AMMs are an integral part of the decentralized financial ecosystem

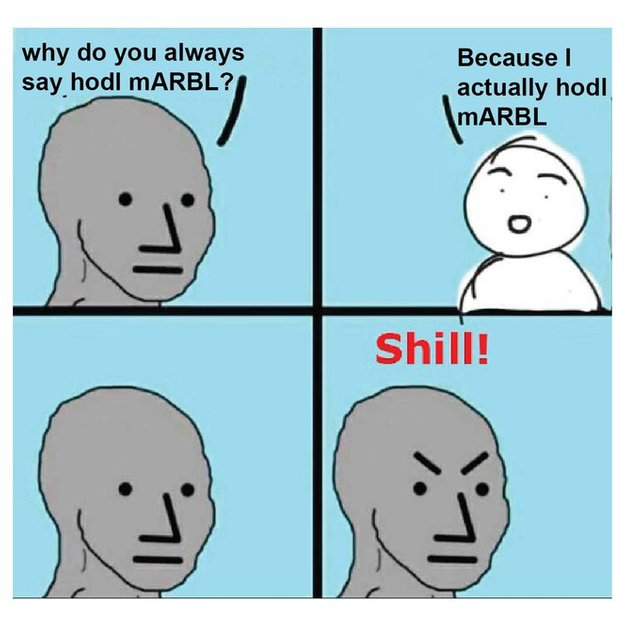

The system is built on decentralised software and hardware. AMMs are used by investors and liquidity providers to maximize returns and avoid risks. The underlying software is decentralised, which allows it to be decentralized and secure. The platform supports several cryptocurrencies and will enable you to exchange them with your own assets. Currently, you can purchase MARBLs with Bitcoin or Ethereum.The DEX runs on the Binance Smart Chain and is a fork of the Uniswap blockchain. The tokens are the liquidity providers and receive MARBLs if they make a trade. You can also pool your time and earn through it. This way, you can get more rewards without spending any money.LPs provide third-party liquidity to the DEX. LPs earn 0.25 per cent from each trade. Typically, a Marblecake transaction costs $0.25 per transaction. This is a small cost that can easily be paid by the users of the decentralized exchange. If you have the means to pay a lower fee than the average market price, you should consider signing up for the platform and using it to invest in cryptocurrencies.

Yield farming is a complex and risky business model

The LPs' fees are typically around 0.25 per trade. A small percentage of these fees goes to the treasury fund of the DEX. The LPs earn $0.25 on each transaction, which can be a significant cost for some users. The LPs' fee structure is designed to allow investors to make as many trades as possible, without paying too much for it.The LPs charge 0.25 percent of each trade. The LPs' fees go to the treasury fund. While the LPs' fees are not fixed, they are capped at $0.25 per trade. These fees, however, can be reduced by limiting the number of LPs. This allows traders to buy and sell a large amount of cryptocurrencies without the high cost of a middleman.It is often unprofitable, and is risky for both the lender and the borrower. It is also prone to slippage when the market becomes unstable. Furthermore, a yield farmer is a provider of liquidity for an exchange. He or she is called a yield farmer. Providing liquidity for a decentralized exchange is the equivalent of lending.

The benefits of yield farming are many

First of all, it rewards users for their work. The return on a yield farming strategy can range from 10 to 20 percent. Moreover, the holder can choose between multiple currencies. It is possible to combine multiple currencies and use them in various ways. With the help of a blockchain, investors can easily access and exchange crypto assets on a single platform.The mining process is also important. In some cases, it is easy to abuse a cryptocurrency by placing it in a node and receiving a reward. The mining process itself can be time-consuming and can be dangerous. A good strategy is to invest your money in a reputable farm. A farmer can earn profits by making the most of a stable investment. If he's an experienced investor, the rewards may be much higher than in a new ICO.

More Information

Website: https://marblecake.exchange/

Twitter: https://twitter.com/marblecakedex

Telegram: https://t.me/marblecakedex

Whitepaper: https://marblecake.exchange/wp-content/uploads/2022/03/marble_whitepaper_march2022.pdf

Discord: https://discord.gg/fXptUmYu8f

Reddit: https://www.reddit.com/r/marblecakedefi/

Author

Bitcointalk Username:Catesknee

Bitcointalk Profile Link:https://bitcointalk.org/index.php?action=profile;u=2252669

Telegram Username:@catesknee

Binance Smart Chain Address : 0xF375763Dfa77Bca876C81DDc7d3AE897B2ccF356