Who don’t want to be rich?? Every body have some dream and they want it to be true in this life. Yes for sure some are luckily billionaire by birth but some earns themselves which is a great pride for them. Here is a best investment strategy which can make you crorepati.

We have seen a lot of examples where peoples have made millions and billions by investing in stock market. Today I have done research on 5 stocks which can give you up to 90000% returns in future.

Hold on.. you might be thinking it is fake, as 90000% is not a joke, but its possible which needs your patience and regular review on your investment.

There are a lot of stocks like “EICHER MOTORS, INFOSYS, TCS, TITAN INDUSTRIES, ASAIN PAINTS, HDFC BANK”, which have made many crorepaties and still counting.

Today I am sharing list of some stocks on which I have done research and I’ll show you their performances. Let’s get started

1)TCS:- TATA CONSULTANCY SERVICES is an IT sector stock which have made many millionaires since its establishment. Here’s a research data on the basis of which if you invest Rs 2,00,000/- as on date 26/08/2018 at a price of Rs 2043/- per share and hold it for 12-15 years your investment can give nearly 45-50 times returns which would be nearly 1 crore. TCS is a stock which can be kept for a lifetime, which will give you life time earning even if you are sleeping. Here are some of the data of TCS

• Market Cap: 782,178 Cr.

• Current Price: 2,043

• 52 weeks High / Low: 2046.05 / 1210.33

• Book Value: 241.80

• Stock P/E: 28.66

• Dividend Yield: 1.22 %

• ROCE: 75.57 %

• ROE: 30.03 %

• Sales Growth (3Yrs): 9.16 %

Compounded Sales Growth

10 Years: 17.97%

5 Years: 14.34%

3 Years: 9.16%

Compounded Profit Growth

10 Years: 19.37%

5 Years: 13.06%

3 Years: 9.95%

Return on Equity

10 Years: 36.14%

5 Years: 36.03%

3 Years: 33.99%

2)INFOSYS:-Infosys is the 2nd largest company of IT industry in India, It have made many millionaires which I had already shared with you in previous blog. If you want more details regarding this then please click on the below link

https://steemit.com/msgc/@mdsarfraj/infosys-is-giving-rs-7-30-crore-without-any-hard-work

Here are some of the data of Infosys which may inspire you to invest in this company

• Market Cap: 301,047 Cr.

• Current Price: 1,378

• 52 weeks High / Low 1436.65 / 874.00

• Book Value: 313.78

• Stock P/E: 18.73

• Dividend Yield: 3.16 %

• ROCE: 37.82 %

• ROE: 23.36 %

• Sales Growth (3Yrs): 9.77 %

Compounded Sales Growth

10 Years: 13.99%

5 Years: 11.81%

3 Years: 9.77%

Compounded Profit Growth

10 Years: 11.25%

5 Years: 10.65%

3 Years: 8.15%

Return on Equity

10 Years: 25.27%

5 Years: 23.93%

3 Years: 22.97%

3)RITES ltd:- Rites is a railway infrastructure company and have a very good capacity which can give you a good return in future 10-15 years. But my opinion is to hold this stock for at least 20 years as this would be sufficient time for it to make you crorepati. This company is debt free since last three years. Stock is trading at Rs 311/- per share. Here are some of the attractive data of this company

• Market Cap: 6,220 Cr.

• Current Price: 311.00

• 52 weeks High / Low 326.55 / 190.00

• Book Value: 111.36

• Stock P/E: 20.24

• Dividend Yield: 2.14 %

• ROCE: 14.17 %

• ROE: 15.78 %

• Sales Growth (3Yrs): %

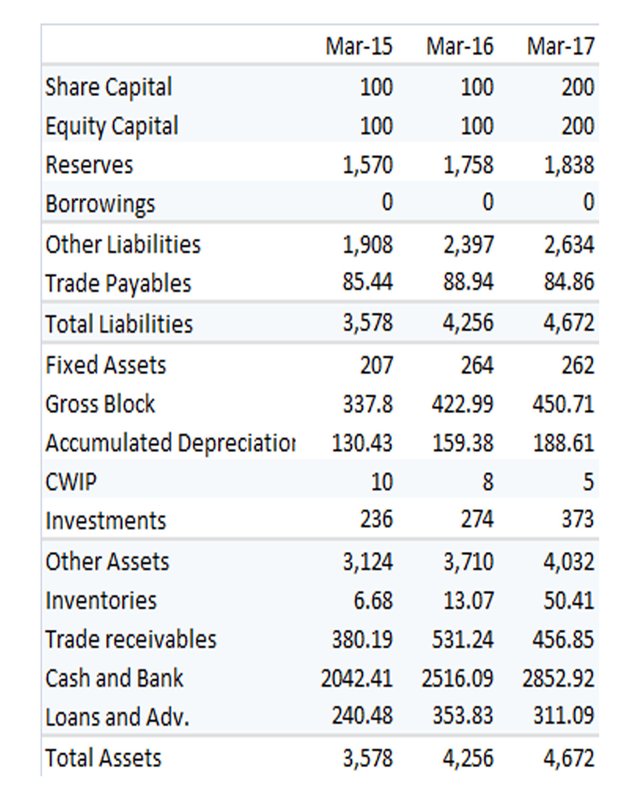

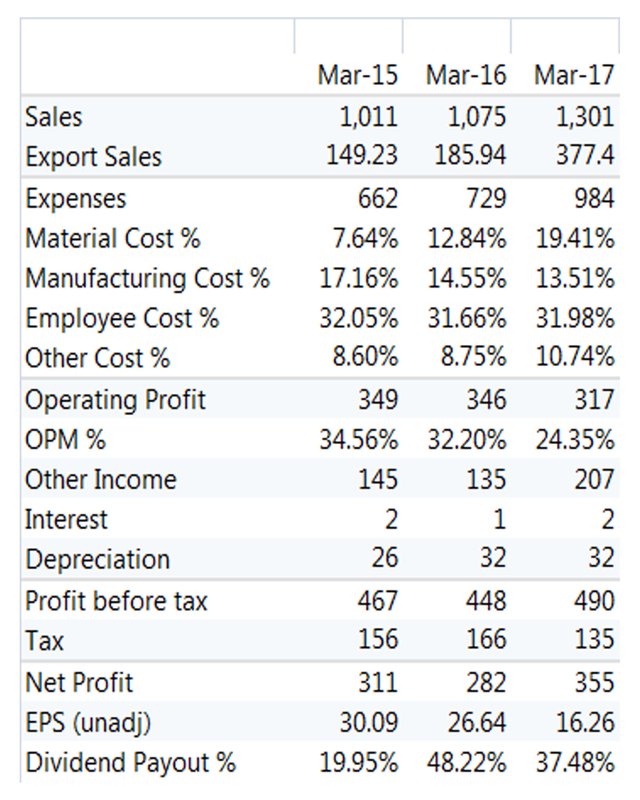

Here is the balances sheet of the company

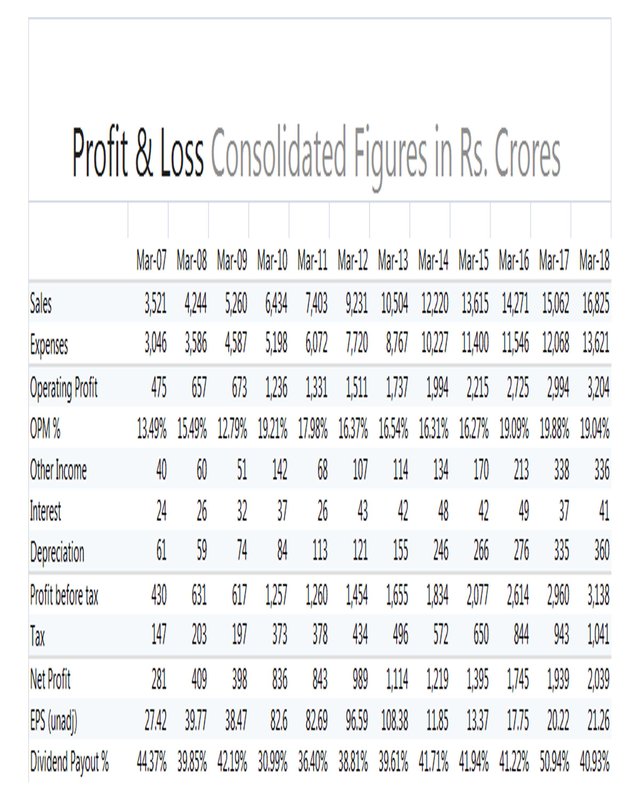

THIS IS PROFIT AND LOSS A/c OF THE COMPANY

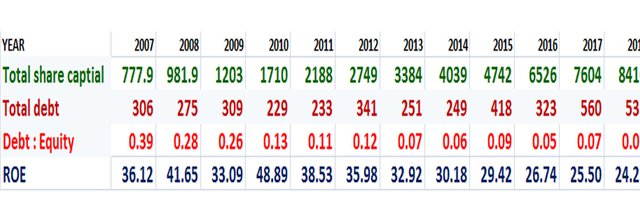

HERE IS THE ANALYSIS OF THE COMPANY ON THE BASIS OF BALANCE SHEET AND P/L STATEMENT

4)ASIAN PAINTS:- This is one of the best consumer product company which have a very good track record. Investment in this company is very secure and risk reward ratio always favors the investors. One can invest 1,50000/- at current levels and keep patience for nearly 15-18 years and you will be wonder of the returns it will pay to you. Currently stock is trading at Rs 1,394/-.

• Market Cap: 133,664 Cr.

• Current Price: 1,394

• 52 weeks High / Low 1488.60 / 1082.00

• Book Value: 93.64

• Stock P/E: 59.99

• Dividend Yield: 0.62 %

• ROCE: 54.38 %

• ROE: 25.46 %

• Sales Growth (3Yrs): 7.31 %

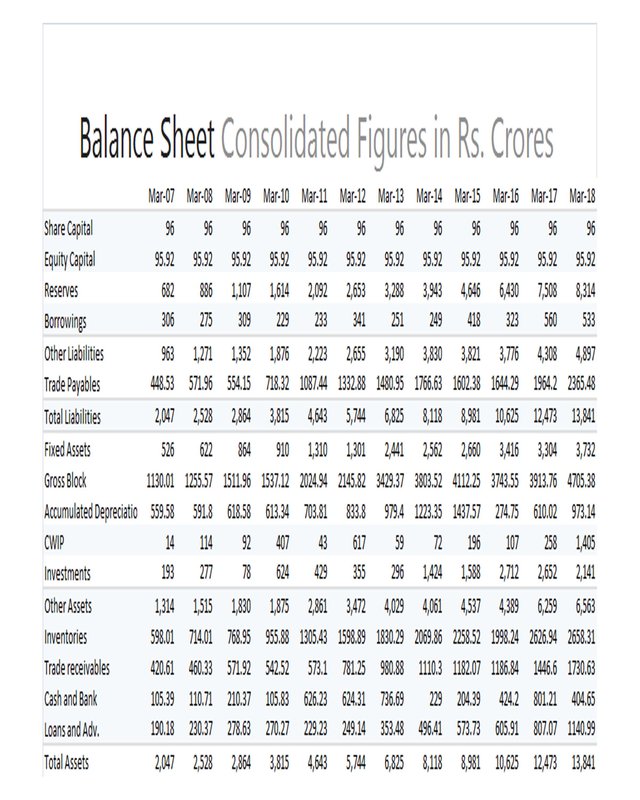

HERE’S THE BALANCE SHEET OF THE COMPANY OF LAST 12 YEARS

PROFIT & LOSS A/c OF THE COMPANY OF PREVIOUS YEARS

ANALYSIS ON THE BASIS OF BALANCE SHEET AND P&L STATEMENT

5)HDFC:-Housing development finance corporation ltd. This is the fifth company in our list which had and outstanding performance since its inception. This stock is really very good for investors as risk reward ratio as it is the top most financial company and a subsidiary of the top private sector bank i.e HDFC BANK. Current stock is trading at Rs 1,919/-. One must invest nearly Rs 1,90,000/- in this stock at current valuation and can have a very fine returns in future. Some data of this company is below.

• Market Cap: 324,451 Cr.

• Current Price: 1,919

• 52 weeks High / Low 2051.00 / 1638.00

• Book Value: 375.84

• Stock P/E: 33.61

• Dividend Yield: 1.03 %

• ROCE: 129 %

• ROE: 18.46 %

• Sales Growth (3Yrs): 8.69 %

Compounded Sales Growth

10 Years: 13.80%

5 Years: 10.76%

3 Years: 8.69%

Compounded Profit Growth

10 Years: 16.92%

5 Years: 13.96%

3 Years: 15.87%

Return on Equity

10 Years: 20.07%

5 Years: 20.02%

3 Years: 19.82%

These are the list of top 5 companies in which you need an investment of nearly Rs1,50,000/- to Rs 2,00,000/- and which will get multiplies itself to make you a crorepati one day. These all stocks have made many millionaires till date and still counting. What’s your opinion on the future of these companies…