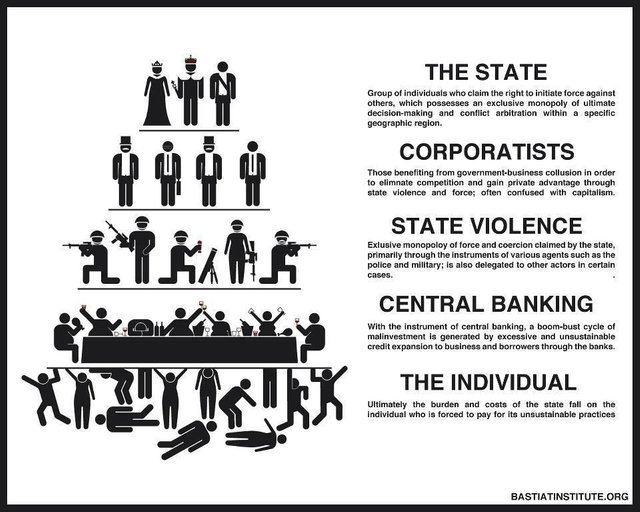

The creme brulee is to figure that public and private entities governing our lives were in on the whole scheme from the beginning. A fucking ponzi-scheme to the ^n degree.

And like every great pyramid built, the base should be considered the stronghold that keeps everything afloat. But in this economically engineered pyramid, the People that hold together everything are the first to be let go and destroyed.

The media lionized CEOs who in fact were pathetic bourgeois too fearful to be eaten by the great white shark. They rather chum the peons of his corporatist island, than have the board of directors, investors, CEOs to be the main entree. But little do they know that in doing so, they were also preparing for their inevitable demise. What other scheme could these bafoons come up with? A&M....buybacks.

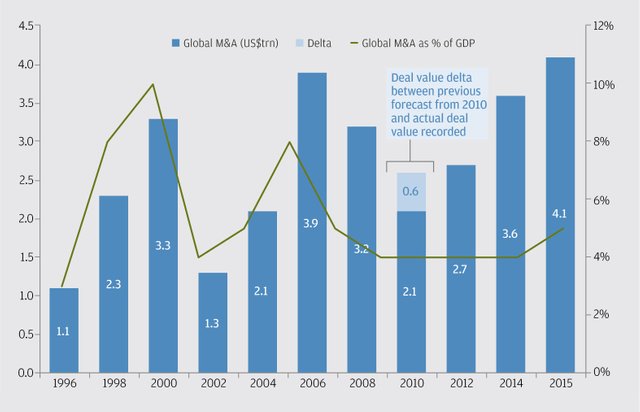

Hence the title of this blog. For it is cheaper to buy off your competition than to compete with them in this secular stagnation bubble: low-return, synthetic growth, and highly volatile debt are the new norm. And its even cheaper if you are the only competition in the market to buy-back your shares for profits.

(M&A Market 2015)

It's growing alright, but not for good reasons.The key is in the Federal Reserve's low interest policy. M&A contracts earnings are valued more when interest rates are low than high.

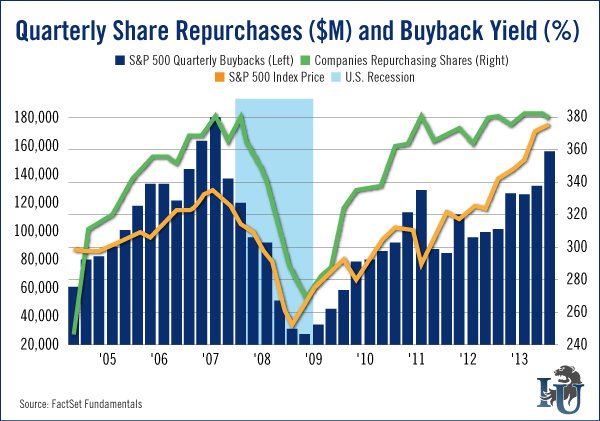

In a stagnating economy, companies can't generate fast growth, and investors are also faced with the same predicaments. The buyback market option, seems to be growing at an exponential speed.

(Buyback Yield 2015)

Why is buying your own equity bad? Well lets take a look at this example:

Say Company A has 15 million shares and earns $15 million per year, its earnings per share (EPS) is $1 ($15M/15M shares). The price-to-earnings ratio (P/E) of 20, the stock will trade at $20 ($1 in EPS x 20 P/E).

Company A buys back 2 million of its shares, it still earns $15 million per year in profit, however that $15 million is divided by 13 million shares instead of 15 million.

While the company didn't earn any more money, earnings per share rose to $1.15 ($15M/13M shares). If the stock continues to trade at a P/E of 20, the stock climbs to $23.00.

There was no change in the company's business, but through a reduced share count, earnings per share the stock price jumped 23%.

Seeds and stems. For all you pot smokers out there. Yall probably done this once or thrice, but when your bud is gone all you got is seeds and stems. Yall smoke the shit out of it, and get a synthetic high. Same concept is happening here. The M&A and Buyback Markets have no value, yet they are playing with their own seeds and stems to get the illusion of highness.

Sure its cheaper to do all of this, and sure it looks like your making an earning. But how long can this last until everything implodes.

Nice Read

I Remember

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you :)

It's a scary time to be living.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Indeed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit