It did not take long on Monday, July 31 for the dollar to break below the 93 handle and fall to its lowest level in 13 months.

And with the dollar so far losing around 9% of its strength since the beginning of the year, even mainstream analysts are predicting that this trend could very well send gold and silver prices much higher.

The price of gold could see substantial upside as the U.S. dollar index continues sliding in value, some strategists are forecasting.

The greenback has declined nearly 9 percent against a basket of foreign currencies year to date as the likelihood of parts of President Donald Trump's economic agenda getting underway has been called into question, and the prospect of further interest rate hikes from the Federal Reserve has pulled back.

The dollar index could certainly drop to the 92 mark (about 1.5 percent below its closing price Wednesday of 93.40), said Phillip Streible, senior market strategist at RJO Futures. And though these levels are important to watch in the dollar, what's more interesting to him is the impact on gold prices and other commodities.

"We could really see other markets, like gold, push up through that $1,300 level. We could see silver recapture $18. We could see oil prices — they've already got some bullish fundamentals buoying them — but with the dollar selling off like this, you are probably going to see that … recapture $50 again," he said Wednesday on CNBC's "Trading Nation."

And analysts at CNBC are not the only ones forecasting a breakout for gold and silver.

Gold:

Gold hit its highest in almost seven weeks on Monday, boosted by a struggling dollar and U.S. economic data that has cast doubt on whether the Federal Reserve will raise rates again this year.

Spot gold was down 0.1 percent at $1,267.7 an ounce at 1337 GMT from an earlier $1,270.98, its highest since June 14. It is on course for a two percent rise this month.

"Dollar weakness is driving the gold price. It's not just against the euro, it's against most major currencies," said Commerzbank analyst Eugen Weinberg. "U.S. politics is a mess and U.S. data has not been inspiring."

"We think that there is more upside on gold," said INTL FCStone analyst Edward Meir in a note. "A combination of a weaker dollar and falling U.S. bond yields should propel the precious metal higher, with North Korea being a wild card." - Reuters

Silver:

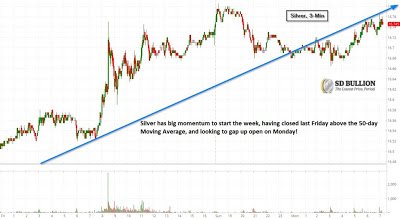

What a difference a week makes. After struggling early on last week, after a hesitant Fed and a lip-stickypigGDP estimate for the 2nd quarter, the silver price is breaking out here early Monday morning in the pre-market action. Rally possible as early as today.Silver solidly punched through and closed above the 50 day moving average on Friday. Today looks to be a gap-up at the open. Silver can break-out to the upside in a big way here! – Silver Doctors<iframe width="560" height="315" src="

" frameborder="0" allowfullscreen></iframe>

https://steemit.com/steemsilvergold/@midastouch/gold-bullish-embedded-stochastic-1-290-1-300-usd-is-next

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit