Option trading is catching up fast among rookie stock investors. Once they come to know that the risk is much lesser compared to conventional trading, they waste no time and jump on to business. However, this is not advisable. It's necessary to know the nooks and crannies of the business before one decides to delve in. Unless a person has acquired a solid foundation on how the options work it won't serve him the purpose of achieving his goal, that is, making profits. Therefore, below are listed a list of methods that are comprehensive and elucidates the process in a lucid manner. They involve less risk than stock owning and can be used as a beginner's guide when it comes to option trading. A best option trading service always follows the right procedure of this kind of trading.

Covered call writing:

suppose a person owns a certain stock. He sells a buyer the right to buy that stock at a predetermined price. Though that limits the potential for profit, the person collects premium in cash that he can keep, no matter the circumstances. This cash reduces the overall cost. Now, if the market sees a steep loss, he definitely suffers a loss. But his losses are significantly lesser than someone who didn't find the extra cash in the beginning.

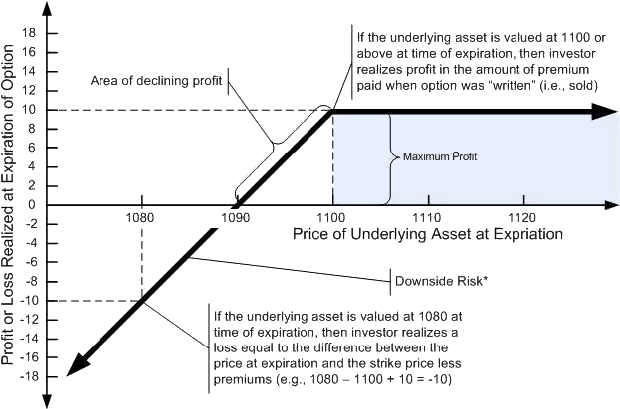

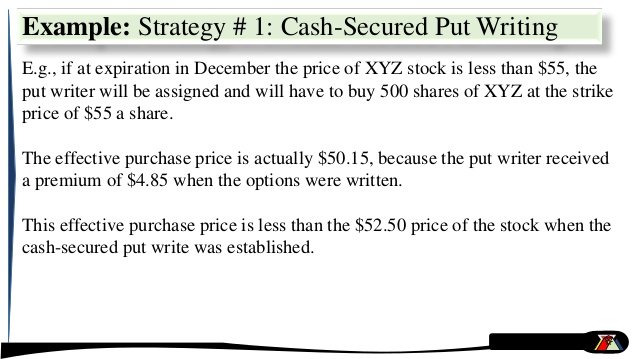

Cash secured naked put writing:

selling a put option on the stock a person wants to own and choosing the stroke price which reflects the price he is willing to pay for it. In this case, he collects premium in cash for accepting the obligation of buying a stock by paying the predetermined strike price. Of course there is an option where he does not need to buy the stock. But even in that case he gets to keep the cash premium he received earlier. A person having enough cash in his accounts to buy the shares he intended to is considered to be cash secured.

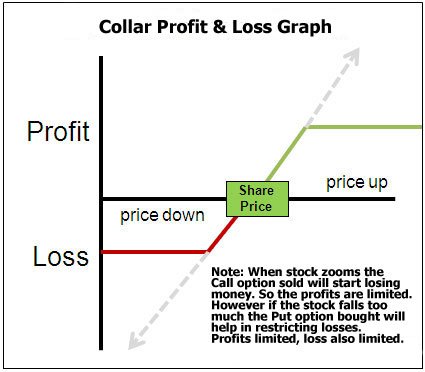

Collar:

it is a covered call position where a "put" is added. This acts as an insurance policy and keeps losses at a minimum level. However, the trade off is that the profits are also lowered considerably. Nevertheless, this has been popular amongst orthodox stock investors.

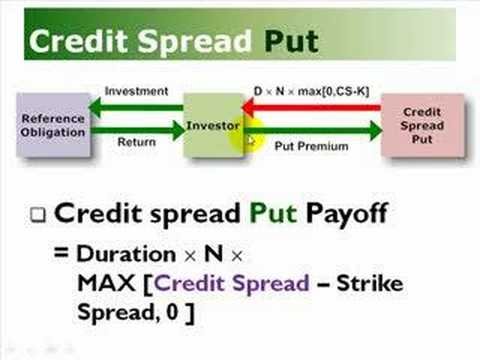

Credit spread:

This involves the purchase of a call option in lieu of selling another or the purchase of a put option in lieu of another. There expiration dates are same and it is known as a credit spread because the investor gets to collect cash for this trade. A high priced option is sold for a less expensive one and it limits both the profits and losses.

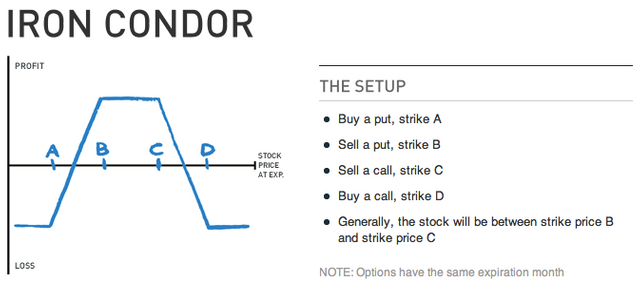

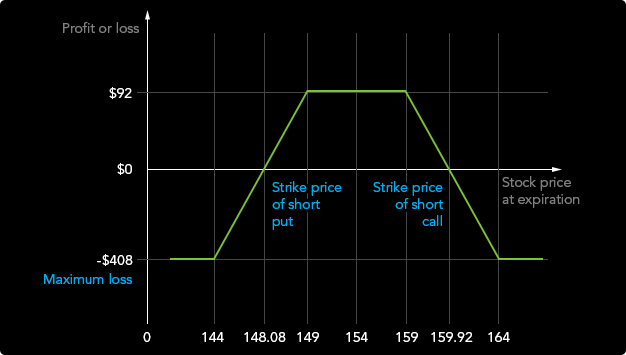

Iron condor:

In this position, there is one call credit spread and one put credit spread, simultaneously. This, like all the others limits the profits and losses.

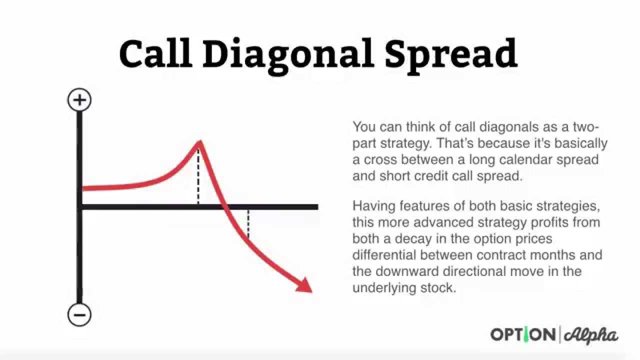

Diagonal:

This is also called the double diagonal spread. Here the options have different strike prices with different expiration dates. The option that has been bought has a later expiration date than the option sold.

Nice post! I wish people wrote more about investing in general than only crypto related stuff here on steemit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit