Introduction

Today, the Automated Market Maker niche is another niche that crypto enthusiasts can make huge profits from. An automated market generator is essentially a smart contract on the Blockchain network that contains and stores liquidity reserves. A cryptocurrency enthusiast can trade liquidity reserves at a rate controlled by a fixed formula. Conversely, anyone can increase the liquidity of these smart contracts by receiving an appropriate transaction fee as compensation. Today, there are many Blockchain networks competing for central position. These Blockchain networks offer a variety of incentives that allow them to stay ahead of their competitors by providing investors with a wide range of Blockchain networks to choose from. Today, the dominant Blockchain networks are Ethereum, Binance Smart Chain, Polygon Matic, and Solana.

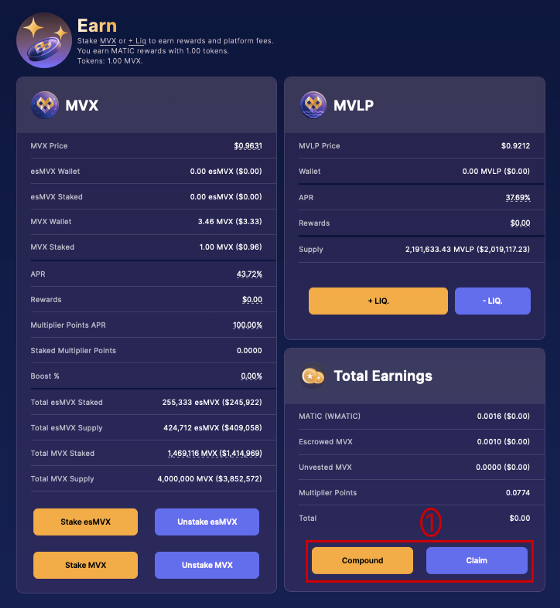

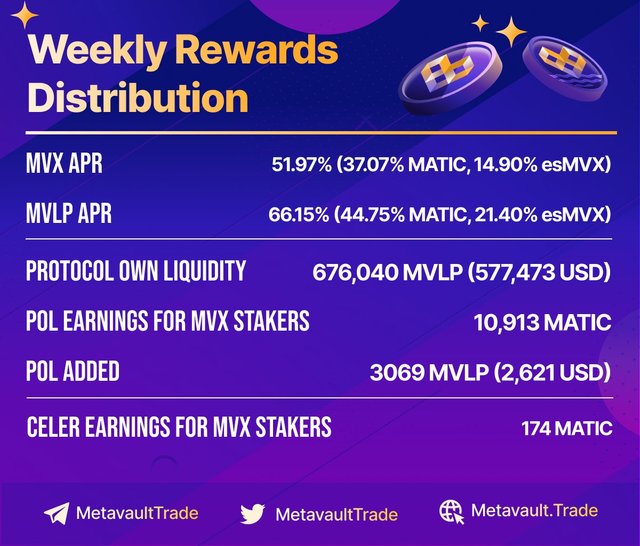

MATIC rewards from platform fees:

This is the simplest and easiest form of reward: MVX creators will receive 30% of the fees collected from across the platform in the form of MATIC.

In the case of a blockchain that is not the Polygon network, the reward is paid in a native blockchain token, such as NEAR in the case of the Neighbor Protocol.

Metavault.Trade earns income by charging traders a small commission when they use the platform for the following purposes:

Swaps – Fees vary depending on the level of swap assets in the pool.

Opening and closing a deal - commission 0.1% of the position size.

Borrow to take advantage of trading or short selling assets - 0.01% commission * (borrowed assets) / (total assets in total assets), deducted at the start of each hour.

Other situations in which platform fees apply are as follows:

Traders with liquidated leveraged positions - 10% commission per position.

Liquidity providers issue or buy back MVLPs - this is called a "rebalancing fee", depending on the condition of the pool.

The table below shows the platform fees and how they are returned to the MVX and MVLP generators after conversion to MATIC.

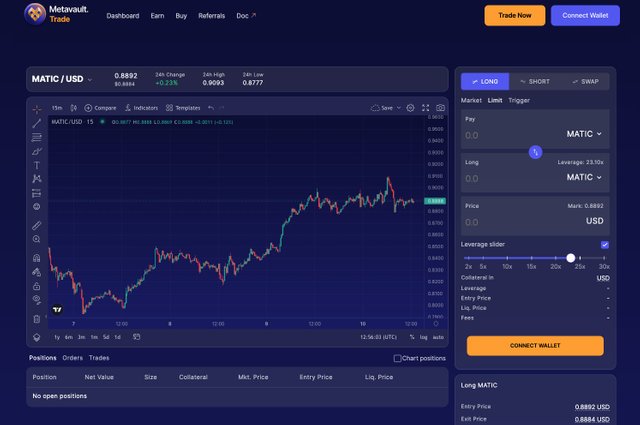

Metavault.Trade Market Maker Platform.

Partial Liquidations…

In case the market goes against your trade, there will be a price at which the loss will be very close to the margin.

The liquidation price is calculated as the price at which (collateral - loss - commission for using credit) is less than 1% of your position size. If the price of the token crosses this point, the position is automatically closed.

Due to borrowing fees, your liquidation price will fluctuate over time, especially if you have more than 10x leverage and the position is open for more than a few days, so it is important to keep an eye on the settlement price.

If any collateral remains after deduction of losses and commissions, the corresponding amount will be returned to your wallet.

Pricing…

Thanks to the innovative design, transactions on Metavault.Trade do not affect the price even for large orders. This means you can execute large trades exactly at the tick price.

The price of the marker is displayed next to the market name and below the exchange field.

Long positions will be opened at a higher price and closed at a lower price, while short positions will be opened at a lower price and closed at a higher price.

Another advantage of the platform is that there is only a small spread to enter and exit a trade. In the example below, there is no spread or the entry and exit prices remain the same.

Metavault Trade Decentralized Perpetual Exchange

Trade the best cryptocurrencies with up to 30x leverage directly from your personal wallet.

Reduce the risk of liquidation

The combination of quality price channels determines the timing of liquidation. This protects the positions from temporary wicks.

Cost savings

Enter and exit positions with minimal spreads and no effect on the price. Get the best price at no extra cost.

Simple Swaps

Open positions through a simple swap interface. Easily switch from any supported resource to the location of your choice.

Available on the following networks

A commercial Metavault has already been deployed in the polygon network, and the Fantom Opera.Near protocol is coming soon.

Trading

Metavault.Trade is an advanced decentralized exchange that requires no registration. To start trading on Metavault.Trade, you only need a Web3 wallet.

Tokenomics

Staking

Staked MVX Generates Three Reward Types:

(Native Token Like MATIC/CRO)

EsMVX

Multiplier Points

30% swap and leverage fees are converted to (native tokens like FTM/MATIC) and distributed to accounts with MVX.

Treasury Assets

The MVX-USDC LP pair is provided and owned by the protocol. 100% commission from this currency pair is converted into MVX and deposited in the MVX treasury.

Supply

The maximum supply of MVX is 10,000,000. This maximum arc is controlled by a 28-day temporary lockout, a possibility that will only be considered if protocol requirements call for increased liquidity. The rate at which the circulating supply changes will be determined by the number of tokens distributed through other DEXs, transferred, burned, and spent on marketing:

1.2 Million For Marketing, Partnerships And Community Development

2 Million For The Metavault DAO Treasury (Staked+Locked)

4 Million Reserved For Rewards (EsMVX Reserve For Multichain Expansion)

1 Million Paired With USDC For Liquidity On Uniswap

300,000 For MetavaultDAO Team (Linearly Vested Over Two Years With A Three-Month Cliff)

1.5 Million Allocated To Presale

Important Points Table Of Metavault Trade..

Basic PointsCoin

Name Metavault Trade

Short Name MVX

Max 10,000,000

Learn More:

Website: https://metavault.trade/

Twitter: https://twitter.com/MetavaultTRADE/

Discord: https://discord.com/invite/metavault

Telegram: https://t.me/MetavaultTrade

#PROOF OF REGISTRATION

Forum Username: FernandoLangston

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3438836

Telegram Username: @Lumpkine

Participated Campaigns: video

BEP-20 Wallet Address: 0x8b0Cf72985d99F394e4Eb9EFe357a025e5CF0459