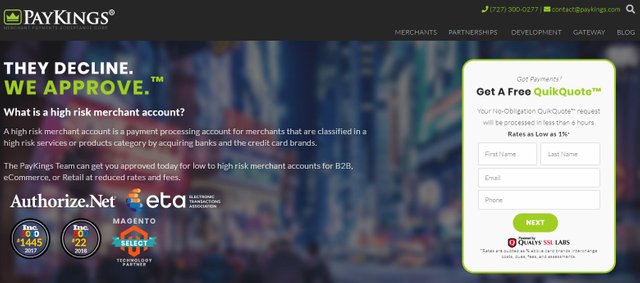

High risk merchant accounts are the obvious necessity when it comes to accepting credit cards. Without high risk merchant accounts, you will be missing out on payment processing services. PayKings is the low-cost retailer with a high risk of merchant services you need to accept payments from your customers.

In many cases, you will have difficulty getting a merchant account if your business is considered high risk. If someone approves your business, you will typically be charged higher prices and fees compared to other customers.

Keep in mind that there is also a category of merchant account providers that caters to high-risk merchant accounts, but some of these exist only to delete companies with outrageously high rates and contract terms.

It is important to remember that the merchant processor also carries financial risk and that they use the internal method to determine the processing rates and other terms of the contract for each client who wants to sign up.

Any business can be classified as a high risk for various reasons. However, the consequences are typically significant for business owners when their business is classified as a high risk group.

If you are a small business, try using some popular payment service providers like Square or PayPal, but you need a high risk merchant account when you have a business type that is considered high risk.

High-risk merchant or credit card processors do not treat all companies equally. As with other companies, a high-risk merchant account can typically get better or favorable/generous terms if their processing is high.

Chargeback thresholds are what sets merchants at high risk and low risk. Each processor has a chargeback monitoring program. When a low-risk grocer enters a program, it is given time to resolve any issues before being exposed to large fees.

High-risk dealers are immediately considered eligible. Excess fees are charged each month when a high-risk retailer is in a chargeback monitoring program. Typically, the reversal fee rates are higher for high-risk dealers than others.

When a business is labeled high-risk, merchants can still accept credit payments. However, these companies are subject to higher rates of processing. Also, banks may request a reserve on a company's credit card processing.

Sometimes, high-risk merchants can cause banks to reclassify a business. However, this is not easy considering the many factors that led to the classification. A positive history of credit card processing of at least six months or a small number of chargebacks and refunds may trigger a reclassification. Banks expect a chargeback rate of less than 1% of a company's total transactions.

High risk merchant accounts are the obvious necessity when it comes to accepting credit cards. Without high risk merchant accounts, you will be missing out on payment processing services. PayKings is the low-cost retailer with a high risk of merchant services you need to accept payments from your customers.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit