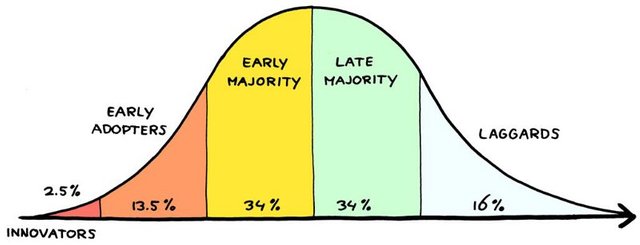

You may have seen this graphic before. It’s the technology adoption curve.

A new age is beginning

There is a massive mostly unseen tsunami of technological disruption forming at the moment, and it’s coming in the form of Cryptocurrencies with Bitcoin being the first. You can also call this new wave, the Internet of money.

Right now, we are kind of in the 1993–1994 creation period during the early Internet days. The Facebook and Twitter of Cryptocurrency are still a decade away. However, with the rate of innovation and adoption increasing, it is probably closer to 3–5 years away. Thousands of coins[2] and hundreds of new companies are being spawned all with different blockchains or tokens, working on solutions to solve new problems or bring current services into a brand new decentralized world.

We are nowhere near the early adoption majority phase of the curve yet. It is still really hard to use Cryptocurrency. If you currently have a diverse portfolio, the safest way to hold your assets are in multiple wallets, some web-based, some in desktop and mobile apps, and some even in hardware wallets. You have to secure many of them with 2-factor authentication, and remember to save your private keys and 24-word phrases in a safe yet easy to access location.

For a quick example, let’s take IOTA, which by the way is the only Cryptocurrency without a blockchain (it uses a technology/network called The Tangle to handle its transactions). In order to store IOTA you have to first download their wallet, then you have to find a safe to use seed generator, then download it (I used the JavaScript NPM version). Next you have to run a few commands in a terminal window to create your private seed. Now other digital wallets are a bit easier to use, but they all add to the complexity in investing in Cryptocurrencies.

When sending out the first emails back during the early Internet, you not only had to know a bit of code to create that email, but it then took about 10 minutes to send it. Now a tweet sent across the globe in an instant can start a revolution.

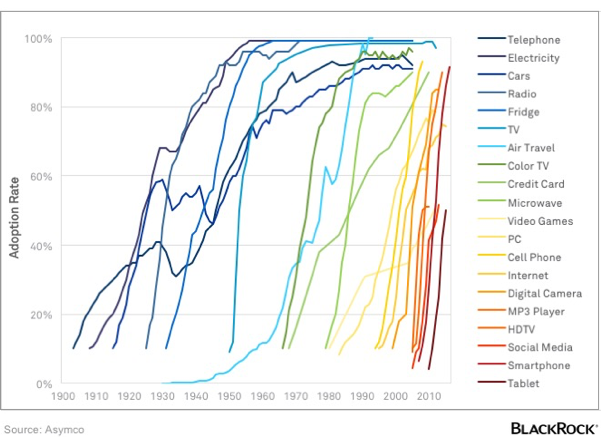

Here is another chart we should take a look at.

Above is the technology adoption rate graph, where we can see how long it took various technologies to get widely adopted. Electricity and the telephone took several decades before reaching 60% adoption. And as we near the digital age we see adoption skyrocket, especially with each generation getting up to speed faster than the last. Kids born now are digital era natives, these kids will be the first generation bringing ownership of automated cars into the majority. They will also be the first generation completely using cryptocurrencies.

The adoption rate of money.

Looking back at the previous revolutions in money, in the 16th century there was a radical proposal to replace gold with gold certificates written on paper. Andreas Antonopoulos (A technologist and Bitcoin Jesus) from this Bitcoin video here says,

“If you think people find Bitcoin weird, imagine a time when they told them gold is no longer the money, bits of paper are… they were like you gotta be kidding me. So that idea was so radical, it took 400 years before it became broadly deployed in mainstream society.” — Andreas Antonopoulus

However let’s go much further back than that. From about 100 thousand years ago to about 20 thousand years ago, there was no form of money. Anthropologists have shown that no tribe or civilization based their trade on barter. [3] Here is a great talk about money myths and bitcoin from Wences Casares (CEO of Xapo).

Early tribes relied on an inefficient subjective type of ledger. They needed to remember who owed them what. If you slayed a woolly mammoth and some of your friends asked for some meat, you’d need to remember how much meat you gave to who, so later you can could ask for similar favors. However, this was a system that worked for a very long time, longer than any other form of trade and commerce.

The 6 characteristics of money

Scarcity

Divisible

Transportable

Durable

Recognizable

Fungible

Bitcoin is orders of magnitude better and superior than Gold in every single characteristic of money. It is scarcer (Only 21 million will ever exist), divisible up to a 100th million, transportable like a digital file, and more durable since you cannot destroy a Bitcoin. It’s cryptographically recognizable and fungible.

The same characteristics exist for practically every cryptocurrency out there as well. Some are inflationary based like government issued fiat. Some are deflationary with a set amount. And a multitude of others have different attributes and use cases. With IOTA it’s for machine to machine transactions for the Internet of Things, Ethereum, NEO and Lisk are platforms for creating decentralized applications in this new space. ZCash and Monero have extreme privacy meant for dark web usage. District0x tokens are for voting and the list goes on.

All these cryptos have created a new asset class as well as usher in the new digital revolution of money. Each of these tokens and their blockchain ledgers have speculative value and it is time to jump in and join us in the lunatic fringe. It is a fun time now, right before the early adoption really starts. Welcome to the Internet of money.

If you want to support me, you can donate me Ethereum:

0x39f9fa7e1B85000005F94a0b092dAF2891373344

I feel it's still early as well. More people are starting to hear about BTC, but have no idea about alts and they have no idea how BTC works. I think once BTC hits $5000 more people will hop on board, and then $10,000 will be big and lot's of people will start researching BTC. Just my guess though...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very well said. Found this article via twitter and I'm glad I did. Followed and upvoted :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a good perspective of where we are at. It's easy to forget that most people just don't get it still, when you're on here and everyone is talking about crypto like it's normal.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@crypmate nice read, great post ! I found you on my daily money top list and strongly believe your post is undervalued, so I upvoted and resteemed your post ! All the best !!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent piece, though I will dispute where we are on the curve. We are beyond Pioneer and into early adopter phase. Granted, this timeline is moving slowly, but it always corresponds with the difficulty of adoption. In this case, the learning curve is significant. I believe that will accelerate dramatically over the next two years and we will be early mainstream by late 2020.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great read and Thank you. I first heard, and looked into bitcoin in 2012, and was talked out of it. I got in early May, just before $2,000, I just wish I had more to invest. I thought people were crazy when I heard predictions of $5,000 by year end, I knew it would rise, but $5000? Now I know there is no limit!

Thanks again!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great write up! I read BTC to $6000 by year end and $13,000 by FEB 2018. Only 1% of people know about BTC, once we hit 3%--KABOOM!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

take the red pill, enjoy the ride

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

so true. I have to remind myself that it is still early in the game and that most people outside the crypto bubble have no idea how it works.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit