DEPOSITORY NETWORK: TRANSPARENT LENDING ON THE BLOCKCHAIN TECHNOLOGY

Published on July 13th, 2018 by TIVERE AKPORODE

WHAT IS DIGITAL ASSETS

A digital asset is any text or media that is formatted into a binary source and includes the right to use it. Digital files that do not include this right are not considered digital assets. A digital asset can range anywhere from motion pictures to documents and any other type of data.

WHAT IS DEPOSITORY NETWORK?

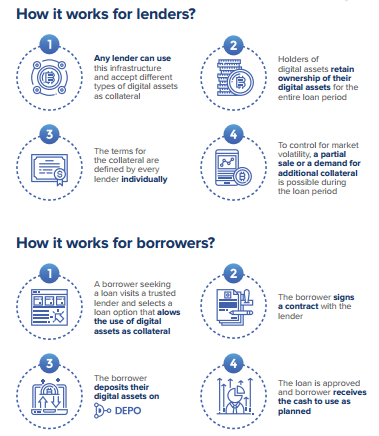

Depository Network is the first of its kind, a network that provides vital elements such as a safe decentralized depository for a collateral asset in the digital world. It is the world`s very first multi-platform network that enables lenders (Peer to peer) to lend in marketplaces, banks, and other credit institutions. Their core purpose is to build and spread the DEPO multi-platform network worldwide and to reach a tipping point for mass adoption using blockchain assets (accepting digital assets as collateral) than the traditional lending method. They will also provide a secure decentralized cryptocurrency asset collateral system which can build hundreds of collateral depository platform.

PROBLEM

Owners of digital asset are not able to use, deposit or liquidate their asset.

- The digital asset does not have the necessary liquidity and owners must sell these assets to take advantage of their value

Lenders are unable to accept digital asset as collateral which may results in a locked financial value for a market with huge financial capitalization.

It is not possible for lenders and private companies to create their own digital asset depository. The lack of these options, however, compels the exordium of the new tools that are needed to help the blockchain industry in becoming the main technology used for collateral contracts in the near future.

SOLUTION

To ensure potential security, transactions are executed by the use of cryptographic multi-signature wallet in storing digital asset.

Keys are kept by the borrower, lender, and DEPO for transparency and to ensure no party acts at its own discretion.

Institutions are allowed to build independent depositories within the system with its decentralized method of lending.

Assets can be pledged by owners of digital asset as collateral and in turn, receive a loan from lending institutions.

Lenders can build their own depository on DEPO and start accepting digital asset as collateral.

Loans will be accessible on DEPO in any currency supported by the lender.

DEPOSITORY NETWORK BENEFITS

High tech infrastructure.

Provision of full support and other execution.

Independent service provider.

Digitals asset is retained by lenders customers.

The use of DEPO enhances cost efficiency.

TOKENIZATION:

A. TOKEN PRICE WITHIN ICO IN USD

TOKEN PRICE: 0.02 USD

PRESALE: 0.005 USD (75% DISOUNT)

ICO FIRST STAGE: 0.01 USD (50% DISCOUNT)

ICO SECOND STAGE: 0.015 USD (25% DISCOUNT)

ICO THIRD STAGE: 0.02 USD

B. ICO CAP

SOFT CAP: 2.6 MILLION USD ($2,600,000)

MID CAP: 6.8 MILLION USD ($6,800,000)

HARD CAP: 15 MILLION USD ($15,000,000)

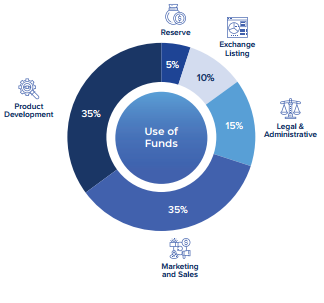

USE OF FUNDS

TEAM MEMBERS

ADVISORY BOARD MEMBERS

CONCLUSION

DEPO decentralized has initiated a means of secure peer to peer lending of the digital asset and a more secure way of lending loans on the cryptocurrency blockchain. A platform that can be used by anyone who owns a digital asset with all records encrypted in the database. With DEPO decentralized and secured means of giving loans by the lenders, borrowers are safe.

CONTACT INFORMATION

WHITEPAPER

TELEGRAM

FACEBOOK

TWITTER

LINKEDIN

GITHUB

YOUTUBE

REDDIT

BITCOINTALK

WEBSITE

ARTICLE WRITTEN BY TIVERE AKPORODE