.jpg)

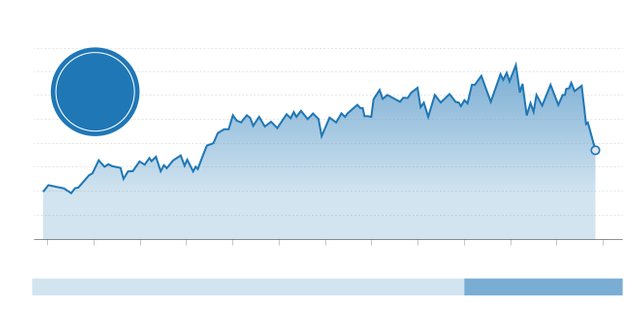

Has Facebook become a Tobacconist? That is, in a company with a solid business model, large margins and a huge return for its shareholders, but with an image problem that is second to none?The question, which had been raised two months ago by Marc Benioff , the CEO of cloud giant Salesforce, has become a very tangible reality on Wall Street, when the owner of the largest social network in the world has reached to plunge up to 6.5% in the middle of the official confirmation in a statement of what the Bloomberg news agency had declared a week ago: that the US authorities are carrying out an investigation "about the practices of Facebook in relation to to the privacy [of its users]. " The company has accumulated a fall of almost 7%. That supposes a loss of value of 69,000 million euros(87.00 billion dollars) - that is, as much as all the Basque GDP - since the scandal broke, a week ago. At mid-session, however, the company was recovering and its fall was around 2%.The fall of Facebook was more relevant if compared to the rise, at that time, of 1.76% of the Nasdaq , the market specialized in technology companies in which it is listed. This divergence seems to indicate that Facebook has a serious image problem that separates it from the rest of the market. It also introduces a new dynamic on Wall Street: the end of the FAANG , which are the technological companies that have pulled the most stock market in the last two years: Facebook, Apple, Amazon, Neftlix and Google.

Now, the 'F' of Facebook has fallen, and the 'G' of Google is in danger of following that path, since its business model is similar to that of the social network owned by Mark Zuckerberg, that is, to capture more possible information from its users. In fact, on Sunday, Facebook admitted that, just as it had spread in, precisely, social networks -including his own-, has been collecting the data of calls and text messages from Android phone users, which is, precisely, the operating system manufactured by Google. Amazon-which has little presence in the area of online advertising- and Apple -whose devices use their own software, the iOS, which is much more restrictive than those of Facebook and Google when it comes to respecting the privacy of their users. - are emerging, for now, as the great beneficiaries of the crisis.The bad image of the Zuckerberg company is a very real problem. What investors fear is that this public relations catastrophe triggers some kind of regulation of the activity of Facebook - and, by extension, of Alphabet, which owns Google - that limits the enormous freedom with which these companies operate in the market. In principle, the maximum penalty that could be imposed by the US regulator around 100 million dollars (80 million euros), is perfectly acceptable to the company.Companies such as the electric car manufacturer Tesla and the rocket company Space X -both, led by the controversial billionaire Elon Musk- have left the social network, and, in what may be a real reason for alarm for Facebook, the Dutch giant of consumer products Unilever threatens to do the same. And both the number of users and the number of hours they spend in the social network is stagnant, at least in the most mature markets. At the same time, a number of rivals, such as Twitter or Snap, threaten to take certain demographic groups from Facebook, such as Generation Z., that is, those born between 1995 and 2005. But those are potential problems. For now, Facebook's difficulties are image.

(photos are collected from internet)