In my previous post, I counted the problems referring to M&A process and, then, presented the company which intends to solve to solve them. Since it was briefly, today I’m going to soak myself in details of LEXIT ecosystem.

To make distinctions clear, let’s compare actual procedure of M&A and that what offer LEXIT team.

Traditional M&A process

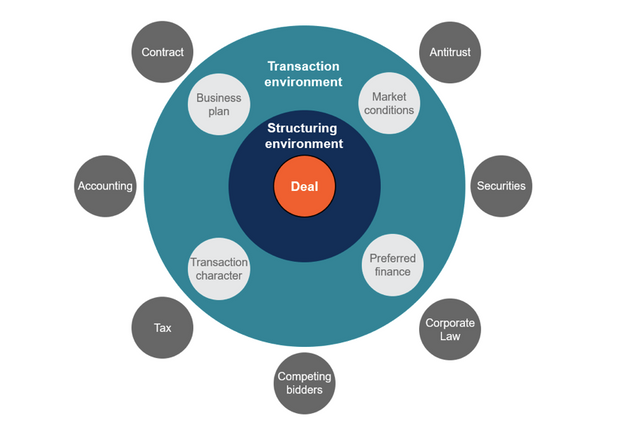

The mergers and acquisitions (M&A) process has many steps and can often take anywhere from 6 months to several years to complete. One of the most complicated steps in the M&A process is properly structuring the deal. There are many factors to be considered such as: antitrust laws, securities regulation, corporate law, rival bidders, taxes, accounting issues, contacts, market conditions, forms of financing, and specific negotiation points in the M&A deal itself.

Highly-educated and experienced advisors are certainly needed for both sides even considering impressive costs for their services.

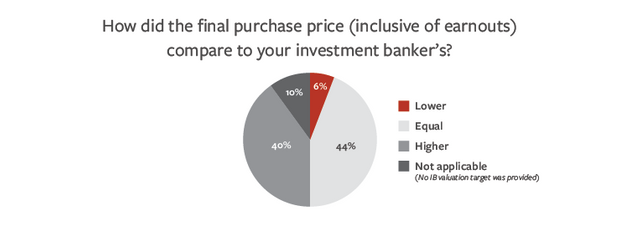

A 2016 study asked CEOs who had recently sold their businesses with the help of an investment banker whether their advisor added value. For a full 100% of respondents, the answer was yes, with 69% reporting a “significant” impact. Eighty-four percent of the owners achieved a final sale price equal to or higher than the initial estimate provided by the advisor.

With these kinds of outcomes, one would think hiring an advisor would be a no-brainer. But many would-be sellers are skeptical of the cost of bringing in outside help. Part of the problem is that the specific value-add of an advisor can be opaque until you actually start working with him or her.

Here is enough risk in entrepreneurship without adding the variable of making decisions without a good foundation of knowledge. An experienced mergers and acquisitions professional will outline a strategy and process for facilitating due diligence between the parties. Many potential transactions are lost in due diligence. Facilitating due diligence without an experienced business broker managing the process can have similar results as asking a builder to construct a house without an architectural blueprint.

Advisory Costs

As usually for M&A deal, any buyer or seller should retain a capital M&A advisor (investment banker), a lawyer, and an accountant. These people don’t work for free, so their charges are part of the expenses of doing a deal. Of course, advisor fees vary based on the deal and how much work the advisor does, but here are some very general guidelines:

A lawyer may charge anywhere from $25,000 to more than $100,000.

An accounting firm may charge anywhere from $25,000 to $75,000.

Investment banking fees vary, but in a very general sense, you should expect to pay roughly 3 percent to 10 percent of the transaction value.

Some deals involve other costs as well, including a real estate appraisal, an environmental testing, a database and IT examination, and a marketing analysis. Fees vary, of course, but all these functions likely cost anywhere from $10,000 to more than $100,000 apiece.

Therefore, high expenses are a cornerstone of the barrier for small enterprises for M&A. In the case of only one has such opportunities, a cash-strapped one have to accept all possible conditions, especially when this deal is the last variant for avoiding the default.

M&A process with LEXIT

Seller send the application to be listed on the marketplace and pay relatively small fee. LEXIT staff scrutinize all given info, check accuracy and reliability of a potential deal. Any listings that are suspected to be fraudulent or related to any illegal activity will be barred and reported to the appropriate authorities. As the guardians of the ecosystem, members of the Anti-Fraud Detection Team will be LEXIT employees and undergo a rigorous vetting process before being accepted.

Then, in the case of successful verification, an auction appears on the list of offers.

If the deal is considered to be urgent or the seller just want to make it more visible among other ones, he can pay for placing to the first positions of the list.

While browsing, buyer, taking into account the assessments of platform experts, evaluates appropriate offerings. In the LEXIT ecosystem, these experts are called “assessors.” Both independent industry experts and advisory firms can join the LEXIT ecosystem as assessors. Assessors must be vetted and approved in order to participate on the LEXIT platform.

Outside service providers are permitted to become assessors and submit personal views, but they cannot assist in an official capacity unless engaged separately through a contract that is external to the platform. Service providers must abide by LEXIT standards in order to become—and remain—part of our network.

Assessors may be selected to offer views on listed transactions. Sellers choose up to 10 assessors whom they can invite to post views. Buyers will be more likely to select assessors who have assisted with previous listings and received high ratings. However, experts cannot, in any official capacity, judge or decide the amount, value, quality, or importance of a transaction. Assessors who are selected to post will be paid a standard amount of LXT, which is not related to the length, quality, or any other characteristic of the transaction being considered.

When both buyer and seller are «interinterested” in each other, they move into the Deal Room. It’s a virtual place for all negotiations, private terms and confidential documents. The room is secured cryptographically, robust and stable information security frameworks will be used to mitigate any risks.

Considering what I mentioned about “the problem of dominance", when the more poor have less rights and power, it’s vital to notice that both seller and buyer can invite limited number of assessors to the deal room to have equal opportunities to check the conditions and, maybe, pitfalls equally. (Egalitarianists have sized up LEXIT team:D)

So, the deal could be closed within 12 weeks. Rather fast, isn’t it?

Trust as an archaic phenomena

Valuations, bids, and transaction volumes will be immutably recorded on the blockchain via smart contracts, which eliminate the need for contracting parties to trust each other. Due to the smart contracts are automatic, there are no more worries about decency of deal participant. Moreover, gigantic fees of third-parties just absent.

Summarizing, I suggest to look through the table below.

The softcap is already reached. Please, use the following links to participate in ICO (main sale stage) and learn more about LEXIT as an innovational and rational solution for M&A world.

LEXIT Telegram Reddit Twitter LinkedIn BTT White Paper

#LEXITco

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit