Is it any wonder that Janet Yellen intimated earlier this week that the Fed may be done with interest rate hike program following today's very disappointing Q2 GDP numbers and subsequent revisions lower for prior quarters? Perhaps the economy is not as 'transient' as Mother Felon believes.

Needless to say, this economic outlook here on July 28 didn't do much to boost stocks or the dollar, which are both moving lower in the markets, however it seems to have sent a nice signal to gold and silver, which has so far moved decently higher in early and mid-morning trading.

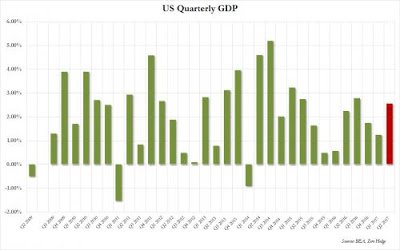

In the latest double negative whammy for the economy, not only did Q2 GDP print fractionally less than expected, at 2.6% vs consensus expectations of 2.7%, but Q1 GDP of 1.4% was also revised slightly lower, from 1.4% to 1.2%, while the Fed's favorite inflationary metric, core PCE, tumbled from a downward revised 1.8% to 0.9%.

PCE rose 2.8% and was the biggest contributor to growth. Business investment, net exports and federal government spending were also positive. Inventories, residential investment and state and local government spending were drags on growth

The BEA also released its annual update of GDP figures using "newly available and revised source data" for the 2014 - 2016 period. From the fourth quarter of 2013 to the first quarter of 2017, real GDP increased at an annual average rate of 2.1 percent, the same as previously estimated. For all of 2016, GDP was revised down slightly to 1.5%, from 1.6% previously. For 2015, growth was revised from 2.6% to 2.9%. for 2014, GDP was revised to 2.6 from 2.4% previously

GDP prints starting in Q3 2016 and through Q1 2017 were all revised lower. One amusing finding here is that following the revisions, Q3 2014 GDP is now said to have been 5.2%, while that abysmal Q1 2015 GDP print which was blamed on the weather is now 3.2%. - Zerohedge

<iframe width="560" height="315" src="

" frameborder="0" allowfullscreen></iframe>

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The Fed will be monetizing with reckless abandon soon. QE to infinity is near. There are only two end-game scenarios to the Fed's QE adventure: 1) Default or 2) Hyperinflation. They'll choose 2 - and blame it on some macro event or nebulous econo-babble theory.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit