The word "frugality" gets a bad rap. It is a critical component in your wealth formula and something the rich know exactly how to manage.

Let's define frugality from a wealth standpoint

Simply put, frugality is the art of NOT buying stuff.

It is the one thing that you have control over, whether in good financial times or bad. If you make a lot of money, you can still control frugality. If you lose a lot of money, you can still control frugality. Frugality is best seen as a habit rather than something you consciously have to administer. And like all habits, it takes 20+ times of repetition for them to become subconscious. You can start implementing the art of frugality at any time, and if you apply discipline and consistency, you will become wealthier.

We are talking about simply NOT spending money. You see the thing that most people forget is that STUFF in your life is a liability. Liabilities are bad, unless they are intentional. You might have an ethos in which you manage liabilities for some reward, and in that case liabilities have their place. Those that borrow money for real estate investments, for example, understand the power of liabilities and wrestle them like a lion tamer. But one mistake can be fatal. They understand the risks here, and in that case liabilities have an important role in their strategy.

But for the majority of us, they don't. They sap our mental energy, risk our emotional well being and take our focus away from our true mission.

Why is STUFF a liability? Well if you purchase a physical good, you have to store it. That requires real estate. Sure, it might be as small as a diamond ring, but you still have to store it. You have to protect it. You have to worry about it. You don't want to lose it. Maybe it is worth so much that you have to spend money on a safety deposit box rental at your bank. Maybe you have to buy some big alarm system in your house for the risk of theft. Maybe you sit awake at night concerned about someone stealing your STUFF. Hence, it is a liability.

The physically larger the item, the more liability. If you bought some new sports car, you have to store it. You have to maintain it. Sure, you love the feeling of driving it down the road. People look at you and nod at the wonder of the car. But 99.9% of the time, the car sits in a garage depreciating in value. Maybe you can believe that one day you'll sell this car at some celebrity car auction and make millions. Trust me, that isn't going to happen. You will probably sell it at a massive loss when you find yourself in a bind and need some cash. Your investment of time & money in that car will disappear, and then you will just look at it from the perspective of regret.

Stuff has a financial cost way beyond its acquisition cost

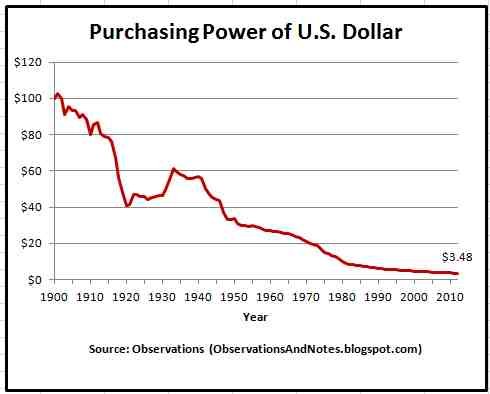

The money that is required to acquire stuff comes at a cost. First, the value of money depreciates over time meaning that if you park money for a period of time into something that is not liquid (e.g. you buy something), that money will be less value organically due to natural inflation. This is a substantial cost. Consider the following graph:

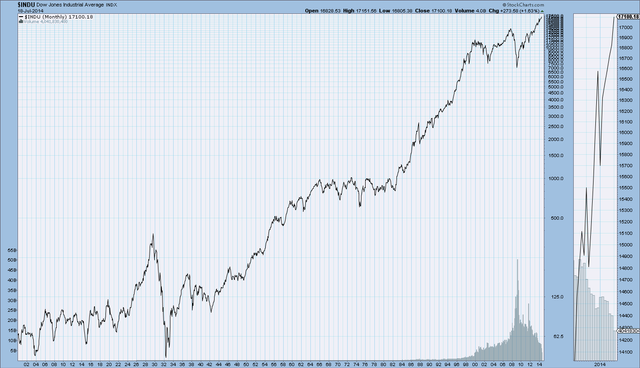

You can see how the value of a $USD over 100 years has dropped from $100 to $3.48. Yep, that is the value of a dollar. Horrible. In contrast, the value of an investment in the stock market, has a polar opposite curve:

So to counter the loss of value of $1, if you had invested it in a blue chip stock in 1910, you probably would be far richer today than if you bought something with it.

Frugality isn't just for Ebenezer Scrooge

But this is so BORING! Who wants to live a life like Ebenezer Scrooge?

Nope, not for me. Money isn't about coveting and hoarding. Money is about freedom if you are doing it right. You see it is not a boolean argument (programmers will understand me when I say that). It isn't a True or False thing. Frugality is a sliding scale.

You can live a full and rich life, surrounded by those that you love, in a financially secure and independent manner, and be frugal. Maybe you can be mega wealthy and have that too. Personally I doubt it. If you spend too much of your valuable time worrying about money, then you are doing it wrong. Money should not sap your time & energy. It should GIVE you time and energy. If you are doing it right.

So if the one thing you have control over is not spending money, then you should master that skill. Frugality is simply the mastery of not spending money.

Stuff stops you from portability and travel

You live on this world once, and for a finite amount of time. On your deathbed chances are that you won't regret not having more stuff. You will regret the things you didn't do, and the loss of the people in your life. Stuff is a distraction from the truly important aspects of life.

One of the most common traits of those that retire is that they immediately want to travel. This is because they immediately get time back and want to use it to broaden their minds and have those experiences that only travel can bring. But if you are surrounded by possessions that require maintenance, you can't travel for long periods of time. If you have to burden someone else to look after your house, turn over your car engines, keep an eye on things, etc. chances are that they won't do it at a level that you would, and you will find yourself on the other side of the world being told of some adverse event that occurred that disturbs your vacation and peace. Stuff requires attention, and this is attention that isn't necessarily welcomed in your life, particularly if you intend to travel.

OK, I get it. Don't spend money

Well that is part of the message. I am not saying you should live life in deprivation. Unless you are specifically choosing that as a part of your life strategy - then that's great and I applaud you for following a strategy that is making you happier.

But for most of us in the western world, we are living with the constant pressure to take money from our wallet and give it to someone else. Often for a false return. So you have to be educated to the true cost of buying stuff, and the true cost of ownership.

The 3x rule

If there is one thing in this article that you can take away and burn into your brain it is this:

$1 saved = $3 earned

Let's break this down. If you work a regular job, you have to go to work each day. That requires a decent car that will get you there, most of the time. It requires that you fuel, register and insure that car. It requires that you park that car. It requires that you share roads with millions of others in the same boat as you - roads that need to be repaired, etc. and this is reflective in taxes you are charged. You probably have to wear nice clothes or a uniform. Unless this is provided to you, you may have to spend thousands on suits & ties, nice shoes, etc. You probably need makeup, get your nails done, regular hairdressing appointments, etc. to appear worthy of your job. There is a cost associated with earning money that you wouldn't bear if you didn't have to.

If you are a freelancer or a small business owner, there is a fixed cost to trade. That could be rent, insurance, computers, Internet, electricity, that has to be paid each month just so you can keep the doors open, so to speak.

When you eventually earn money, the first thing that happens is you are obligated to account for that money. This requires systems, time, engaging with CPAs or attorneys to make sure you are in compliance, etc. If you are a regular salaried worker, the taxes are pre-calculated and taken from you BEFORE you even get the money. And there is all the other deductions like social security, payroll taxes, unemployment insurance, etc. What you end up with is a far smaller percentage of what you actually got paid.

This is a racket. This system is designed to extort money from anyone without their consent and where does it go? Into the wealth accounts of those you don't know, have never met, maybe a faceless corporation or government department. You have no control over what they do with that money - it is no longer yours as much as you might believe the fiction that you have any influence over political will or direction. You are simply being extorted in the same way the mob used to shakedown people for "protection".

Then all the bank fees that you are subject to, in order to store the money. Your bank will also attempt to extort money from you by way of bank fees, overdraft costs, merchant fees for using credit/debit cards, etc. If the vendor is subjected to a 3% fee to take your credit card, they have built that into the price of what you are buying, so you are really the one paying for that.

You see if you didn't have to earn the money, you wouldn't be subjected to all of these costs of keeping it.

