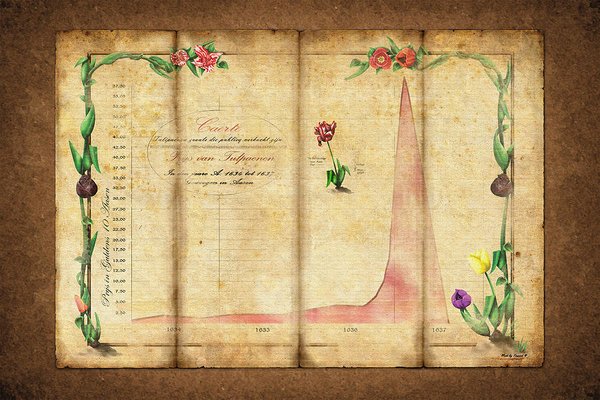

The first bubble in history was the Dutch Tulip Mania of the 17th century.

The ''Semper Augustus'' the dutch imported from Turkey was very popular. The demand for it was hard to keep up with and the price went through the roof. Clever traders stockpiled the bulbs they had, to sell them later on for a higher price. So the the price kept going up.

This went on for a while and the people started to believe that the price of tulip bulbs could do nothing but rise. This caused that the demand only got bigger and bigger and that more and more people bought them. So the price went up again and again.

Tulip bulbs became impossibly expensive. In 1635 one tulip bulb was sold for 6000 guilders (former dutch currency), the price of a mansion on the Amsterdam canals at the time. The strange thing was that no one wondered wether a tulip bulb was really worth that much.

That's what you can call quite a bubble. The tulip bulb market kept on doing well until 1637 when the price of tulip bulbs suddenly dropped just after hitting it's ceiling.

People suddenly realised that you could grow a tulip bulb yourself. The bubble burst.

The price plummeted to just a fraction of the record price. The traders and speculators who still had the bulbs in stock, couldn't sell them anymore at the high price they paid for them. They had to accept big losses and a lot of them went bankrupt.

You could wonder why the dutch at the time didn't realise the tulip bulb market was in a bubble. They must have been crazy to be willing to pay the price of a house for one single tulip bulb. Right?

But look at the world today, stock markets around the globe keep moving up because of the central bankers who just can't stop their printing presses and keep interest rates impossibly low. Not only government debt, but all debt is getting way out of hand.

We are living in somewhat the same situation as the dutch traders in the 17th century. A situation where nobody knows what is normal anymore and everything gets crazier day by day. Even the leaders of the financial and monetary systems are taking uncharted actions. At least in my opinion.

We'll have to see what the consequences of all the QE programs from the recent years will be. I personally believe we are heading toward a financial disaster on the world financial markets somewhere in the near future.