It’s that time of month again when we contemplate the profitability of mining the most privacy-focused currency on the market: Monero. This particular cryptocurrency hasn’t seen much fluctuation in difficulty until early 2017. Since then, it has seen tremendous growth, especially during Q4 of 2017, as miners flock to its network. As a result, we’ve seen a boom in difficulty since the beginning of December. It’s clear that this diamond in the rough has gained a fair share of recognition among the mining community.

But why? What developments have lead to such a surge in difficulty?

According to coinmarketcap.com, Monero has seen quite a price hike — like the rest of the cryptocurrency market — since it sat at $81.00 in November and shot up to $400.00 by the end of December. Its recent surge in price is undoubtedly the most attractive prospect to seasoned and new miners alike.

It’s also likely that Monero’s ASIC-resistant qualities make it attractive to miners moving away from Vertcoin, due to its recent reward halving in December. Vertcoin, which is also ASIC-resistant, depends on a miner base very similar to that of Monero’s, so it’s quite an easy and attractive prospect for miners not seeing the returns they envisioned with Vertcoin to instead point their hashrate at Monero.

As far as the long-term goes, Monero, being one of the most solid coins on the market, is sure to see bigger gains this year with the imminent release of Ledger Wallet support, a custom Monero hardware wallet, bulletproofs, a MimbleWimble sidechain, and more. These innovations (aside from Ledger support) will take time. But rest assured, Monero’s price is likely to rise, slowly but surely.

Despite the price and difficulty increase, is Monero still worth mining? If Monero has only just recently peaked your interest, such a question is difficult to answer and requires further analysis.

Monero difficulty update for January 2018

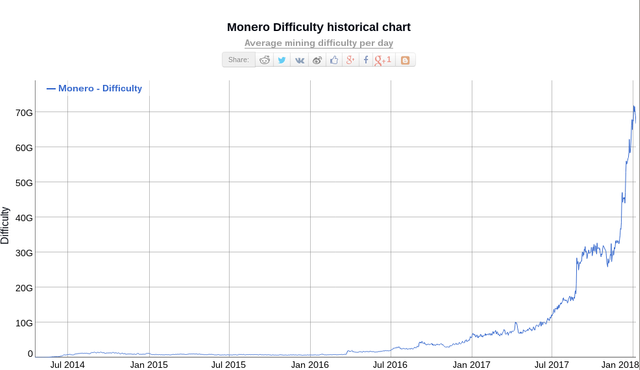

Throughout the summer, we’ve seen a very steady rise in difficulty, starting with 8.8G in June to 16.2G by the end of July. From July to the end of August, a massive surge in miner interest sparked, resulting in 16.2G increasing to 27.3G. This number had remained relatively steady all the way up until late December, when difficulty rallied to 66.7G by the 8th of January.

Here’s the chart showing the historical difficulty movements on bitinfocharts:

For those who’re new to mining, this chart depicts the rate at which you’ll be granted rewards in accordance with the amount of energy spent by your GPU to mine. From an economic standpoint, this chart can be thought of as representing your GPU’s “buying power”. As we can see, the same amount of energy would’ve returned far higher rewards since Monero’s creation all the way up until the summer of 2017, at which point the difficulty adjusted drastically, resulting in more energy being required to see the same kind of returns.

However, if you’ll bullish on Monero’s price performance for this coming year, mining Monero now could definitely pay off in the near future.

Is it worth it to start mining Monero in January 2018?

The answer to this question appears to be cautiously optimistic, depending oon your rig. For example, with 6 Radeon HD 7990 AMD GPUs, you’ll be getting about 6,720 H/s. Not factoring in electricity costs, you’ll be making $106.69 USD a week. Considering that 6 HD 7990 GPUs cost $2,400 USD, you’ll pay the rig off in 5 and a half months. There are some other more expensive GPUs that you will see with marginally better improvement in hashrate, but the HD 7990 is probably your best bet in terms of performance-per-dollar.

However, these estimates are based upon Monero’s current price. If you’re a firm believer in Monero and its goal of absolute privacy, you’ll be bullish on Monero’s price making headlines in the future. It’s important to factor in the potential for the coin you’re mining to appreciate in the future when considering whether or not to mine a specific cryptocurrency. Although, just as the value of a coin can rise, it can also drastically fall, leading to even worse profitability. In the event that the profitability of your Monero mining rig were to absolutely crash, a Monero GPU rig can always be re-purposed into mining another ASIC-resistant cryptocurrency, such as Vertcoin. In other words, all isn’t lost if you invest in a Monero rig and find that profits are a bit lacking.

There’s more to it than money

At this point, profitability is fairly lucrative. Paying off a 6 GPU rig in 5 and a half months is not bad at all. But there’s much more to mining than just money. It’s incredibly fun to set up a mining rig and see the Proof-of-Work algorithm in action, knowing that you’re playing a valued role in securing a network of a revolutionary cryptocurrency. If you’re someone who legitimately enjoys computer science projects and exploring the technical side of cryptocurrency, I encourage you to build a mining rig and try mining Monero for yourself. If you decide you don’t want to mine Monero in the future, you can always re-purpose your rig for another GPU-optimized coin.

On the other hand, If you’re someone who purely wants to make a profit, mining Monero may also be for you, unless you’re bearish on Monero or don’t want to wait 5 months to start seeing a profit. If miners leave the network, however, difficulty is bound to decrease, which could act as a catalyst for paying off your rig even quicker. This is unlikely, since Ethereum is going to implement its Casper update soon, which will begin to phase out mining on the Ethereum network in favor of the Proof-of-Stake protocol. This may result in a mass of miners flocking to ASIC-resistant coins, such as Monero. If you’re thinking about mining Monero, you may want to get started now and secure your ROI before difficulty starts ramping up.

To the question in your title, my Magic 8-Ball says:

Hi! I'm a bot, and this answer was posted automatically. Check this post out for more information.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @surajshete! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit