The use of smart contracts in the crypto space has gone crazy in 2020 as the Defi sector has transformed beyond imagination and has become the fastest-growing industries in the blockchain technology world.

Many decentralized applications (DApps) and cryptocurrencies operate via codes to enable the exchange of goods, services, funds, data and many more. However, centralized financial institutions, for example, banks or insurance companies, heavily relied on third parties to manage their transactions, while most Defi projects leverage smart contracts to ensure that transactions are legitimate, transparent and trustless, following the predetermined provisions of the contract.

In a nutshell, Merlin Lab smart contracts play a vital role in the vault by ensuring that users assets are automatically reinvested and auto-compounded at the appropriate time without involving any third party.

HOW DO THE MERLIN SMART CONTRACT WORKS?

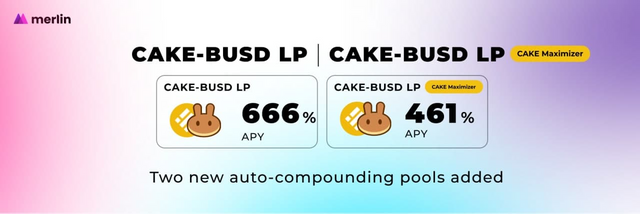

After users deposited their crypto-assets into the Merlin liquidity pools, the Merlin smart contract automatically stakes the coins into PancakeSwap, the smart contract further reinvested all rewards earned from the original staked assets into the vault that has the highest APY at that moment.

In most cases, the CAKE Maximizer vault often has the highest APY. Merlin Lab has other vaults similar to the CAKE Maximizer vault in the liquidity pool to offer users multiple choices. Also, the smart contact compounds each of the vaults at the best time, usually every 2-4 hrs.

BENEFITS OF SMART CONTRACTS TO MERLIN PROTOCOL

The use of smart contracts by Merlin Lab makes its protocol faster, more transparent, accurate, and secure. Users no longer need to manually login into their account always to reinvest their assets and also developer need not continue to check their time every 2-4 hrs to manually compounds the vaults, all these are now automated by “code is law” courtesy of smart contracts.

ISSUES WITH SMART CONTRACTS AND MERLIN LAB SOLUTIONS

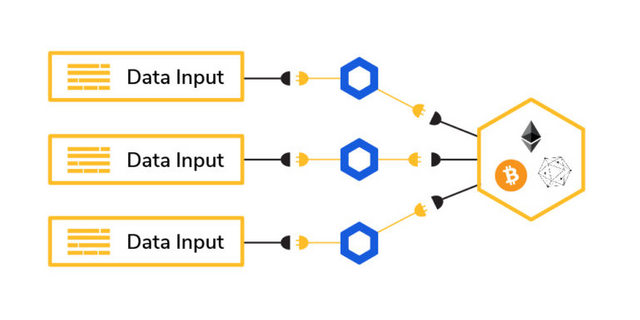

In Merlin protocol, smart contracts are processing external data without having a centralized, verified data source. E.g, Merlin protocol users need access to reliable cryptocurrencies price feeds that are accurate and manipulation-free.

The use of a data-oracle platform, such as Alpha Homora and Chainlink platform are the solution to this problem. Leveraging on the Alpha Homora Fair LP Price (FLP) and the Chainlink Fair Asset Price(FAP) will enable Merlin users to access trusted, verified FAP from multiple sources that can’t be manipulated and safe from any form of attacks.

MERLIN SMART CONTRACT AUDITING FIRMS

As part of the duties of Merlin Lab to offer a secured platform to all its platform users, Merlin Lab has partner with three audits to help audit its smart contract, the auditing firms are listed below:

• Hacken Cybersecurity: Completed

• Certik: Completed

• Haechi Labs: In Progress

Credible and reputable smart contract auditors help restore confidence in the smart contracts and identify any possible threats and bugs in the smart contract code.

CONCLUSION

Smart contracts are fast changing the ways we access financial services, exchange information, and interact with one another. As Merlin smart contracts continue to make investing in cryptocurrency more transparent, reliable and efficient, we expect to see continuous auditing of the Merlin smart contracts to ensure users assets are safe and secured more than ever before.

Useful links to the project

Website: https://www.merlinlab.com

Telegram Announcement: https://t.me/merlinannouncementsTelegram

Telegram Community: https://t.me/merlinlab

Twitter: https://twitter.com/MerlinLab_

Reddit: https://reddit.com/r/MerlinLab

Medium: https://merlinlab.medium.com/

AUTHOR

Bitcointalk Username: Alaho15

BitcoinTalk profile link: https://bitcointalk.org/index.php?action=profile;u=2513944

BSC Wallet:0x0e55B03D7c3c5427E7b10F6b0B420bb16842b4c5