Presentation of Suretly

Among the plenty of decentralized items and administrations. Suretly is here with a non-decentralized administration but then guarantees to present with an outright new type of venture elective (known as group vouching). Suretly, with the capacity to play out all around the globe, has intended to present with a framework which will help with turning the procedure of credit appropriation substantially less demanding and more receptive.

Complete Detail of the Product

To conquer the constraint of nation's lawful confinements, Suretly group has anticipates setting up a different legitimate element in every nation (simply like Russia, Kazakhstan and USA) which will bolster them in proceeding with their operations with no limitations. Presently working to pass Starta Accelerator program in New York, Suretly group as of now holds the title of era's finalists (which is Europe's biggest quickening agent) and have taken an interest in LendIt in March 2017.

The venture is upheld by Higher School of Economics in Russia.

Through enthusiasm from around the globe and 275 financial specialists' interests, Suretly proficient its presale battle of 50741 preSUR tokens on sixteenth May 2017, which helped them in raising ETH 1612, 21; BTC 65, 22; LTC 340, 73; Waves 1652, 36.

Dissimilar to P2P loaning, Suretly clients are not the ones who will loan cash. In any case, they do ensure to reimburse to the loan specialist on the off chance that a borrower neglects to return. Essentially, Suretly clients work here as an aggregate personality choosing whether the advance ought to be affirmed or not. On account of advance endorsement, the sum will be raised by the enormous pool of Surety clients.

It won't not be right to specify that, Suretly is endeavoring to associate the three (borrower, bank and Suretly client) by giving them benefits like

diminished advance loan cost for the borrower

extending the advance portfolio with an expansion in advance endorsement and disposed of default hazard for the loan specialist

giving speculation chance to the Suretly client

In less complex words, this framework works precisely the route shared loaning works, other than the part that clients don't loan cash straightforwardly.

Realities identified with Funds and ICO

The underlying conversion scale of 1SUR identical to 0.1ETH or proportionate in Bitcoin, lite-coin or waves.

The ICO is still in process (11.07.2017 — 11.08.2017) and group anticipates raising somewhere close to $1.5 – $10 million USD by offering 15% of its offer. Suretly has presented themselves in the market subsequent to being almost certain of how they wish to circulate their tokens. As a state of actuality, the organization has chosen to issue extra 10% to the alternative of the pool for compensating present and future workers and a 2% abundance for the general population who will help them with the showcasing, if battle closes effectively.

Seeing How It Works

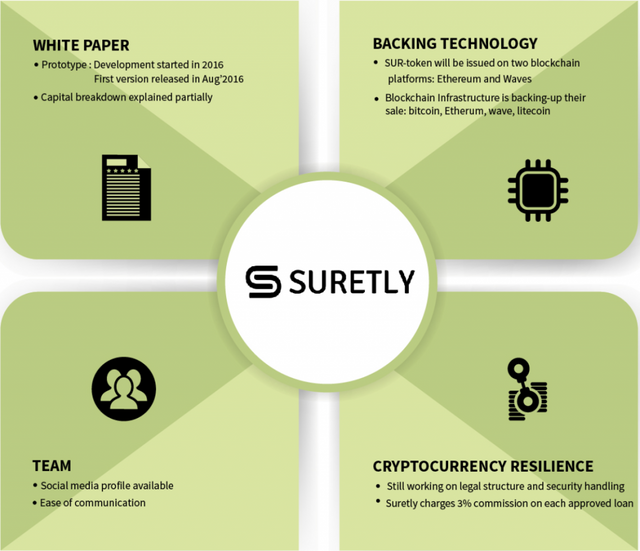

Suretly clients can unwind as it's not recently the borrower's appearance they need to judge from, rather it's their entire monetary history which will help with settling on a ultimate choice. To be more exact, on the application borrowers are partitioned into seven distinct classifications relying on the level of dependability their profiles speak to. And keeping in mind that Suretly clients will get a most extreme commission (greatest utmost is $1.5) on the off chance that they vouch for the borrower with the higher hazard factor, Suretly charges 3% commission on each affirmed credit, paying little respect to whether the advance is reimbursed by its primary borrower or not.

The base and most extreme volume of the accumulation have been recommended as $1,500,000 – $10,000,000 separately, additionally the reserve will be come back to financial specialists in the event that showed sum is not accomplished. According to white paper, assets will be put away by the outsider (Escrow), in any case, certainties identified with who precisely this outsider will be have not been said.

According to few words from colleagues, "Our crowd is made of card sharks, individuals who like high-hazard speculations," Lobachev said. "Our most prominent item is surety for a borrower including normal hazard and normal returns, and in second place is surety for the least secure borrower with the most astounding return."

Organization subtle elements

Site – https://suretly.com/en

With Headquarters in New York, this secretly held organization of 2 to 10 representatives was established in Russia in the mid year of 2016. What's more, despite the fact that exclusive the demo form of the item is accessible in U.S, the group is as of now grounded in New York, Moscow and Novosibirsk. Created on abnormal state, according to most specialists, this venture has shockingly noteworthy prospects for scaling.

Group

Discovering proficient experience, particularly on most normal and applicable stages is not that troublesome. In less difficult words, the group is not mysterious and is very dynamic on different informal communities. Thus underneath realities exemplified about the group depend on the data gave on the official site and group LinkedIn profile. Be that as it may, we can add to the rundown that, Suretly has concentrated more on key members, with a significant little data about the group on the whitepaper.

Eugene Lobachev – (CEO, Founder) – occupied with advancement and improvements of new businesses, 'Advances ONLINE SERVICE' was the venture Eugene was taking a shot at before Suretly. He finished his lords from Russian Academy Of Entrepreneurship in 2010.

Anna Paulova – CMO – with over seven years of involvement in the field of showcasing and outline, Anna Paulova holds no understanding on this administrative position. In any case, we can't miss the way that she holds the past experience of working with SMM advancements and logical publicizing of the Yandex.ru.

Svetlana Eydelman – CFO – with MBA degree from the City University of New York, Svetlana grasps work involvement with a portion of the notable organizations, for example, New York Stock Exchange and J.Streicher Capital, LLC. Experienced in back, she manages the extension of Suretly in US showcase while creating monetary plans and development system.

Eugene Kovalev – Regional Director for Russia and CIS – moved on from Siberian State University of Telecommunications And Informatics, Eugene holds a solid comprehension of Russian managing an account showcase with the help of his official experience picked up while working with one of the best banks in the business. He is included with online blade tech action identified with online credits, scoring and miniaturized scale fund innovations.

Konstantin Vishnivetsky – Lead Developer – with no way to deal with different social connections, Konstantin holds the experience of 14 years in the field of creating programming items utilizing C++, Java, and SQL.

Vlad Zubarev – Business Development and Advising – got MS from the State University of Nizhni Novgorod, Vlad holds 15 years of involvement in programming advancement. Originator of XenZu advances LLC Company, Vlad has past work involvement with Cisco System in 2000 (in start-up stage).

Venture chance

We have no questions that this venture has been actualized with high caliber, neither do we have any inquiries identified with capabilities of the administration and staff. Be that as it may, there is dependably the factor of hazard which can alarm the potential speculators. All things considered, this venture has based borrower's hazard profile as the central factor of income for the underwriter. Actually, the underwriter assumes the most critical part in this entire framework, and if there is no underwriter, there will be no cash for the borrower. Additionally, if there is just a single underwriter he'll be 100% in charge of the non-reimbursement of the obligation. Besides, the underwriter just gets the chance to send paid unknown SMS so as to get subsidize reimbursed, as neither the choice of recording a court objection is given (the organization is as yet chipping away at this element) nor the borrower number (character) is revealed.

Our interpretation of venture

Regardless of the hazard we have specified above, it is accepted that the monetary model of the venture will expand half of the given advances with the guide of Suretly stage quarter by quarter. In addition, while the reality of the matter is that loaning market is substantial, the part containing 'individuals surety' is yet not created. Additionally, we should mull over that Suretly is not bound to any Blockchain engineering and neither similar works around the crypto group, which implies utilizing token won't not look practical to numerous.

FILa.

nice tiopic thank you for info

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

follow me if you can bro

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi all, I would suggest to stay away from mcap and bgf. They know how to earn money oh sorry launder money :) in a legal manner in a way that does not look scammy. I am very impressed with mcap with the marketing they have done and studied the loopholes in the system as there is no regulations on crypto.

Moreover they did good study on manipulating the price on coinmarketcap.

Recently I heard they stopped the selling.

At that time rate was 0.00158 approx.

But my friends buying was still possible at this rate.

In short let people buy at higher rate for considerable time which is pumped rate and then dump it so that people sell on less rate. Haha.

Moreover MCAP is growth fund like mutual fund grows our 💰. I dont like idea of posting it on exchanges. All they are to do is to invest our hard earned money in diversified coins and share the profit with us. But thats not the case to let investors buy at higher rate and dump to force them sell at lower rate.

Now new thing they come up with mcaplabs loyalti to keep the game going on. And normal investors who are holding 300 to 1000 mcap. what these people are getting is nothing. Loyalty they brought into picture just to attract investors. Recently they reduced the loyalti payout as well.

For me it all looks scammy scammy. Everyone knows it. All are waiting for considerable per mcap rate to sell, but I suppose its never gonna reach. May be some pumping may help :)

May god bless all investors.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Solid blog. Good to see I'm not the only one who thinks like this. I've been asking myself. How many people really do a proper background check before seriously investing in an ICO? Does anyone know about: https://www.coincheckup.com This site did all the research for you. It's truly amazing. On: https://www.coincheckup.com/coins/MCAP#analysis For a complete MCAP Indepth analysis.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit