💎Happy Sunday, Steemers! We have a wild Highlight for you today (memes galore), but first - an update on the market.

- The stock market took a dive for the first time in four weeks.

Why? Rate hike fears resurfaced to the top after the Fed released notes from its most recent policy meeting - we’re not out of the woods yet!

INFLATION

Are We Reaching the Peak?

The great debate: Has inflation peaked, or was July just a good month?

It might be a little bit of both.

July’s consumer prices came in at a better-than-expected level.

Food prices are dropping but remain super inflated compared to 2019.

Let’s look on the bright side - no Sunday scaries here.

Here are 10 common consumer items where prices are falling:

- 🐔Boneless chicken: -23.6%

- 🧈Butter: -13%

- 🥚12 large white eggs: -9.3%

- 🚗Car rentals: -9.5%

- ⛽A gallon of gas: -8%

- ✈ Airline tickets: -7.8%

- 🌭Hot dogs: -6.1%

- 🍅Tomatoes: -2.5%

- 🐮A gallon of milk: -2.5%

- 🏨Hotels: -3.2%

SUNDAY CARTOONS

Another Meme Stock Saga

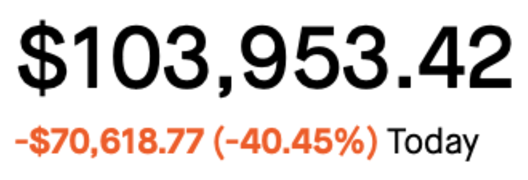

Bed Bath & Beyond (BBBY) has seen the best and worst of times in the past two weeks.

Why BBBY? Similar to the GameStop saga, retail investors on Reddit’s r/Wallstreetbets found a hole in the system. Bed Bath & Beyond is a heavily shorted stock, meaning hedge funds are betting against it hard.

So, thousands of investors banded together to squeeze the stock.

The results were mixed; some investors made out like bandits, and some missed the boat.

- At one point last week, BBBY shot up to $28.

- BBBY ended the week at $11.03.

After Ryan Cohen (investor with a huge stake) sold off, things turned sour.

Highlights: A student made $110 million trading Bed Bath & Beyond.

Lowlights: Many Redditors aren’t afraid to post their losses on the subreddit:

Moral of the story: Don’t “YOLO” your life savings into a stock just because someone on the internet says you could make fast money - you might end up on the wrong side of the coin.

MIND BREAK

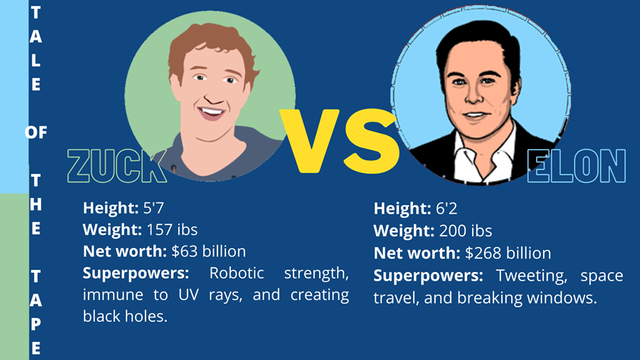

Battle of the Billionaires

Who would win in an arm wrestle? Elon Musk vs Mark Zuckerberg.

Despite the height and weight difference, we’re going with Zuckerberg - it’s tough to beat robotic strength.

RECESSION

Ask a CEO

Will the U.S. economy avoid a recession?

- 3% of corporate executives said "yes".

The other 97% are bracing for a recession — or they at least think the U.S. economy is already in one, according to a new survey.

A growing consensus: Many companies and executives feel the Federal Reserve will trigger a recession as it battles inflation with more and more aggressive interest rate hikes.

CURRENCY

The Dollar's Rebound

The U.S. dollar had its biggest weekly gain since April 2020.

The Euro was down 0.54% to $1.0034 against the dollar, which put it back near even with the greenback.

We've shared and upvoted your post on @crypto.defrag

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit