In previous liquidity pool their is no such platform that can provide the way back assiduity for creating the reluctance between the pool that can emerge the different type of token to make users put the liquidity on it and on the behalf of it get the other suspected aspects that makes an integral part to make an assumption to utilize all the core features to get out the emerging ERC 1155 standard token to utilize all the option of different types that can accumulate the new outcomes.

As we know that to being a part on liquidity pool you must have a desired effective platform that would be called as farm in which you kept your tokens and get the tokens out of it there fore this MOCKTAIL SWAP is been introduced that can assumed the other related aspects that can enhances the probability for getting out the new things with comprises of fungible and non fungible tokens that is been comprises on single contract address at there user can placed token and get out the massive return that would be the core expenditures that makes an integral part.

Let we discuss the massive features about pool and farming that is been introduced in this platform that creates a massive assumption why you need to utilized this pool.

What is MOCKTAIL?

Basically Mocktail is a Semi Fungible token that comprises the AMM(Automated Market Maker) that allow user to place at the pool and getting out the massive return on the behalf and other features you also been addressed that includes compounding,yield aggregation there fore assuming that TVL option is also been locked as well that can provide how much money is been locked makes an assumption of the huge ability of this liquidity pool.That’s why they have fast swapping spillage with low fees.

How it works:

This MOCK token is semi-fungible that can comprises of technically technically, 2²⁵⁶ token types with up to 2²⁵⁶ copies of each. That contains the multiple copies of tokens that comprises with in different addresses.The authority been given to each address.

You can also comprise this token on a pool I.e BNB that is been swap into MOCK that can represent as MOCK LP that been created by the liquidity pool.All related information is been introduced in Defi Pulse although TVL that makes an assumption of market pair that can make an integral part by the bottom line in return by the LP that is been provided among the liquidity pool.

The distribution is been done by the APR and APY.There Mocktail swap APY shows compounding that can generate the amount of return that is being made on reinvesting.Therefore it is also need for them fast peace of Defi that make them for take on the higher returns. It also engage the collateral option as well the more you borrow the token the most you placed an collateral to reduce the risk of crashing that can make an integral part.

Risk of Yield- farming:

This Mocktail swap also decline the risk of by comprises of semi fungible token that have the portability of accessing the information that can address the speculation that been take on the different aspects having risk management strategies is also implemented that can create the efficient pool having more LP that can enhance the profits.

Their are numerous other platform like compound finance,maker DAO,Synthetix and AAVE etc but they did not comprises of semi fungible token that MOCKSWAP does that would be the core aspect.

Exchange:

This Mocktail swap of enchanting contradiction have diligent aspect that is been comprises of :

When you make a token swap (trade) on the exchange you will pay a 0.2% trading fee, which is broken down as follows:

0.17% - Returned to liquidity pools in the form of a fee reward for liquidity providers.

0.03% - Sent to the Mocktail Swap Development Treasury.

REWARD LP MULTIPLIER:

Initial Liquidity Pools (LPs) for farming MOK tokens:

Reward multipliers:

MOK/BNB LP

MOK/BUSD LP

MOK/CAKE LP

MOK/TRXLP

MOK/WINLP

All of the swapping is been introduced by the LP that they can get the huge profit in return having said they can comprises of all the features that is been needed for farming that indicated on this pool.

Staking Pools:

Stake MOK to earn new tokens. You can un stake at any time. Rewards are calculated per block.

Staking Pairs:

MOK Pool

BNB Pool

BUSD Pool

WBNB Pool

MOCK have no hard cap?

Why?

Mock have no hard cap because it can limited the occurrence amount of reserved blocks that can absolute maximum supply that is been persevered by the the units no further creation of block and its unit that have slow inflation. Therefore the amount of blocks per supply is been preserved that is team added the desire supply that’s why they have no hard cap.

Reducing block emission:

The amount of block is been reduced but gradually slow inflation that incentive people to add more liquidity that is the biggest reason we did not used block.

Deflationary Mechanism:

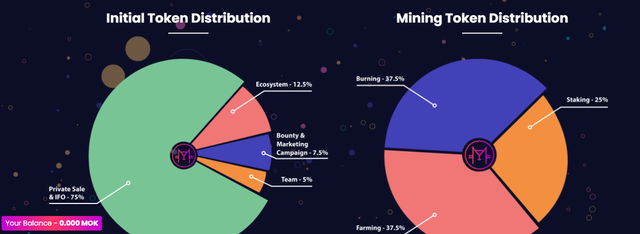

The token is been burned and distributed on the many Mocktail swap product this would enhance the probability of the new attachment of MOCK TOKENOMICS.

Road Map:

Analytics:

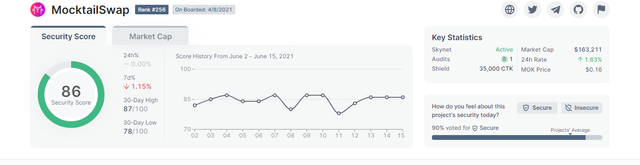

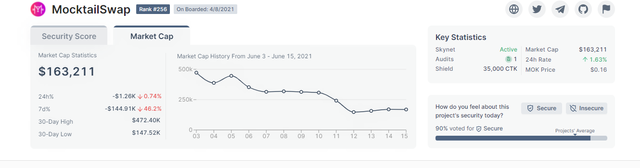

CERTIK ANALYSIS:

About MOK Token:

This token was issued by the MOCKTAIL SWAP that is integrated by the MOCKTAIL Token.

Symbol: MOK

Token Type: ERC1155

There are the following information about the MOCKTAIL SWAP

Ticker: MOK

Chain: Binance Smart Chain (BEP-20)

Address: https://bscscan.com/address/0xCA69C118Fa550387794d48900a866891217E5C9F

Emission rate:

Emission/block (MOK) Emission/day (MOK)

Emission 5 150,000

Effective Emission 5 150,000

Distribution:

Distributed to Reward/block(% of emission) Reward/block (total MOK) Reward/day

Farmers 60% 3 90,000

Stakers 40% 2 60,000

Other Deflationary Mechanics:

At present,

Weekly Surprise Burning from 50,000 MOK to 500,000 MOK.

Conclusion:

The semi fungible token that can bring the huge contradiction that allows them to make collaboration with fungible and non fungible token and other related comprises they can make a huge prospect to exchange token by using same contract address that is being used for all tokens that one is act as utility token and other is security token. And non fungible that is been comprises of burst of kitties,video etc that make all comprises that is summarize by semi fungible token contain both types that’s why they can make an integral part to used that kind of LP to make a part on it and get the huge advancement that is being the huge aspect.

Platform Official Information:

WEBSITE: https://www.mocktail.finance/

ANN: https://bitcointalk.org/index.php?topic=5326502

WHITE PAPER: https://docs.mocktailswap.finance/

TELEGRAM: https://t.me/MocktailSwap

TWITTER: https://twitter.com/MocktailSwap

Author information:

BTT Username: Omair Amin

Profile: https://bitcointalk.org/index.php?action=profile;u=2603103

BSC WALLET Address: 0x6D4793ecAb20Bc68E13F776FA2aDd2f0dC69d8c1