Turn this on its head. If you didn't need the money, because you were not an "out of control spender" then you would not be working 3x as hard to make it. That is time that is being sucked from your life and given to someone else. Time you will never get back. Time that only becomes more and more valuable as you progress through life towards your final end.

So for each $1 you save, that is $3 you don't have to earn. Simple.

It isn't just about saving

Although many people try and turn frugality into a FUN experience, and adopt the life of minimalism, it isn't for everyone. Some of us gravitate to that naturally. Maybe it is because of how you were raised. Maybe it was some past experience that taught you the value of money. Those who lived through the 20th century, particularly the Great Depression or war times, appreciate the value of money due to not having any. You don't unlearn that. But those of us who were raised through the wealthiest period of western economics, haven't got that memo yet.

Money needs to be appreciated for what it is. Having it reduces stress. Having it reduces the need to constantly earn it. But having it alone won't work. You saw the charts of how money degrades over time. You need to do something with it, in order to reveal its true value. And that is to purchase assets with it that generates some sort of passive income. Income that doesn't require any of your time or energy to make. Dividend income, rent, etc. These forms of passive income are critical and I will start to discuss them in future blog articles. But unless you have a grounding in the first thing that you have control over, that you can do today whether you have any money or you don't, you need to first embrace and understand frugality.

Make a conscious effort to put money into your life strategy

Put down the credit card right now, and let's make an effort to define your "mission". You need to establish some sort of framework for your life. Something that equates to happiness and peace for you. Whatever that might be. Maybe you have been hypnotized by the media that it is about buying that new car, new dress, new iPhone, whatever. It isn't. "Retail therapy" is an evil thing. It is not to be celebrated or used as some panacea for a void in your life. If you believe that, you are wrong and immediately must stop and confront your misguided belief system. This is critical. Don't accept that spending money is going to give you any form of positive psychological response because it only creates hoarders and poor people. If the media is telling you otherwise, they are LYING to you.

Money should support your wonderful life - not be a replacement for any part of it. And the one thing that will enslave you to work is the lack of money. So stop spending.

One thing that you should consider is that for every $100 you spend, have at least 48 hours of delay time. This means before you sign on the dotted line for some commitment, you need to stop and walk away. Live with the decision of whether you need it, and then X times 48 hours later, think again if you want to do it. If you do, then you have at least seasoned the idea and not made it a reactive response to some stimulation. You have engaged the left side of your brain and thought through it rationally and with some scientific or mathematical critical thinking. Maybe you still will need to spend the money. 8 times out of 10, you probably will realize you don't need to.

So in the end, you have the power here. You control spending. No "luck" is involved. Seize the power and realize the true cost of spending. Maybe adopting some form of frugality is the answer. You decide. It's your life. Enjoy it and be at peace.

Need to follow this basic advice. I just spent money on lunch and boba after. Its so easy to spend and we never think about it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well you gotta eat. The thing is that focusing on the little things is good, but you get only little results. The bigger items that we forget about (like do you need that car, are you living in too big a house, etc.) are often overlooked and consume most of our money. Make a budget of everything you need to spend on. Then really critique the budget and question every line item. Then you can make substantial impact.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has received a 5.43 % upvote from @boomerang.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @beunconstrained!

You raised your level and are now a Minnow!

Do not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got a 5.71% upvote from @upmewhale courtesy of @beunconstrained!

Earn 100% earning payout by delegating SP to @upmewhale. Visit http://www.upmewhale.com for details!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @beunconstrained! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got a 2.68% upvote from @booster courtesy of @beunconstrained!

NEW FEATURE:

You can earn a passive income from our service by delegating your stake in SteemPower to @booster. We'll be sharing 100% Liquid tokens automatically between all our delegators every time a wallet has accumulated 1K STEEM or SBD.

Quick Delegation: 1000| 2500 | 5000 | 10000 | 20000 | 50000

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post had been curated by the @buildawhale team and mentioned here:

https://steemit.com/curation/@buildawhale/buildawhale-curation-digest-10-18-18

Keep up the good work and original content, everyone appreciates it!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit