Presale

MVX token price at launch: 1 USDC

GMX community sale = 200,000 MVX at 20% discount (0.8 USDC/MVX), 200 slots

Whitelisted public presale = 1,000,000 MVX at 10% discount (0.9 USDC/MVX), 500 slots

Metavault DAO community sale = 300,000 MVX at 20% discount (0.8 DAI/MVX), 300 slots

Total $ to be raised in presale: 1,060,000 USDC + Metavault DAO Treasury allocation from MVD -> MVX sale

->500,000 USDC paired with 500,000 MVX initial liquidity V3 Pool

-> 60,000 USDC as marketing budget

-> 500,000 USDC as initial MVLP liquidity (owned by the MVX Treasury)

Important Points Table Of Metavault Trade

Basic PointsCoin

Name Metavault Trade

Short Name MVX

Max 10,000,000

Token Information

MVX token address: https://polygonscan.com/address/0x2760e46d9bb43dafcbecaad1f64b93207f9f0ed7

After staking MVX, you will receive staked MVX:

MVX staked token address: https://polygonscan.com/token/0xacec858f6397dd227dd4ed5be91a5bb180b8c430

#polygon #metavault #trade #ido #sale

What Is Metavault.Trade?

Metavault.Trade is a platform for selling and buying digital goods by using cryptocurrency and fiat. Metavault.Trade is unique because it does not have any limits imposed on the trading of the products. The platform is designed to create a new market where you can buy, sell and trade virtual goods, game items and digital assets. The platform Metavault.Trade is designed to make the process of purchase and sale of digital goods as easy and simple as possible, using the functionality of the platform allows you to buy and sell digital goods in a quick and easy way, as well as to use them in your game account in a safe way.

Metavault.trade is a blockchain-based marketplace for trading digital assets and services. It has an in-built exchange mechanism, where you can buy and sell value-add services and products, digital assets and other e-tokens. It is built for the future and for the people. It is the sole purpose of creating a platform that is decentralized and where you can have a full control over your digital assets. With Metavault.Trade, you can buy, sell, trade and exchange your digital assets and services in a secure environment.

There are many ways to make the world a better place, and for some it’s through the technology. Metavault.trade was created by a group of like-minded individuals who believe in a future where the whole world is interconnected. One of the most common problems in this field is the lack of a simple, straightforward integration that can be used by anyone.

The Problem

Currently, most cryptocurrency users trade through centralized exchange platforms. Through this exchange platform, users will be able to trade cryptocurrencies easily and safely. The problem, however, is that centralized exchange platforms often use his KYC for trading. This is a problem for some people as it relates to identity and privacy. On the other hand, users can trade freely without worrying about their privacy using a cryptocurrency trading platform that facilitates transactions and does not require identity.

The Solution

To solve this problem, Metavault.Trade was born as a decentralized exchange that doesn't care about user's identity. This service is provided by Metavault. Trade is a decentralized, on-premise seamless exchange that allows users to trade quickly and securely with leverage via their personal wallets. This means that Metavault.Trade does not need to create an account for the user as it only requires a connection to the user's digital wallet. Users are free to trade their favorite pairs without worrying about their privacy.

In addition, Metavault.Trade has many interesting features for users, such as helping users to avoid the risk of liquidation thanks to high-quality price data feeds that help them determine when to liquidate. This is a platform offered by his Metavault.Trade where users can open positions in their favorite pairs through his Metavault.Trade user his friendly interface and very low trading fees, traders can Get the best price.

Metavault.Trade's ecosystem is built on governance, liquidity, and a DAO system where users have to own tokens according to their chosen sector. If users want to earn a share of the platform's revenue, they can purchase MVX tokens, a utility and governance token, from Metavault.Trade. If a user wants to receive a portion of the fees collected by Metavault.Trade, they can get MVLP tokens and staking tokens and get rewarded. Finally, if users want to participate in the DAO, they can own MVD (Metavault.Trade DAO token) and with this token, users can participate in different decisions.

Benefits

Metavault is the world’s first system to provide the best from both worlds — the benefits of a centralized trading platform, and the benefits of decentralized platforms. Metavault.Trade is a fully decentralized platform, which uses smart contract functionality to ensure that the assets and funds of traders are safe. The Metavault.Trade platform supports the most popular and most traded cryptocurrencies, including Bitcoin, Ethereum, Litecoin and Bitcoin Cash, and will be continually updated as new coins emerge. The Metavault.Trade platform is accessible from any internet connected device. As the project evolves, new features will be added to the platform. Metavault.trade is a trading platform for cryptocurrency. It is unique for many reasons: It provides live market data for all the coins in the market and has the most advanced Cryptocurrency Exchange Engine that you can find in the market.

It’s time to face the facts. Metavault.trade is still a relatively young platform. We have been in the market for less than a year. During that time, we have managed to build a strong customer base. We have migrated from a zero user base to a fast growing user base. We have been able to add multiple new features due to the customer feedback and satisfaction. At present, we are working on some killer features that are going to bring a new revolution in the market. People are going to get surprised with these new features.

Rewards

Long-term holders receive rewards as Escrowed MVX (esMVX) and Multiplier Points, both with minimal supply inflation.

Both MVX holders who choose to stake on the platform and MVLP holders (i.e. liquidity providers) receive rewards. These rewards can be in the form of tokens — Escrowed MVX (esMVX) and MATIC — and Multiplier Points (MP). The full reward structure is available at the end of this chapter, but here is brief summary:

- Staked MVX earns MATIC, esMVX and MPs.

- Staked esMVX earns MATIC, esMVX and MPs.

- MPs: earns MATIC when staked

- MVLP held in wallet earns MATIC and esMVX.

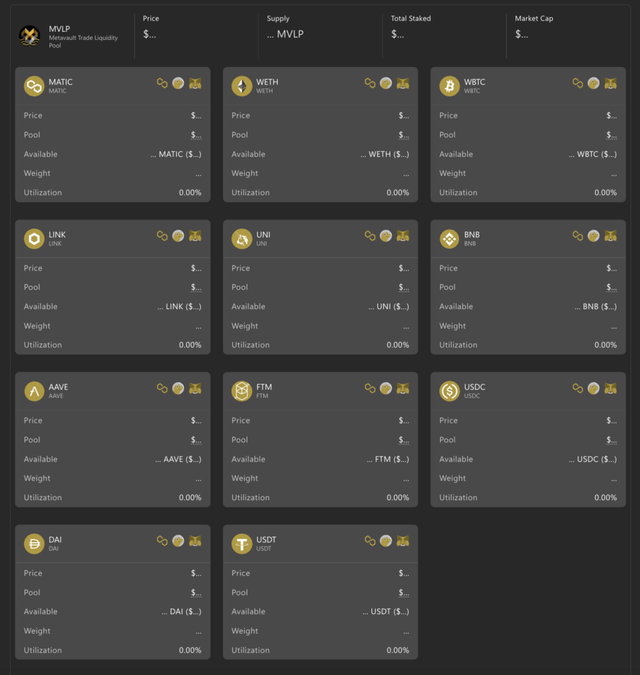

The Multi-Asset pool

The great innovation at the heart of GMX, and now of Metavault.Trade, is the Multi-Asset pool. All the assets supported by the platform are pooled together and a token called MVLP represents the index of these tokens. The price of MVLP will fluctuate with the prices of the underlying assets in the basket and the Profit and Loss (PnL) of the traders — when they loose on a trade, their losses flow into MVLP.

How does this shared liquidity lead to a reduced price impact swap solution? Let’s say for example that the pool is made up of five assets (BTC, ETH, MATIC, USDC and DAI) in equal proportions in terms of dollar value: 20% of each. If a trader wants to buy 50% of the BTC supply with USDC, they can do so instantly, without any price impact. After the order goes through, the state of the pool will simply become BTC: 10%, USDC: 30% and the rest unchanged. To understand how unique this feature is, I encourage you to check how much price impact you get for a very large order on a CEX with an order book or on a DEX like Uniswap!

At launch, the assets supported on Polygon will be six large caps and three stablecoins:

- BTC, ETH, MATIC, LINK, UNI, AAVE

- USDC, DAI, USDT

#polygon #metavault #trade #ido #sale

Now let’s get back to the pool in the example above. Post-swap, it is unbalanced compared to its initial state. The liquidity providers will be incentivized to deposit BTC and disincentivized to deposit USDC, which will lead to a rebalancing of the pool.

Connect Wallet

Connect Your Wallet By Clicking The “Connect Wallet” Button In The Header.

Open A Position

Users Can Take Either A Or A Long Or Short Position On A Coin — A Long Position Results In Profit If The Price Goes Up, While A Short Position Results In Profit If The Price Goes Down.After Selecting Either “Long” Or “Short” As You Require, Enter The Pay Amount (The Amount You Wish To Trade) And Use The Slider To Specify The Leverage.

In The Above Example, The Price Of Entry Is $3,372.40 And The Price Of Liquidation Is $2,824.65.The Fees For Opening And Closing A Position Are Both 0.1%. Additionally, There Is A “Borrow Fee”, Which Is Paid Every Hour To The Trade’s Counterparty.

Check This Fee Under The Swap Box. Note — There May Be Some Slippage Since There Is A Delay Between The Time The Trade Is Submitted And Its Confirmation On The Blockchain. You Can Customise The Slippage By Pressing The “…” Icon In The Top-Right Of The App.

Position Management

A List Of Open Positions Can Be Viewed By Clicking On “Positions”. Click “Edit” To Manage Your Leverage And The Liquidation Price By Depositing Or Withdrawing Collateral. By Default, The List Displays Leverage As Position Size Divided By Its Collateral. To Display Leverage As Position Size +PnL Divided By Position Collateral, Click On “…” In The Top-Right Of The App.

MVLP

MVLP Is A Token Whose Value Is Made Up Of An Index Of Assets Used In Swaps And Leverage Trading. Users Can Mint MVLP Using Any Index Asset Or Burn It To Collect An Index Asset. The Price Of Minting Or Redemption Is The Combined Value Of The Indexed Assets / MVLP Supply. MVLP Holders Earn EsMVX. Since MVLP Holders Supply The Liquidity Required For Leverage Trading, They Profit When Metavault.Trade Leverage Traders Make Losing Trades. They Also Make A Loss When Leverage Traders Make Profitable Trades, With Their Collateral Going Towards The Payout.

Rewards

Long-term holders receive rewards as Escrowed MVX (esMVX) and Multiplier Points, both with minimal supply inflation.

Both MVX holders who choose to stake on the platform and MVLP holders (i.e. liquidity providers) receive rewards. These rewards can be in the form of tokens — Escrowed MVX (esMVX) and MATIC — and Multiplier Points (MP). The full reward structure is available at the end of this chapter, but here is brief summary:

- Staked MVX earns MATIC, esMVX and MPs.

- Staked esMVX earns MATIC, esMVX and MPs.

- MPs: earns MATIC when staked

- MVLP held in wallet earns MATIC and esMVX.

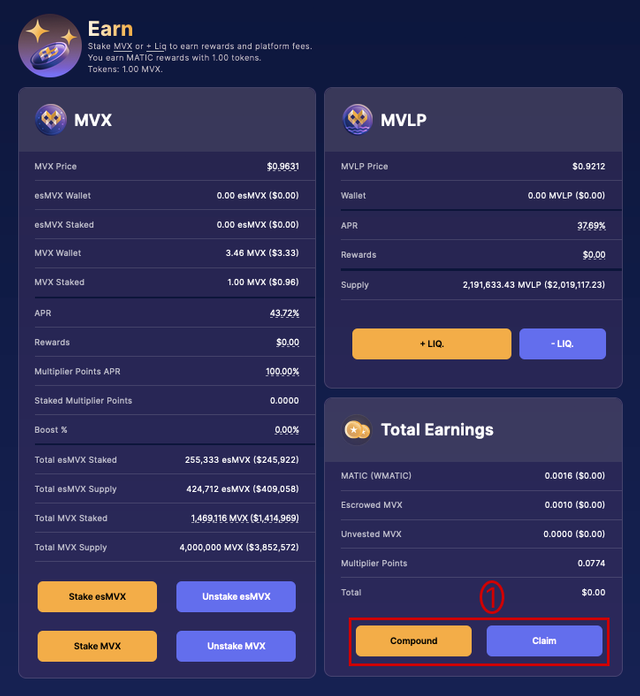

Compound or Claim rewards

Users can claim rewards anytime by going to the “Earn” page and clicking on the “Claim” button in zone 1, the “Total Earning” box.

Claiming will transfer any pending esMVX and MATIC rewards to your wallet.

The platform also has a one-click way of compounding all rewards. This will be very helpful to users who want to maximise their earnings.

Clicking on the “Compound” button will send a batch transaction with only one confirmation needed. You will see a recap of all the transactions that will happen before confirming the transaction in your wallet:

Claiming and then staking unvested MVX and/or esMVX.

Staking MPs.

Claiming WMATIC rewards and converting them to MATIC.

Claiming WMATIC and compounding them into MVLP or MVX

Quick links and info

The earn page also has a “MVX” and a “MVLP” box. Each of these boxes shows the following information:

- Token price.

- User assets.

- Rewards info (APR…).

- Total and staked supply.

Each box also shows direct links to all actions available to the users regarding the tokens.

MVX box:

- Buy, stake, unstake MVX.

- Stake, unstake, vest (available soon) esMVX

- Transfer account to another wallet (see dedicated section)

MVLP box:

- Add, withdraw liquidity.

Vesting

It is possible to convert esMVX to MVX through the vesting process, which involves reserving the average of MVX and MVLP that was used to earn the esMVX.

While vested, a small amount of esMVX gets converted into MVX every second.

This MVX is claimable immediately.

If the account misses the MVX or MVLP required to vest, the user has to purchase these tokens again.

Tokens may get deposited into a user’s vault at any point during vesting.

Distribution Rate

Distribution rates change on a monthly basis.

June 2022: 50,000 esMVX for MVLP provider & 50,000 esMVX for MVX staker

July 2022: 60,000 esMVX for MVLP provider & 60,000 esMVX for MVX staker

August 2022: 50,000 esMVX for MVLP provider & 50,000 esVMX for MVX staker

September 2022: 50,000 esMVX for MVLP provider & 50,000 esVMX for MVX staker

Detailed Rewards Mechanics

MVX holders are strongly incentivised to stake their tokens on the platform because this gives them three different types of rewards. They get:

- A share of the platform fees — paid in MATIC.

- A new token: esMVX, which generates its own rewards.

- Multiplier Points (MPs) that are yet another way to boost your MATIC earnings even more.

Let’s examine each one of these rewards and how they add up in detail.

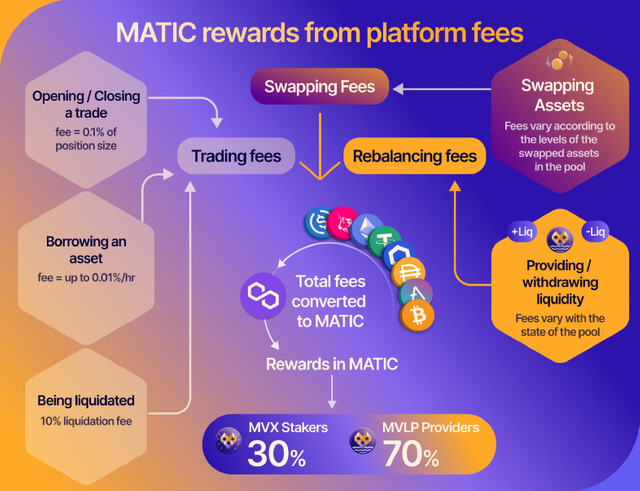

MATIC rewards from platform fees

This is the simplest form of reward and the easiest to understand: MVX stakers will get 30% of the fees collected from across the platform in the form of MATIC.

In case of blockchains other than Polygon network, the rewards are paid in the native token of the blockchain, e.g. NEAR in the case of Near Protocol.

Metavault.Trade generates revenues by charging traders small fees when they use the platform for the following:

- Swaps — fees vary according to the levels of the swapped assets in the pool.

- Opening and closing trades — fee of 0.1% of the position size.

- Borrowing to leverage trade or short an asset — fee of 0.01% * (assets borrowed) / (total assets in pool), deducted at the start of every hour.

The other situations earning fees for the platform are when:

- Traders with leveraged positions are being liquidated — fee of 10% of position.

- The liquidity providers mint or redeem MVLP — this is called the “rebalancing fee”, it depends on the state of the pool.

The chart below summarizes the platform fees and how they flow back to MVX and MVLP stakers after being converted to MATIC.

Escrowed MVX rewards

MVX stakers get rewarded with a new token: escrowed MVX (esMVX). It is non-transferrable and there is only two ways to use it:

- esMVX can be vested to be converted and distributed as MVX. If you choose that path, then your esMVX unlocks linearly over one year and MVX is sent to your wallet at each unlocking.

But there is an additional requirement to fulfill to vest your esMVX: you need to lock the average MVX (or MVLP) with which you earned your esMVX in a vault. Your MVX/MVLP cannot be sold while it is locked but it still accrues rewards. The locked tokens can be withdrawn anytime from the vault with no redemption period, but this will prevent any further vesting of esMVX.

- esMVX can be staked and will then earn the same rewards as staked MVX: MATIC rewards from platform fees, more esMVX, and multiplier points.

This second option is probably the most interesting one as it compounds rewards and generates higher APR and earnings.

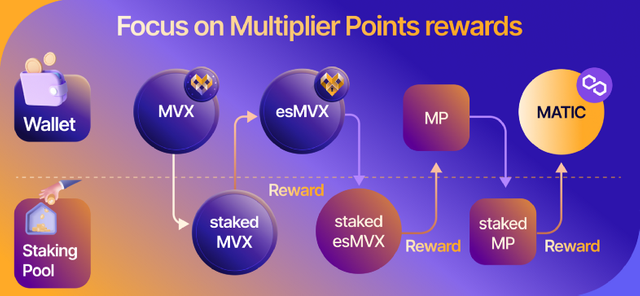

Multiplier points rewards

The third reward MVX stakers get is not a token but comes under the form of multiplier points (MPs). Like in a game, those points give you access to rewards, but you can also lose them if you undertake certain actions.

Let’s look at the rewards first:

- MPs are awarded at 100% APR.

- Each MP can be staked to earn the same amount of MATIC as a MVX token.

In this regard MPs are similar to staked esMVX: they allow you to increase your MATIC payout.

But in order to keep your points, you have to keep your MVX and your esMVX staked. Unstaking MVX or esMVX will incur a burning of multiplier points proportional to the amount of tokens being unstaked.

For example, if you staked 1000 MVX and accrued 200 MP so far, then unstaking 500 MVX — 50% of your staked amount — will burn 100 MPs.

This gamified system rewards you points for staying staked for longer as the only way to acquire multiplier points is through staying staked for the long haul.

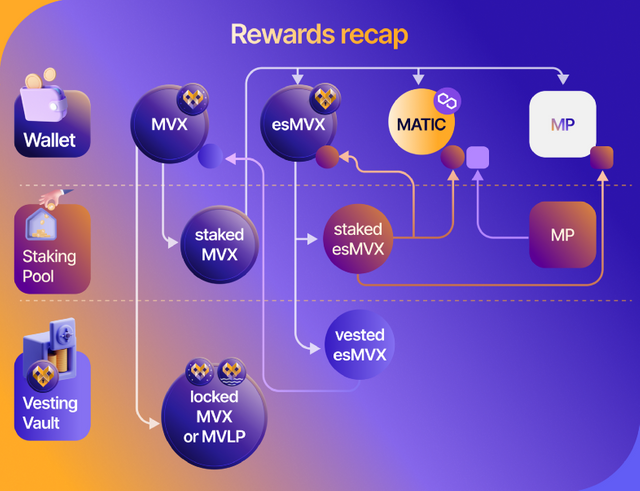

Rewards recap

In the previous section we gave a detailed review of each reward type. The following drawing gives a visual recap. If you focus on the wallet section where the rewards accumulate, you will see an increase in the amount of either MVX or esMVX + MATIC + MP, depending on what you choose to do with MVX and esMVX.

The richness of the reward structure allows you to design many strategies depending on your time horizon. But for those who want the greatest share of the platform fees, staking all esMVX is probably the best option because it gives access to a compounding effect. Indeed, since staked esMVX acts basically as staked MVX as far as reward goes, this strategy will accumulate the most MATIC through MVX, esMVX and MP boost.

Conclusion

The platform was designed to be as flexible as possible and features a number of advanced trading features, such as: market orders, limit orders, stop loss orders, trailing stop loss orders, fill or kill orders, stop limit orders, take profit orders, one cancels other orders, all-or-nothing orders, post only orders and hidden orders.

#polygon #metavault #trade #ido #sale

Social media Links:

Website: https://metavault.trade

Telegram: https://t.me/MetavaultTrade

Twitter: https://twitter.com/MetavaultTrade

Medium: https://medium.com/@metavault.trade

Discord: https://discord.com/invite/metavault

Documentation: https://docs.metavault.trade/

Author:

Username: Aerox arwana

Forum profil link: https://bitcointalk.org/index.php?action=profile;u=3370312

Polygon Wallet address : 0x3c93Deb254681158785454F061BD844cbC277aD4

Proof of Authentication: https://bitcointalk.org/index.php?topic=5414372.msg61004796#msg61004796