OVERVIEW

We've been looking for opportunities to buy the Pound since it showed signs of turning back up after a nasty decline in Q2, Q3 2018. But overall, we view this decline as nothing more than a correction within a newly establishing uptrend off the +30 year low from October 2016. The rally in September was significant as it resulted in the market poking back above the daily Ichimoku cloud for the first time since April. The rally also ended a series of lower tops and lower lows, with the major pair finally shifting gears to start putting in higher lows and higher highs.

EXPECTATION

We'd like to see this dip quickly supported for a recovery that takes us back up through 1.3100 and towards some very important resistance at 1.3300. A break through 1.3300 will start to get the attention of the market and we suspect should really strengthen our bullish outlook. The stop-loss for the position has been placed well below the Ichimoku cloud bottom and below the September higher low at 1.2785.

POSITION:

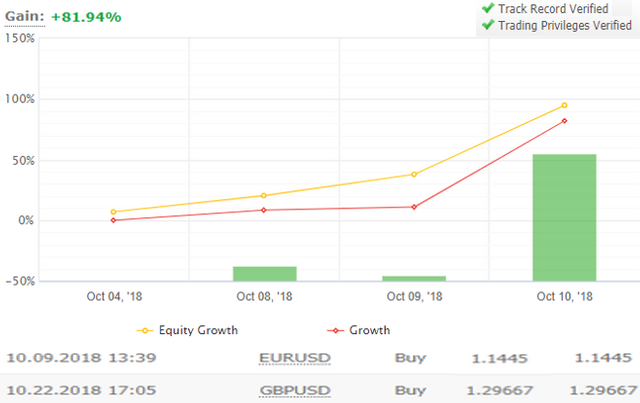

Long 1.2967 with a stop-loss at 1.2764. We are leaving the objective open and will manage accordingly.

PROFIT & LOSS

MARKETPUNKS BONUS CLIP