Cryptocurrency prices are sliding downwards since our last markets update, as the top ten digital assets are all seeing a loss of gains on January 8. BTC/USD markets reached a high of $17,200 on Saturday evening on January 6, but the value has dropped since then to a low of $13,900 per BTC. The price has since rebounded and is hovering between $14,800-$15,050 during this afternoon’s trading sessions.

FUD from South Korea and Coinmarketcap Data Brings a Price Storm

Bitcoin markets have seen a two-day decline since reaching its high of $17,200 this past Saturday. Yesterday afternoon the decentralized currency hovered just above the $16K zone, dipping to the $15,800 range a few times. On Monday, January 8, the price of BTC has sunk further taking most other digital asset markets with it. During the early trading sessions, (EDT) bitcoin prices touched $13,900 with around $15.8Bn in 24-hour trade volume. Many traders and cryptocurrency enthusiasts are blaming this week’s tumble on South Korea and its officials inspecting local banks tied to digital asset trading platforms.

Today the U.S. dollar is the top currency traded with BTC commanding 37 percent at the time of writing. This is followed by the Japanese yen (35%), tether (USDT 9%), and the South Korean won has dropped considerably to 4.7 percent. A few days ago when markets were more bullish, tether USDTs were averaging approximately $1, but since today’s dip, USDT is now $1.02. Additionally, tether has the third highest digital currency volume worldwide at the moment which happens consistently during dips.Another thing to note is the cryptocurrency website Coinmarketcap has droppedSouth Korean exchanges from its aggregated global price averages. The website has left an asterisk next to each price that states “* Price Excluded.” Coinmarketcap dropping South Korean exchanges has made the website’s price data fall by over 100 billion, as the total valuation of all markets is only $721Bn after reaching a high of $850Bn.

Technical Indicators

Looking at the charts shows bitcoin core markets have dropped several legs down since yesterday evening’s trading sessions. During our last report, the two Simple Moving Averages has a nice gap between the 100 SMA and 200 SMA. Today things are changing as it looks like the two trend lines may cross hairs soon. This indicates there is more substantial resistance towards the path to the upside and sellers are in control. 12 hours ago RSI and Stochastic levels were showing overbought conditions but both oscillators are leveling out at the moment.Bulls could quickly rebound from the current vantage point as order books show there’s not much resistance ahead but new positions are filling up. Look for more extended pit stops in the $15,300-15,700 territory. On the back side, there is plenty of foundational support in the $14,000-$13,800 range if bears managed to cause a more extensive market sell-off.

Overall Most Digital Currency Markets Are Seeing Deep Losses

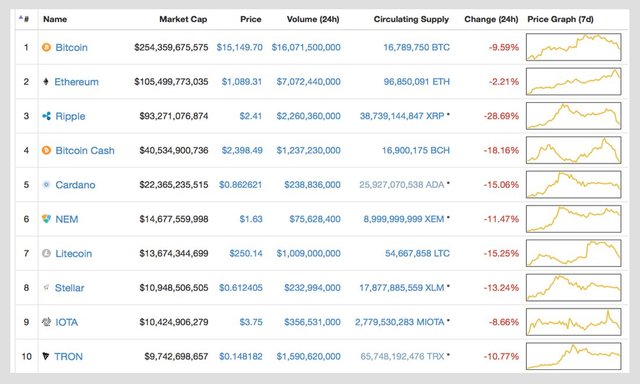

Digital asset markets, in general, are all in the red seeing deep percentage losses today. Ethereum (ETH) has repositioned itself as the second highest market cap but markets are down 2.2 percent. One ETH is averaging $1,089 today after the currency hit an all-time high above $1,200. Ripple (XRP) markets are down significantly as XRP has lost its $3.40 price high. XRP’s price is under by 28 percent and the global average per token is $2.40. Bitcoin cash (BCH) prices are also dipping as the price per BCH has lost 18 percent. One BCH is roughly around $2,398 and markets are seeing $1.2Bn in global trade volume. Lastly, the fifth largest market valuation is still Cardano (ADA), but its prices are down 15 percent. ADA prices are averaging around $0.86 at press time. Additionally, the most traded digital currency pairs on the swapping platforms Shapeshift and Changelly is BTC/ETH by a landslide.

Bear Scenario: Bears currently reign the market right now and have managed to utilize the South Korean rumors coupled with fear, uncertainty, and doubt (FUD). If panic selling continues, the price could tumble below the $13.6K range. Watch for the Displaced Moving Average (DMA) to break $13,600 for some lower scalps. Bull Scenario: Bulls have some work to do to get back well above $15K and $16K price territories. There’s some good size sell walls throughout these positions, but order books show it’s still manageable for a considerable rebound to take place. At the moment, long positions and big players are stepping off to the sidelines waiting for a better entry point.

Post for Upvote and Comment!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://news.bitcoin.com/markets-update-exchange-news-from-south-korea-brings-the-bitcoin-bears/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit