NOTE: This article is now outdated. After the it became evident the economic shuttering would continue for more than four weeks, my views quickly shifted bearish. I'm working on an updated view to post shortly.

I’m invested for long term wealth building. And I wrote in my book – Gen X & Millennials: Protect your Money and Prosper – that my portfolio is largely invested in gold and cash.

I argued stocks are overvalued. New money needs heavily allocated to what’s cheap. I predicted a massive financial crisis somewhere from 2019-2023.

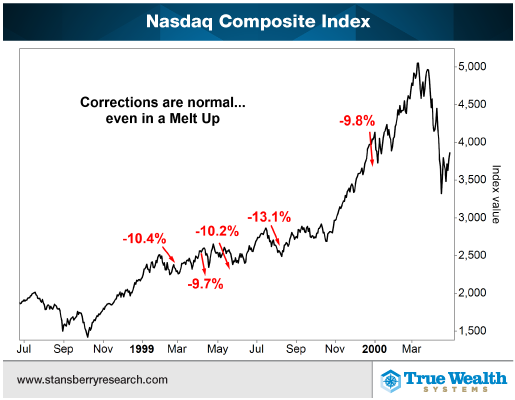

Steve Sjuggerud, editor of the newsletter True Wealth Systems, has nailed this market melt-up and written repeatedly corrections occur in melt-ups.

And I follow traders and trade with a portion of my portfolio. Most traders warned the market was overdue for a correction.

But the 29.5% drop from February 19th to March 16th caught me flat footed.

I wasn’t prepared for the speed and the voracity of the move lower. Normal melt-up corrections are 10%, maybe 15%.

The coronavirus lit a match to the fuel of this correction.

And I lost a lot of money the past couple weeks.

Watch Out for More Drops

But I didn’t panic. I buckled down and developed a plan. I started preparing cash to deploy.

I saw panic occurring everywhere. Society, stock market, bond market, gold market, bitcoin. Panic leads to opportunity.

I’m down big for the year right now. But I’m prepared to buy and quickly turn my losses to gains.

The move down – Thursday, March 12th and Monday, March 16th – was historic. We’re officially in a bear market. And talking heads on CNBC compared the drop to “Black Monday” in 1987 and the financial crisis of 2008.

But remember, this “crash” isn’t financially driven. It’s driven by health.

Many “financial signals” were still in melt-up territory. The market just needed a breather.

Remember, Steve Sjuggerud of Stansberry Research said corrections are normal. Here’s a chart he shared leading up to the Dot com boom, showing the corrections.

The market correction we’re going through, randomly timed to what is referred to as a “Black Swan” event. And that intersection created the appearance of a financial crisis. Or could lead to one if we don’t solve the social health crisis.

I BELIEVE THIS CRASH IS A MELT-UP CORRECTION

But that doesn’t mean this correction can’t get even bigger …

The Fed lowered interest rates 50 bps off-cycle. And pumped $1.5T of liquidity into the market the last couple of weeks.

On Sunday March 15th, the Fed dropped interest rates another 100 bps, effectively to zero. And introduced $700 billion of new quantitative easing (QE).

Congress passed an $8.3 billion emergency funding bill for public health. And this weekend passed a bill to support people out of work due to the coronavirus. Treasury Secretary Steven Mnuchin said on Sunday morning, they couldn’t value how much this aid bill would cost.

Because they have no idea how long the virus will last. Or how many people will get sick.

And that’s why – despite all this financial and fiscal stimulus – the market keeps going down. Investors aren’t worried about the Fed. Because this isn’t a financial crisis.

Investors are worried how long the coronavirus will disrupt the economy. Investors know the coronavirus will pass. And when it does, consumers will spend hard, and fast.

Consumers will have pent up demand and unspent money from not doing anything for a month. The economy will appear great again.

The problem for investors, they don’t know how long the economy will remain shuttered. And for investors, that uncertainty fuels the market down. Fast.

My coronavirus article predicts the week of March 23rd is when testing will occur in meaningful quantities. And that could add lighter fluid to exhaust the market lower.

I acknowledge if we don’t get testing implemented to bring some certainty to the virus curve soon – the constant sell-off in all assets could turn this into “the” financial crisis.

But I believe testing will ramp fast this week, removing the uncertainty before this sell-off morphs into “the” financial crisis.

That and I expect lots of fiscal stimulus …

All-time Highs By EOY

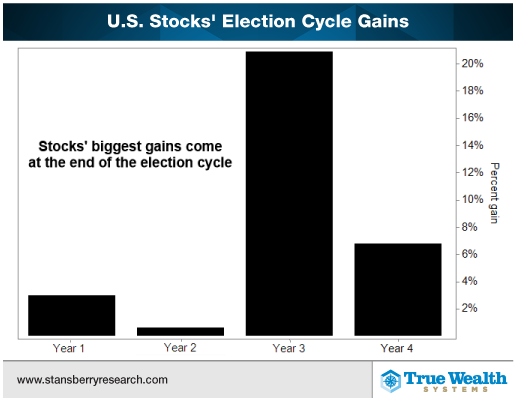

I predict the President’s re-election is dependent on a rising stock market and strong economy.

I’m regurgitating something I heard, so please don’t hold me to this. But I believe the only two incumbent President’s not to win re-election were Jimmy Carter and George H. W. Bush. And both had economies that struggled leading to the election.

Please don’t interpret this as me saying the stimulus is politically driven. I’m just honest – whether people admit it or not – they have sub-conscious bias in everything they do.

The President will use the social panic and tanking stock market to push through massive stimulus. The stimulus may appear to cause a mini rally. But the market will move lower until testing is widespread. And the number of new infections begins to crest.

Once the number of new infections crests, you can predict the end of economic disruption, model earnings adjustments, and re-price the market.

That’s when we’ll bottom. Or at least temporarily.

My coronavirus article projects approximately two to four weeks from March 16th, the rate of new cases should slow. Assuming everyone appropriately overreacts.

But that won’t matter as the number of new cases rises over the next two weeks. The market will still dive lower.

Once the rate of new cases crests in two to four weeks, the market will price in a more certain timing for an end to the pandemic.

The market may rally this week on fiscal stimulus, tank next week as testing increases, and remain volatile until the crest in quantity of new cases.

I predict when the crest in new infections occurs, the market will snap higher. If you sell at this bottom, you won’t have time to buy back.

The market will remain volatile after the initial snap back as companies and people return to normal. Investors will gain clarity on the impacts of shuttering on companies as we head into Q2.

Worse than expected impacts reported towards the end of May, once the panic subsides, could cause another massive sell-off.

But If I’m right and consumers start spending like crazy, Q3 could bring earnings surprises from Q2. Timed with the market digesting the stimulus – the market could soar through the election.

I know you think I’m crazy. The person that claimed for four years a crash is coming, claims a 30% drop is not “the” crash. I’m predicting the market to dive even lower after this historic drop. And then suggesting the market may still make all-time highs this year.

Please don’t stop reading now. Let me explain.

History shows that in the fourth year of a President’s term, the market averages a 6% return, year ending in September. Here’s a chart from Steve Sjuggerud at Stansberry Research:

Remember, this isn’t a financial crisis. It’s a social health crisis. The panic necessarily grows worse than reality.

This may sound contradictory, but the overreaction is needed. That’s how we look back and say the chaos was an overreaction.

This isn’t going to last months. It’s going to last weeks. And it’s not going to seriously impact many (I hope and believe). We just personalize the situation – creating the panic – helping to minimize the impact.

Once the market has certainty around the timing of an end to the pandemic, it will snap back.

The S&P 500 ended September 30, 2019 at 2976. A six percent higher move is 3154.

If the number of coronavirus cases reaches 50,000 next week, the market could close below 2300, a key level per traders I follow.

A snap back from that level to 3154 is a 37% return.

Again, that may sound crazy, but this isn’t normal. This crash occurred due to a social crisis. The result of the pandemic won’t unfold as drastic as the panic. And with all the financial and fiscal stimulus, we could shoot to all-time highs.

Getting back to 3386 (the high on February 19th) would generate a 13.8% return in the fourth year of a President’s term. That’s higher than the historical average of 6%. But we have historically low interest rates.

And historically large amounts of fiscal stimulus and quantitative easing. The stock market should return higher than historical averages.

I’ll admit the coronavirus is a “black swan” event, which easily could drive a lower return than history. I’ll admit we may not hit all-time highs by the election. But I bet the stock market moves towards that direction by the election.

If I’m right, from 2300 to all-time highs is a 47% return!

As I’ve stated, the longer we fail to control the virus, my views change. And the likelihood of this being “the” financial crisis increases.

Get the Hell Out

I’ve warned of a financial crash since 2016, targeting 2019 to 2023. Recently I’ve suggested 2021 to 2022 is my narrowed window.

I wrote extensively in my book – Protect your Money and Prosper – this coming financial crash will devastate many. Because the last crash only covered things up. And made the house of cards more unstable.

I said with interest rates so low, the Fed wouldn’t have any weapons (lowering rates is their biggest weapon) against a recession. And there’s magnitudes more corporate and federal debt around the world than in 2008.

But due to the coronavirus, the financial system got worse. Interest rates are already practically zero. The deficit and corresponding government debt will explode higher.

Debt to GDP in the US is already greater than 100%. That means our federal debt is larger than the value of what we produce as a country.

A $1 trillion fiscal stimulus policy will cause debt to go up at the same time GDP is dropping, due to the economic shuttering. This will make our country significantly more overleveraged.

And companies once again will have no fear of failure after receiving a government bailout. And neither will individuals.

The next actual financial crisis – if we’re not in “the” crisis now – scares me more than when I originally wrote my book. We need to test and control the virus immediately to prevent this from being “the” financial crisis.

Take advantage of this crash to buy and hold gold. Understand the tax consequences if buying outside of a retirement account.

You can buy stocks after another large drop if you want. But beware there’s risks out there in the credit markets you probably don’t understand.

Join the community in our migration to Hive, a community built blockchain for the community. All Steem account holders will receive equivalent stake on the new Hive blockchain.

Please follow @innerhive on twitter for more information.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit