Dear Reader,

They say money is the root of all evil but they forget it’s the owner of the money that ultimately dictates what it’s used for. Money isn’t “bad” and shouldn’t control us, but our current economic system is based on fundamentals that allow it to control us while benefiting and yielding to a group of select individuals and corporations.

Contrary to popular belief, debt can also be an asset to expand and acquire. If used responsibly and managed correctly, the rising global debt benefits central banks but traps the everyday worker in financial decay.

Mainstream media and the public education system will never teach the difference between money and currency or how to use debt as an asset, let alone how to make laser-guided investments, but once you learn how the system truly operates, you can create a positive relationship with your wealth and the economic system we have all grown up in.

The mindset of the wealthy is not to view money as an obstacle, but as a resource. Resources are used to grow, acquire, and sometimes pay for themselves.

On the other side, the majority of the workforce exchange their time for their money and ultimately fall victim to inflation, after which they’re pressured to work more for something that’s worth less to maintain basic living standards.

This is why corporations invest so rigorously into creating businesses built around automated systems and why technologies such as A.I., the Internet of Things, and blockchain are reshaping our workforce: the rich create the infrastructure (work hard once) and then generate sales with little effort and time (income for a lifetime, smart work), then compound and repeat!

Taking Action With Ideas the Mainstream Media Won’t Tell You

6 Ways to Protect and Compound Your Wealth

Tap into what the rich are doing because it’s not just for elites; in fact, anyone can implement this mindset and strategy into their finances today, maintaining living standards and purchasing power by making money work hard.

- Real Estate: Monetizing property is an effective strategy for creating a compoundable and external income that makes your real estate an asset, rather than a lifelong liability.

Strategically acquiring property can increase the success and growth of your real estate portfolio. Not all real estate is created equal. Consider the demographics of the area and the average income of the surrounding population. For example, if there is a large concentration of universities in the surrounding area, students and professionals would be an ideal target market for tenants.

And beyond that, from a prudence perspective, with land, you can build and grow on top of it. Resources such as food, electricity, and businesses can all be grown, generated, or built on top of a piece of open space.

At the time of writing (mid-2019), real estate is a large component of the “everything bubble.” Turning your properties into cash-flowing assets means YOU EARN even during the deepest bear markets and are not relying on market volatility. This logic is also important with dividend-yielding stocks (more on that later).

An important thing to note about monetizing your property is the independence it gives you as an investor. Buying property in the hopes it will be worth more in the future can work, but it isn’t a guarantee. Turning it into an asset reduces risk and makes your portfolio more robust.

- Passive Cash Flow, P2P Lending, and Income Investing

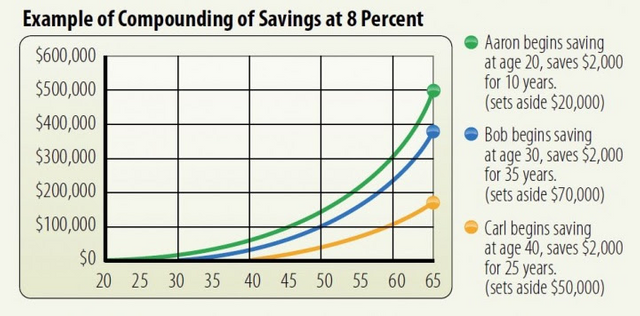

Savings accounts are often creating a delusion of wealth. It’s always good to hold some cash, BUT keeping your life’s savings sitting in one place may hinder your target retirement date. Fiat in your typical high-street bank account is literally decaying from QE-driven inflation. By not making your savings work for you, you are committing financial suicide!

Lending platforms such as PeerStreet.com keep your savings ahead of inflation with yields ranging from 4-10% annually. As you earn interest and keep reinvesting, you are passively increasing your exposure to potential returns without risking your own capital in the process.

- Hedging Against Long-Term Inflation With Long-Term Stocks and Dividend Compounding

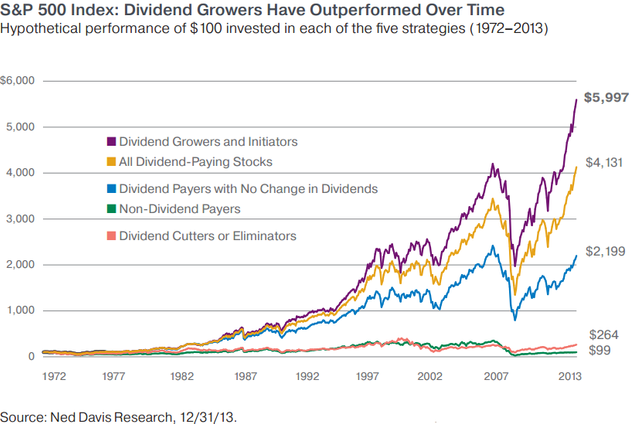

Purchasing shares of longstanding companies is a staple for most investment portfolios. Investors usually make moves into companies for the long-term. As a result, it’s important to be robust and monetize your investments by considering companies that pay shareholders a dividend.

Working out a company’s dividend yield will give you an estimation of how much you can expect to gain. Income investors will seek shares that provide a regular and stable dividend yield that provides income during market downtrends.

Income investors seek companies that reward shareholders because of their stronger performance during bear markets. It’s likely that investors seek these types of shares as a hedge against market downturns on top of protection against QE-driven inflation.

Dividend stocks and high yields give investors the ability to monetize their portfolio, which would otherwise be exposed to market valuation and inflation. Companies like Anheuser-Busch InBev, with its 4% yield, protect your capital against inflation, which currently stands at around 2.0% in the U.S.A.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

- Precious Metals

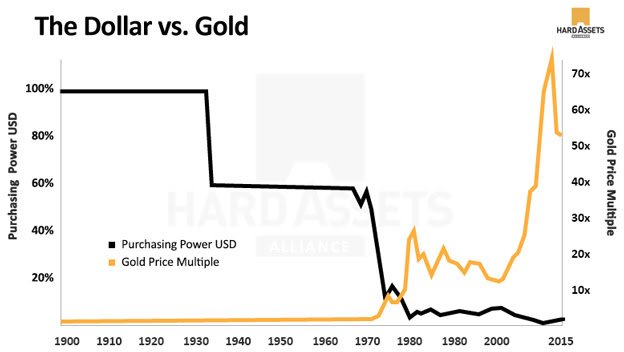

Manipulation in precious metals is obvious and shows no signs of stopping, but history has always shown that holders of gold and silver usually end up better off as the decades pass.

Holding precious metals during the last century would have protected your family’s wealth against a 90% drop in purchasing power. Despite this obvious realization, many ignore gold and its proven track record.

Despite the drawn-out bear market in precious metals, charts do not lie, and allocating a piece of your portfolio to gold and silver could benefit you and your family in economic and geopolitical uncertainty at a later date. Being prepared is better than being caught off-guard!

- New Assets on the “Block,” Cryptocurrencies, Set to Become Money 2.0

Emerging technology can generate fortunes for quick-thinking investors, and the earliest investors in FAANG stocks are testament to that.

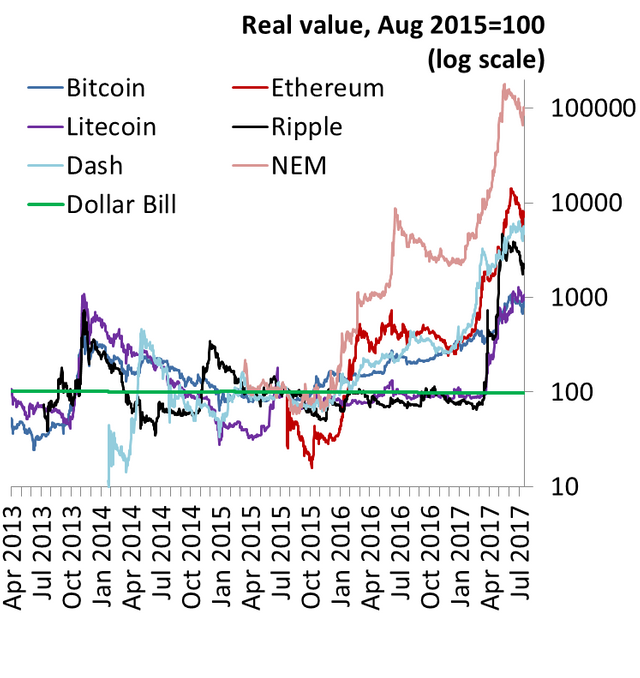

Using blockchain technology, cryptocurrencies provide a whole new asset class that had amassed a combined $800 billion total market cap within a decade at their all-time highs. Despite the 2018 pullback, digital assets are still MASSIVELY UP from 2016 and early 2017, and the fundamentals have only grown.

At the time of writing, cryptocurrencies have outperformed every other asset class YTD in 2019, with a 100% price rally in Bitcoin alone.

Cryptocurrencies are a long-awaited solution to the underlying problems within our economy. Led by Bitcoin, cryptocurrencies provide a diverse and new method to how we define and exchange value, potentially becoming money 2.0 and eventually integrating with the Internet of Things that emerged in the early ‘90s.

- 21st-Century Yields?

Income investors are beginning to take action with some digital assets, such as Tezos (XTZ), EOS (EOS), and others that allow investors to earn a passive income.

By a method called “staking,” you can earn a residual income for holding your coins and gain access to the features of the respective blockchain. Airdrops are also an extremely popular feature where holders get “airdropped” new digital tokens.

The arrival of blockchain tech and cryptocurrencies could be viewed as the next phase after the rise of the Internet, which gave us the Internet of Things. Many now call this next “phase” the Internet of Value!

The world is changing fast and capital acquisition needs to be a game that is strategically played by anyone who wants to live a higher standard of living and have freedom in their lives.

Prosperous Regards,

Kenneth Ameduri

Chief Editor, CrushTheStreet.com!