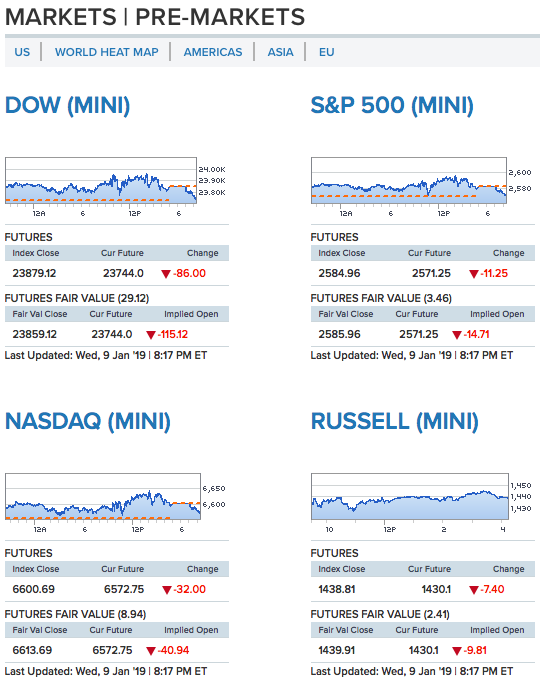

I've been a little surprised that the markets have started the year so strong. Epic swings, but more up than down. I'm not sure what news, data or numbers investors are looking at, but everything looks sour for long term stock performance.

Debt is still growing in the US at epic rates, government is more dysfunctional than ever before and then theres Sears. Every year we seem to be losing another icon of the US economy. Sears has been dying a slow death for the past 20 years. The only thing left of value there is the land. The malls all want it to die because the spaces they occupy with long term leases can be leased out for multiples higher than they are currently getting and quite frankly, Amazon is eating their lunch.

I'm not sure if the bid by ESL will be accepted or not, but 50,000 jobs are on the line here. Not exactly the news needed to justify the 2019 surge we've seen in stocks so far.

To invest in Mene24k Gold Jewerly click Here

To open your own BitShares account, click Here

To open your own Binance account, click Here

To open your own Coinbase account, click Here

Isn't Powell coming out and essentially stating that the Fed is not likely to raise rates -- perhaps even lower them -- in 2019 a factor in the current upswing?

The minutes released today from the mid-December Fed meeting make for an interesting read.

Also, isn't the 'umpteenth' rumor that the U.S.-China trade spat is showing signs of being on the mend (as uncorroborated as those rumors may be) also creating a bullish reaction from the markets?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Markets exploding up. Semiconductor and oil stocks.

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit