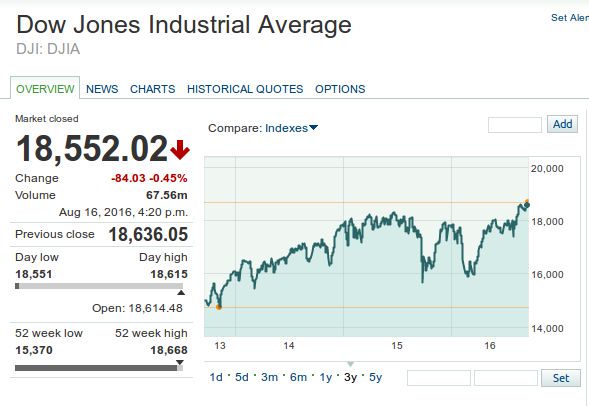

First let us take a look at the important indices.

So what do we see?

We see pretty bullish indices performing at high levels.

Even the FTSE 100 is performing pretty well after the brexit votum.

So it seems everything is ok. More then ok. Or not?

Why we hear such news lately? Especially from these guys?

George Soros (Hungarian-American business magnate, investor, philanthropist, political activist and author. He is chairman of Soros Fund Management. He is known as "The Man Who Broke the Bank of England" because of his short sale of US$10 billion worth of pounds, making him a profit of $1 billion during the 1992 Black Wednesday UK currency crisis. Soros is one of the 30 richest people in the world.)

Billionaire investor George Soros, who rose to fame and fortune by betting against sterling in 1992, on Monday showed his latest hand: nearly doubling down on his bearish bet against the market. The 86-year-old’s fund, Soros Fund Management LLC, disclosed in a regulatory filing it had increased its bet against the S&P 500, the main index used to measure big-stock performance in the U.S., and holds put options on roughly four million shares in an exchange-traded fund that tracks the index. That is up from “puts” on 2.1 million shares as of March 31. Meanwhile, Soros’s fund also cut sharply its position in gold, selling off the bulk of the shares it had bought last quarter in Barrick Gold Corp., the world’s largest gold producer, and cutting sharply its position in a gold-backed ETF set up by the World Gold Council. Soros’s fund had opened the position in the first quarter, disclosing call options in about one million shares. Soros also sold off the stake it opened last quarter in miner Silver Wheaton. The Hungarian refugee has been shifting the fund’s focus back to the big-picture economic global view that earned him recognition as he continues to warn of a coming financial crisis, much as he did leading to the 2007 crash.

marketwatch.com on August 16, 2016

Jacob Rothschild, 4th Baron Rothschild (British investment banker and a member of the prominent Rothschild banking family.)

Lord Rothschild is pessimistic on the outlook for financial markets and has moved to reduce the trust's exposure to quoted equities from 55 per cent to 44 per cent since the start of the year. Some of the proceeds have been used to buy gold and other precious metals, which at the end of June accounted for 8 per cent of the £2.8 billion portfolio. In the trust's half-year results, released yesterday, Rothschild remarks that 'we are in uncharted waters' due to 'central bankers continuing what is surely the greatest experiment in monetary policy in the history of the world'. Rothschild said to date quantitative easing has successfully driven stock markets higher, but he fears this cannot go on forever. He adds that a number of headwinds could also derail markets.

moneyobserver.com on August 16, 2016

Warren Edward Buffett (American business magnate, investor and philanthropist. He is considered by some to be one of the most successful investors in the world. Buffett is the chairman, CEO and largest shareholder of Berkshire Hathaway, and is consistently ranked among the world's wealthiest people.)

The Oracle of Omaha is taking his own advice when it comes to derivatives, after being scalded by the complex financial instrument in 2008. Warren Buffett, the famed CEO of Berkshire Hathaway brk.a , paid $195 million in June in order to terminate Berkshire’s final contract in which Buffett insurance and investing conglomerate sold protection against losses on bonds, according to a regulatory filing by the company Friday. That contract was initiated in 2008, and tied to municipal debt, with maturities ranging from 2019 to 2054. The terminated contract gave Berkshire pre-tax earnings of $103 million in the second quarter and $89 million in the first six months of 2016. The legendary investor has made his disdain for derivatives—a class that includes the credit default swaps that helped exacerbate the 2008 financial crisis—well known. He called the instruments “financial weapons of mass destruction” in 2003. He again reiterated his concerns about the contracts during Berkshire Hathaway’s annual meeting this year, calling the group of complex derivatives a “potential time bomb” on the balance sheets of banks that is vulnerable to economic shocks. Despite those warnings throughout his career, Buffett still went in. In 2004, he bought up a number of contracts, saying it gave him money up front so that he could make further investments, Bloomberg reported. Those derivatives later cut into Berkshire’s earnings in during the crisis, and played a part when Moody’s decided to downgrade Berkshire’s AAA rating to AA2 in 2009. That said, Berkshire still holds onto some derivatives tied to the performance of stock indexes.

fortune.com on August 8, 2016

Donald Trump (American businessman, television personality, author, politician, and the Republican Party nominee for President of the United States in the 2016 election. He is chairman of The Trump Organization, which is the principal holding company for his real estate ventures and other business interests.)

In an interview with Fox Business on Tuesday, Trump was asked if he has money in the market now. "I did, but I got out," Trump replied. He warned of "very scary scenarios" ahead for investors. This isn't the first time Trump has advised Americans to steer clear of stocks. In October of last year, he told The Hill that the stock market is in a bubble. The stock market has gone up more than 6% since he made those comments. "The only reason the stock market is where it is, is because you get free money," Trump said.

money.cnn.com on August 2, 2016

Nassim Nicholas Taleb (Lebanese-American essayist, scholar, statistician, former trader, and risk analyst. His 2007 book The Black Swan was described in a review by the Sunday Times as one of the twelve most influential books since World War II.)

“The fact that the world, as a result of quantitative easing, has seen an asset inflation that benefited the uber-rich, and that nothing has been cured. One cannot cure debt with debt, by transferring from private to public sectors. The markets will ultimately crash again, although this time it will hurt a lot more people,”.

finance.yahoo.com on August 8, 2016

Prem Watsa (Canadian businessman who is the founder, chairman, and chief executive of Fairfax Financial Holdings, based in Toronto - called the "Canadian Warren Buffett.)

Prem Watsa spoke this week on his “concern about the financial markets” that caused him to increase his hedges on his common stocks even as he posted millions in losses in the portfolio for the first half of 2016. Watsa increased his equity hedge ratio to 115% as of June 30, from 88.1% on Dec. 31. A financial statement attributed the increase to added short positions in stocks and stock index total return swaps, along with unrealized depreciation of equity and equity-related holdings. “We are maintaining our defensive equity hedges and deflation protection as we remain concerned about the financial markets and the economic outlook in this global deflationary environment,” Watsa said.

forbes.com on August 3, 2016

The International Monetary Fund (IMF) (international organization headquartered in Washington, D.C., of "189 countries working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world.)

Economists at the International Monetary Fund are urging the European Central Bank to stop yanking interest rates further into negative territory, warning it will take a toll on the region’s already struggling banks and reduce lending to businesses and households.

marketwatch.com on August 12, 2016

Barclays (British multinational banking and financial services company headquartered in London.)

With monetary policy officials from Uganda to the U.K. to Australia slashing interest rates in recent days and the U.S. Federal Reserve continuing to kick its own rate hike can down the road, central banks around the world have been left ill-equipped to deal with an unexpected financial or economic crisis, according to an analysis published this week by banking giant Barclays. The better part of a decade has passed since the onset of the Great Recession and ensuing global financial crisis, during which time governments around the world slashed interest rates in an attempt to jump-start economic growth. But years later, interest rates are anything but back to normal. Japan and some major European economies are now dabbling in negative rate territory, and the U.S. has only seen one interest rate increase in the last 10 years after the Fed lowered its benchmark rate to never-before-seen, near-zero levels back in 2008.

usnews.com on August 8, 2016

Deutsche Bank AG (German global banking and financial services company with its headquarters in the Deutsche Bank Twin Towers in Frankfurt.)

Germany‘s largest bank has admitted it is in "financial repression mode" as it desperately scrambles to implement financial buffers to prevent collapse. Central banks are using interest-rate cuts, asset purchases, and other monetary-policy measures to prop up the economy to keep it at a "status quo”, the bank said. But a market correction could be on the cards if an "external economic shock" hits, they said. The news comes as it was revealed the bank's profits dropped by 98 per cent last month and its share price reached lows not seen since before 2002. Now Dominic Konstam, Deutsche Bank's global head of interest rates research, has issued a report that warned a "collapse in risk assets" could cause "panic".

express.co.uk on August 16, 2016

We do not know what will happen, but we know

- most of the states are heavily indebted

- central banks continue printing money

- the european banks are in trouble and

- the eurozone is collapsing.

The financial markets and the real economy are drifting more and more apart.

So be prepared and stay vigilant!

It's long overdue. According to at least one expert, we are already in recession:

https://steemit.com/money/@tarack/are-we-now-in-a-recession

Were it not for continued central bank intervention that keeps pushing it forward, we should have had the much needed correction. But natural cycles cannot be delayed forever. Check this article out on Kondratiev Waves:

http://goldsilverintel.com/financial-winter-nearing/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Did you compile that info yourself? If yes, bravo, very well done!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes I did it myself. Thank you :)

I wanted to show that everything looks almost perfect but behind the curtain it doesn't.

So I searched a few hours for quotations from some "big guys". Later I added some information about them for the people that maybe don't heard about them before.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i tell people to invest in simple things. in my roth ira account i have stocks like WMT, JNJ, CLOROX. these companies wont die no matter what happens.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit