MARKET EDGES

COMPLIMENTARY ACCESS

“Six month's ago I shifted all my personal accounts and asset allocations to Quad 4 in the USA (I’d already made that move in China, EM, and Europe 9 months prior). So I’m not wearing the baggage of the Russell 2000 being down -12.2% in the last 6 months."

– CEO Keith McCullough, Early Look 3/11/19

Our regime-based Macro risk management process is designed to get investors ahead of big market moves by three to six months. We don't nail every call. But we do pride ourselves on not missing the massive trends in Macro.

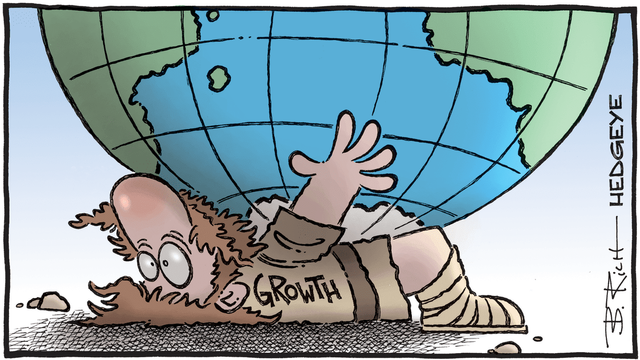

We're reiterating our views on U.S. and global #GrowthSlowing today. These calls are not opinion-based or politically-driven. Simply put, the data continues to confirm. We remain as data dependent as ever.

In this week's complimentary edition of Market Edges, we dig into our favorite long ideas to take advantage of U.S. #GrowthSlowing and dissect growth data around the world:

1. Client Talking Points:

There's increasing risk that U.S. earnings and European economic growth slide into recession.

2. Chart of the Week:

CEO Keith McCullough explains lessons learned from reading hedge fund giant Ed Thorp's book A Man For All Markets and extrapolates how these key takeaways impact his current market calls.

3. Sector Spotlight:

Investors should get prepared for a shallow earnings recession.

4. What the Media Missed:

Stop worrying about investing for the next recession. Instead, get the Quad right and you'll get recessions right.

5. Around the World:

Wall Street thinks Chinese economic stimulus is the next bull market catalyst. Senior Macro analyst Darius Dale shares his thoughts.

Don’t miss this must-read weekly newsletter of big picture Macro insights with investable market implications.

READ THIS COMPLIMENTARY MARKET EDGES

UPCOMING EVENTS

CLICK HERE TO REGISTER

ABOUT HEDGEYE

Hedgeye Risk Management is an independent investment research and online financial media company, focused exclusively on generating and delivering thoughtful investment ideas in a proven buy-side process. The firm combines quantitative, bottom-up and macro analysis with an emphasis on timing.

The Hedgeye team features some of the most highly-regarded research analysts on Wall Street, covering Macro, Financials, Energy, Healthcare, Retail, Gaming, Lodging & Leisure (GLL), Restaurants, Industrials, Consumer Staples, Internet & Media, Housing, Materials, Technology, Demography and Washington policy analysis, including Macro, Energy, Healthcare, Telecom & Media and Defense.

Use of Hedgeye and any other products available through hedgeye.com are subject to our Terms of Service and Privacy Policy.

Congratulations @hedgeye! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness and get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by hedgeye from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit