The aggregate estimation of all traded on an open market digital forms of money has declined more than $10bn over the most recent 24 hours, in the midst of an auction that comprehensively affected the early resource class.

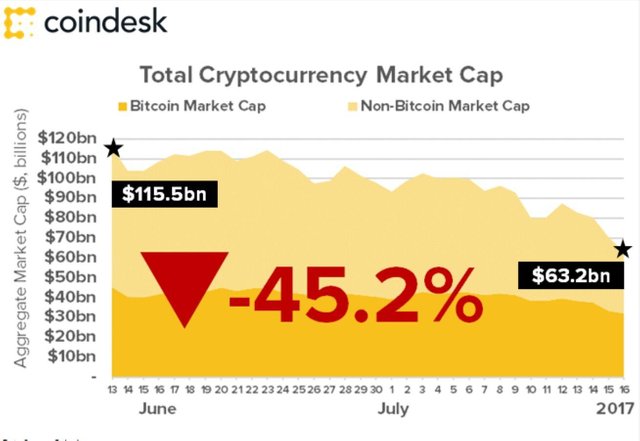

With the move, the market has now declined steeply from a pinnacle come to in mid-June, when it set an unsurpassed high of $115bn, as indicated by information from Coinmarketcap. In a little more than 30 days, the market has fallen 46.9%, tumbling to a low of $61bn at squeeze time.

Among the most influenced in the present decay were digital forms of money that had seen wild picks up as of late, including ether, and XRP, the cryptographic forms of money that influence the ethereum blockchain and Ripple Consensus Ledger, which were down 28% and 25%, individually, finished the most recent 24 hours.

Additionally influenced was the cost of bitcoin, which kept on declining today in the wake of dipping under the $2,000 check yesterday. Generally, it hit its most reduced an incentive since mid-May amid the session.

Like the more extensive market, the estimation of tokens on the dispersed installment framework were down about 38% from an untouched high set in June. In a little more than 30 days, the cost of bitcoin has fallen 38% from $3,018 on twelfth June to a press time low of $1,866 today.

The figure was the most minimal aggregate seen on the CoinDesk Bitcoin Price Index (BPI) in 58 days, or almost two months of exchanging.

Remarkably, the two advancements come in the midst of what could keep on being an attempting time for the cryptographic money resource class after euphoric picks up in the primary portion of Q1. In the coming weeks, specialized improvements in bitcoin and additionally changes to ethereum's rising ICO economy, could keep on putting offer side weight available.

At squeeze time, only three best 50 cryptographic forms of money hinted at any evading the pattern, with little-known resources including chaincoin, mooncoin and SIBcoin posting bigger increases.