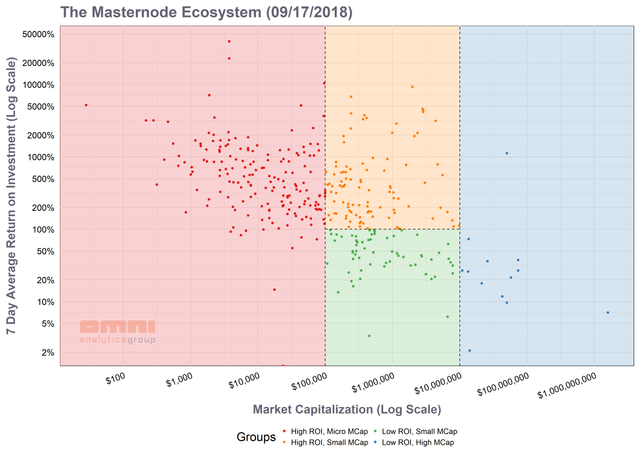

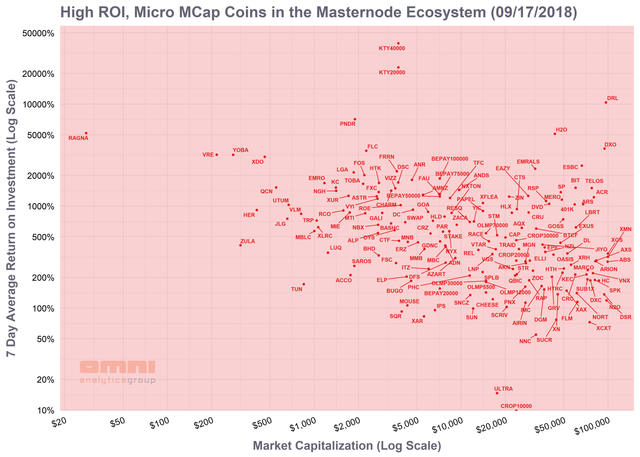

Currently, the masternode ecosystem has more than 400 coins according to masternodes.online. To get a grasp of the risk and opportunities, we created a 2-D map of the masternode coins according to their block reward return on investment and current market cap.

The map highlights a well-known relationship between the market capitalization and block reward ROI; larger, more mature coins have lower ROIs. To further elucidate this, we define micro-cap coins as those with a market capitalization less than $100,000. Coins designated with a "high" market capitalization have a total market value of any amount greater than $10,000,000. As a final differentiator, we separated the small-cap coins into those with ROIs higher than 100% and those below. This created four quadrants that partition the eco-system according to potential risk and opportunities. Within each quadrant, we've highlighted a few coins for context.

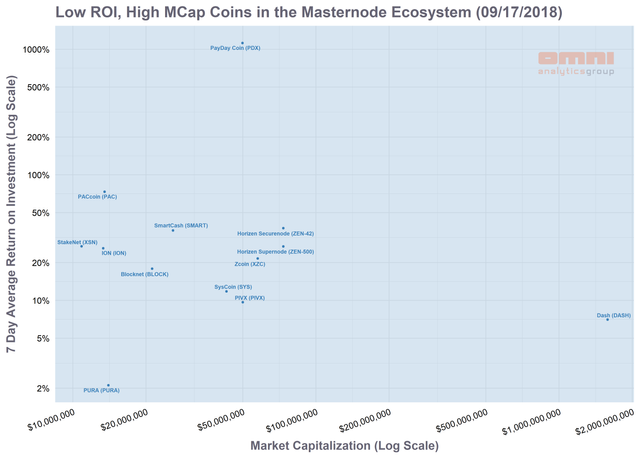

Low ROI, High MCap (Blue):

Dash (DASH)

PIVX (PIVX)

SysCoin (SYS)

ZCoin (XZC)

SmartCash (SMART)

PACcoin (PAC)

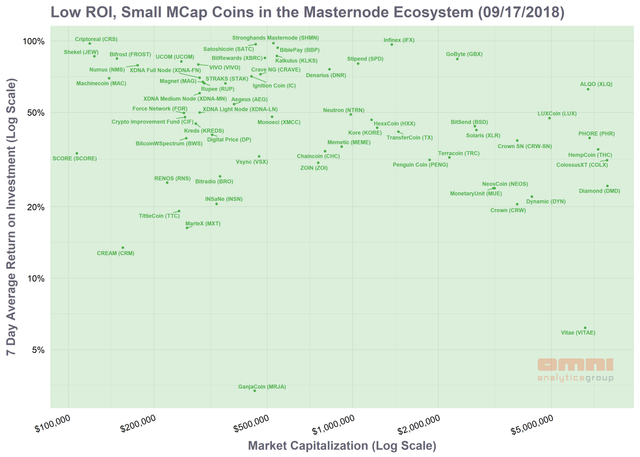

Low ROI, Small MCap (Green):

ALQO (XLQ)

Phore (PHR)

Solaris (XLR)

GoByte (GBX)

Terracoin (TRX)

Crown (CRW)

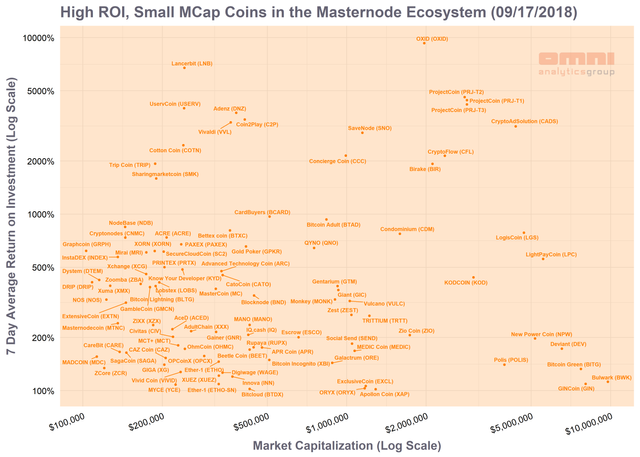

High ROI, Small MCap (Orange):

GINCoin (GIN)

Bulwark (BWK)

Polis (POLIS)

Deviant (DEV)

High ROI, Micro MCap (Red):

FOLM (FOLM)

VIZZOTIO (VIZZ)

SUB1X (SUB1X)