“Don't look for the needle in the haystack. Just buy the haystack!” – John C. Bogle

The purpose of this "Index Funds" strategies is to create an easy to follow mid-long term investment strategy, where you bet on the rise of the Cryptocurrency Market Cap and not on a single coin.

The strategies spread your investment across the top 10 coins. Together these coins hold around 90% of market cap. The strategy is meant for holders who do not want to deal with day trading.

Visit my first post on Index Funds for a detailed description of the strategies

UPDATE: Strategy 3 was removed after week 12 because it kept under performing.

Results from Week 13

First, let’s look at last week values

BTC has maintained its value over 10k however, it has seen another reduction by a 10% this week. Most of the coins right now are in the red compared to last week. The biggest drops were from Ripple losing 22%, Iota by 13% and Nem 17%. However some have also gained Specially EOS with 36%. Ethereum went up by 6% and Stellar by 18%.

Special mention to Steem for also increasing in value, this is thanks to the Weiss Rating which listed 5 coins above BTC in score. These were: Ethereum, EOS, Cardano, NEO, and Steem!

How about the investment?

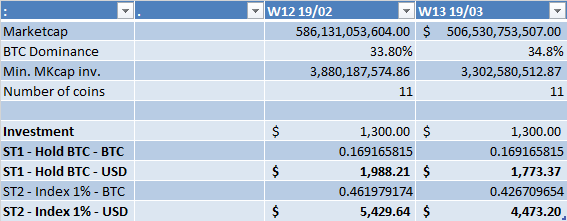

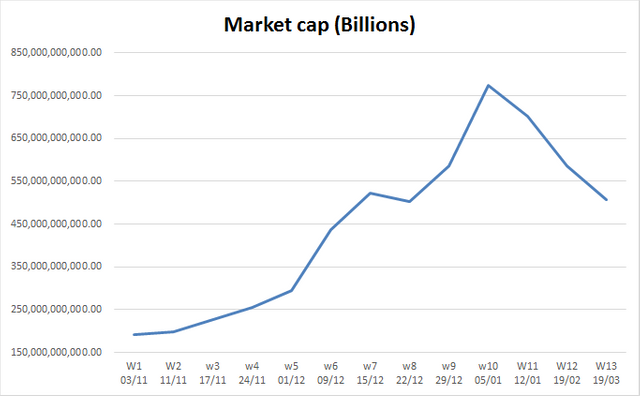

Market cap decreased from $586B to $506B,, $80 Billion loss! The Market cap continues to deflate. We can just brace and hope for the best the upcoming weeks. As mentioned, usually during January the market cap goes down. And with the new futures closing by the end of this month we can expect a rise soon.

Looking at the graph below, we are at the same levels of the last small correction on week 8, this is a crucial moment as we can expect a rise if the past weeks were a correction of the fast increase or we are actually starting a bear market.

BTC increased dominance with a 34.8%. All coins invested still hold 1% above market cap (excluding BTC) established. Strategy 2 decreased bitcoin value of investment from 0.4619 to 0.4267 BTC

Following the strategy 2 rules, EOS was bought again and Dash was sold.

Strategy 2 is still the winner of this week!

The initial investment has kept to a 344% initial value Following Strategy 2

DISCLAIMER: These investment strategies are only for educational, experiment and research purposes. I am not a financial advisor and always with high volatile investments, there is a high risk involved. Trade responsibly and never invest money you are not comfortable with losing.

As a former stockbroker, I agree with diversifying, and thus spreading the risk.

I also agree with commenter @pervi that this strategy is overcomplicated by the necessity of multiple exchanges and wallets. Hopefully that will have a streamlined solution soon.

For myself, I am holding a selection of coins, but I have different criteria for vetting them, and I am also not holding as many; I have a small positions six coins to date.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are right. I am thinking of doing a new percentage portfolio strategy along this one which focus on coins supported by ledger

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice concept. I have the same opinion as you when it comes to deversifying. The only problem I see is that it can be very complicated holding 10-15 different coins, cause they all have different wallets and stuff.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is true, some of this coins can be stored in a nano ledger, but indeed either you keep them in an exchange (always dangerous) or have multiple wallets.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@originalworks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit