In no particular order, here are a bunch of reasons you should not be buying stocks:

There’s a reason why buying stocks is so easy.

Think about it… What is the process of buying stocks?

Well, first you open a brokerage account with one the many different major players. There’s Charles Schwab, eTrade, Interactive Brokers, and about a dozen other companies you can choose from.

Then, you simply link your bank account to your brokerage account. Once you have some money in your brokerage account, it’s off to the races. You can buy and sell stocks in an instant all with a couple clicks.

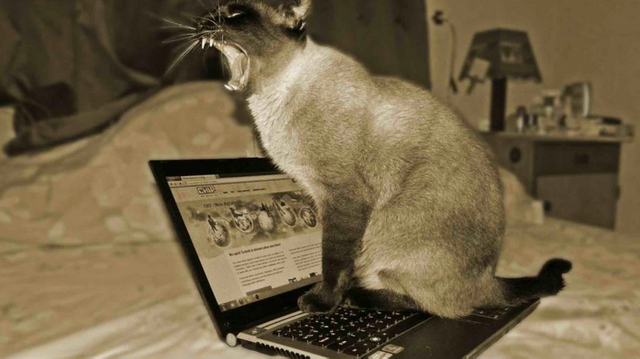

In fact, there are even stories about cats walking across people’s home computers and accidentally executing trades.

Seriously. A cat. Can trade stocks.

This means there is almost zero barrier to entry for people who want to trade stocks… and that’s how the brokerages want it. Because they make money off of every trade. So, they want you to buy and sell as much as possible. They’re not making money off of stocks… they’re making money off of you trading stocks.

The information you’re using to buy stocks is not hard to get.

Ever heard of Yahoo! Finance? How about Google? Bloomberg?

These are all free websites that you can go to and find out all kinds of information about different stocks and the companies they represent.

You can look at all of their valuations, you can review their financials, and you can read what analysts think about certain stocks.

Again, this is all free and readily accessible information.

So how do you get an advantage over other investors? The answer is: you don’t.

Yes, you could do more research than someone else. You can stay up later at night staring at a computer screen trying to figure out what stock is the best buy… but at the end of the day the actual information you are reviewing is not a secret that you are discovering. Everyone else can see the same thing you do.

Some of the best investments out there involve a level of secrecy… meaning that the general public doesn’t know about it or it’s very difficult to get information about it. If you can invest in things where you have an advantage, then you’ll be setting yourself up for success.

In the stock market, it’s almost impossible to have an advantage.

You massively overestimate yourself.

You think that you can get 50% returns. Don’t worry, everyone thinks this before they start trading stocks.

Here is what happens… You start looking at stocks that have had massive run-ups. You think to yourself, “Duh! That was so obvious why that stock went up 300%! All I have to do is find a similar stock before it goes up 300%!”

And then you go out and try it yourself. And you absolutely ruin your account. You end up buying a bunch of stocks that you think are going to explode higher. But… they just crater into the ground.

You think you know a lot about the markets, but the reality is that you are lost in the jungle.

Again, you overestimate your ability. And more importantly you lose perspective.

Have you ever watched one of those finance channels on TV where you see all the stock tickers scrolling across the bottom of the screen?

Of course. We’ve all seen that. It’s an overload of information, but it’s also intoxicating. The colors, the fast pace, and the thought that you can make lots of money make this an addictive habit.

It’s literally like sitting in a casino with all the flashing lights, interesting sounds, and smell of money in the air.

The problem is that you completely lose perspective of the bigger picture. While you are focused on trading some tech stock, there might be a bigger story going on outside of your little world. Something like a geopolitical crisis or decision by a central bank.

Do you know what a Bloomberg Terminal is?

This is a Bloomberg Terminal:

Source: Bloomberg

Basically, a Bloomberg Terminal provides news, price quotes, and messaging across its proprietary secure network. It’s what most professional investors use, as it provides a vast amount of information about what is going on in the markets.

And it costs $25,000 per year.

So, let’s assume, for argument’s sake, that your information source should cost you 1% of your total portfolio. That would mean that you’d be trading an account with at least $2,500,000 in it.

The point is that investors who are trading big money are using expensive tools that give them an advantage… but they are trading the same stocks that you are. Who do you think is going to win at the end of the day?

Do you know what HFT is?

HFT stands for ‘high frequency trading,’ and the strategy is exactly what it sounds like.

Basically, trades are executed in fractions of a second with each trade making a tiny percentage. But, if you do this multiple times a day with large amounts of money, the profits can add up quick.

And here is the alarming part… HFT-ers have been caught in the act of front running the market. Basically, this means that they can see big trades going through from regular investors, and then they make a trade in the short amount of time in between the normal trade.

Oh… and here is another thing… Did you know that many HFTing companies physically moved their operations to be right next to a stock exchange? They moved there because the time that information takes to go through wires is fastest if you’re located right next door to the exchange.

You want to compete against those guys?

All you have to do is make a 1% return a day.

Easy? Right?

Try it, if you think it is.

You might have several days in a row of making small gains. Hell, you might even do it for a couple weeks.

Then you’ll have one day where you erase all of your gains in a single trade. And you have to start all over again.

How do you know what is going on in the company?

Yes, it is a requirement that all companies that are listed on public exchanges disclose their financials and internal business.

However, much of that information is significantly delayed, and recently many companies are reporting using non-GAAP accounting.

GAAP stand for ‘generally accepted accounting principles,’ and it’s essentially what all companies stick to. In other words, it’s like a rulebook that all companies use so when financials are reported, everyone is using the same metrics.

So what is non-GAAP accounting? It’s exactly what it sounds like. It means that you are doing accounting that is not consistent with other companies. When you use non-GAAP accounting you can manipulate the valuation of a company in a ton of different ways.

Investing in multiple different stocks does not mean your investments are diversified.

So you have a balanced stock portfolio with tech, commodities, consumer goods, and some REITs? No matter what happens in the world your money will be safe?

Ummm… no.

A diversified portfolio doesn’t mean that your brokerage account holds a bunch of different stocks.

A diversified portfolio means that you own some real estate, some foreign currency, some physical gold/silver, some collectibles, some private equity, and some stocks. (And now, some crypto-currencies!)

You’re an outsider.

Look at the stocks that you hold. Can you call up the CEO of any one of those companies?

Probably not.

Don’t worry, neither can 99.999% of the other stock holders.

Taxes.

Let’s say you buy and sell the same stock in the same year. And let’s pretend that you tripled your money.

That’s amazing… and you’re going to have to pay taxes on whatever your gains are, just like ordinary income (so subtract the percentage of whatever tax bracket you’re in from your profit).

Obviously taxes are something we all live with. But, when it comes to trading stocks (especially when you are doing it in less than a year, which is a short-term capital gain), your tax liability can be massive.

You are investing in stocks based on what other big investors are buying (or selling).

Form 13F is a filing with the SEC that institutional investment managers with over $100 million in qualifying assets must submit. And it’s available to the public.

So, any investor can see what the best investors in the world are buying and selling. You literally get to look inside of their portfolio.

But… there’s a problem… this filing is delayed by several months. So many times, the stock that you think you should buy has already been bought AND sold by that big investor.

You may think that you’re copying a great strategy, but in reality, your buying into a trade that has passed its prime.

At the end of the day, do you have any control over the company you are investing in?

Have you ever had to evict a tenant out of a rental property?

It sucks. It’s not fun at all. Not only is it very frustrating, but there is an emotional component that is very stressful.

However, once you get that bad tenant out of your rental property, it’s like a weight has been lifted off of your shoulders. It’s a great feeling to have control over your investments because you can personally sway the direction of how things go.

Stocks? That’s more like crossing your fingers and hoping for the best.

Investing in general is gambling and the stock market is like the main floor of Caesar’s Palace.

I don’t care what anyone says… Investing is just sophisticated gambling.

A lot of people find that offensive. They’ll say something like, “NO! Investing is not gambling! Investing is all about finding the opportunities and then committing capital and energy to ensure that the investment grows and becomes successful.”

Well… yeah… that’s 100% true. But, at the end of the day you are making a wager that something will work.

If you invest in a company that you think will be successful in the long term, then you’ve probably done a lot of work. You’ve researched the industry, you’ve looked at the company’s financials, you’ve done due diligence on the executives, and you’ve looked at competitors.

AND THEN, YOU MAKE A BET THAT THE COMPANY WILL BE SUCCESSFUL. Betting is gambling.

Yeah, you might not be chain smoking cigarettes and sipping cheap whiskey at the bottom of the Hard Rock Casino… but you’re still making a bet.

Investing in the stock market is boring, stressful, and it makes you a weirdo.

Now, I’m all about making money, so don’t get me wrong…

But… tell me which you would rather do:

a. Trade stocks while sitting in a dark room all day, staring at a computer screen, eating crappy food, drinking caffeinated drinks, cussing out loud every time you see your screen go red…

…or…

-

Now… with all of that said, I personally invest in the stock market. Owning stocks is a form of diversifying your wealth, so you should consider adding some exposure if you aren’t already. And if you ONLY invest in the stock market, you need to consider all of the exciting and profitable alternatives out there.

That's right! A cat can trade stocks ;-) (and I'm not bad at crypto too)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit