Have you ever imagined a world where Bitcoin is the de facto monetary standard everything was measured against?

What impact would a switch to a new economic order built on the foundation of a deflationary currency with a mathematically defined cap of 21 million coins, have on interest rates, debt, and price stability?

The only way to approximate an answer to this question is to attempt to draw historical parallels to gold, and attempt to extrapolate these into the future.

Bitcoin was, after all, created to emulate some desirable traits found in the precious metal, such as its scarcity, or the self-regulating nature of mining.

So, what could one reasonably expect from a world where Bitcoin is the planetary yard-stick every asset, and every single transaction is measured against?

For starters, debt-levels would be far lower, as nations and individuals would have to live within their means.

Unlike in the current monetary system, where the expansion of the monetary supply is viewed as necessary in times of crisis, the total supply of Bitcoin is hard-coded at 21 million coins. It cannot be changed to accommodate the whims of delinquent debtors.

So, while a Bitcoin Standard wouldn't necessarily preclude banks from engaging in fractional reserve lending, they would be forced to do so without the implicit assurance of government assistance in case of a bank run, or a similar event.

Any financial institution operating at anything below full-reserve would be at risk of failing.

Similarly, Central Banks would be unable to carry out quantitative easing, and affect both the bond and equities market.

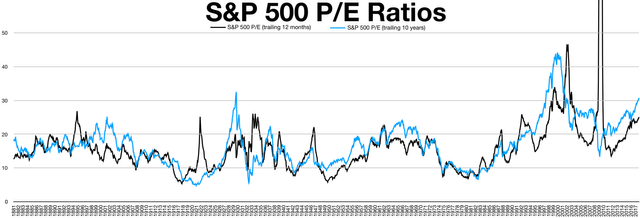

Without demand from central banks, stock markets around the world would be trading at a much lower Price-to-Earnings ratio.

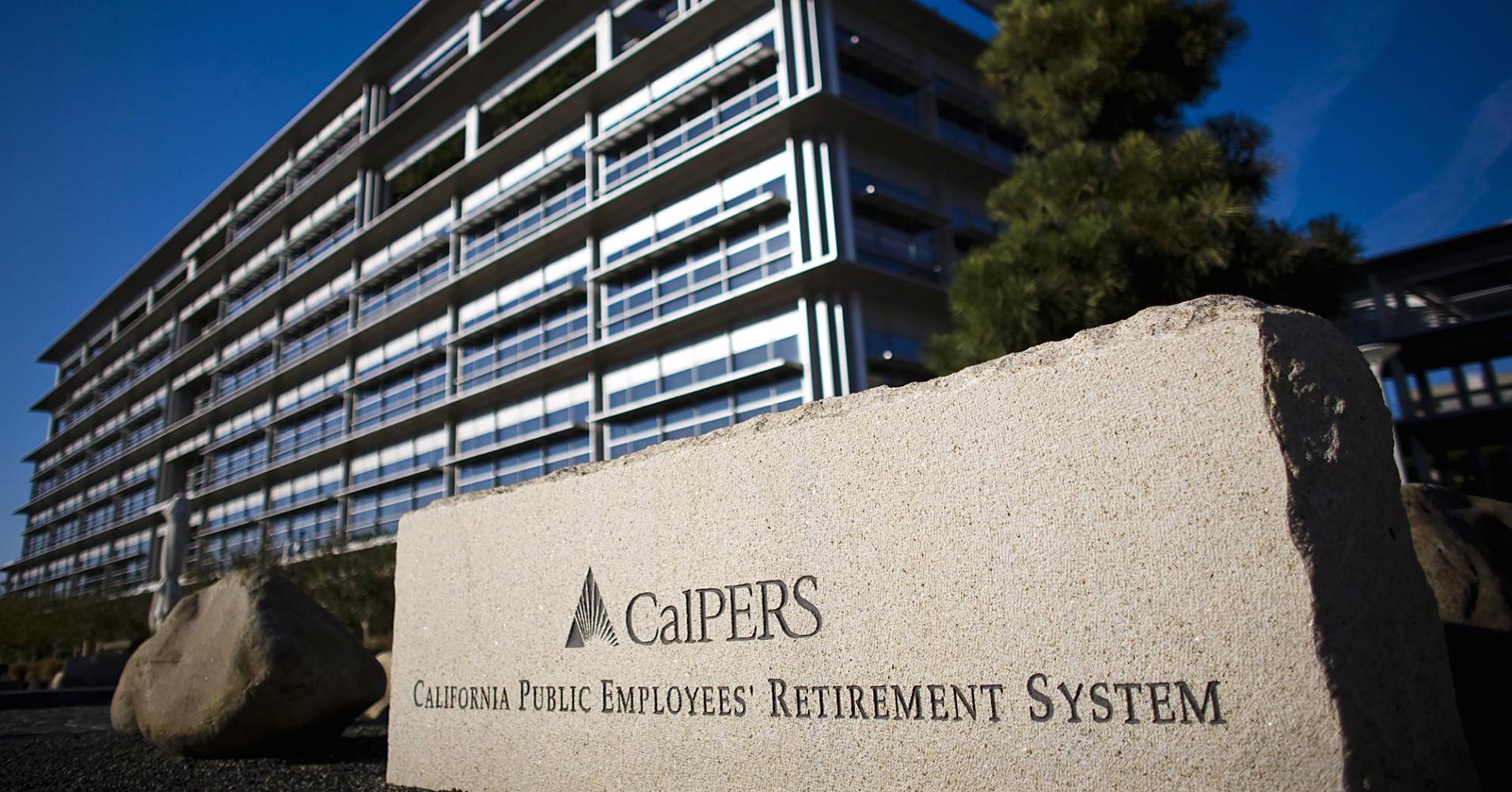

This would, in turn, be damaging to the viability of pension funds, and sovereign wealth funds.

Pension funds make certain assumptions regarding return on investment to determine contributions by enroll-es. Certain large pension funds, like CalPERS out of the State of California, expect annualized returns on equity of approximately 7%.

Well, probably not you and me personally, because we'd have acquired immense wealth through our investment in cryptocurrencies, but on a macro scale it would imply a massive shift in spending and saving habits throughout the world.

In short, one wouldn't be able to paper over the holes in the economy anymore, and kick the can further than the road, like we've been doing for decades now.

Mal-investment, and essentially unsustainable enterprises would be identified, and weeded out by market forces almost instantaneously.

But what about consumer prices? If gold is any indication, a Bitcoin gold standard would probably exacerbate short-term price volatility. As such, basic necessities like groceries and gas would likely go through alternating periods of inflation and deflation.

On the other hand, on a longer time-frame of years, decades, or centuries even, prices would remain stable with a slightly deflationary bias.

To use an oft-cited example, an ounce of gold back in Ancient Rome would have bought you a fine toga, a hand-crafted belt, and a pair of sandals. In 2018, and with that same one ounce coin, you'd be able to purchase a nice suit, a belt, and a pair of shoes.

So, you see, the price of most items against gold hasn't changed in centuries. Prices are only variable when viewed through the lenses of inflationary fiat currencies.

An increase in the demand for gold has historically translated into an expansion of mining output, which in turn puts downward pressure on the price, causing them to mean revert.

Similarly, in a diametrically opposed scenario characterized by falling prices with large numbers of gold producers going out of business often has the effect of buoying up the price.

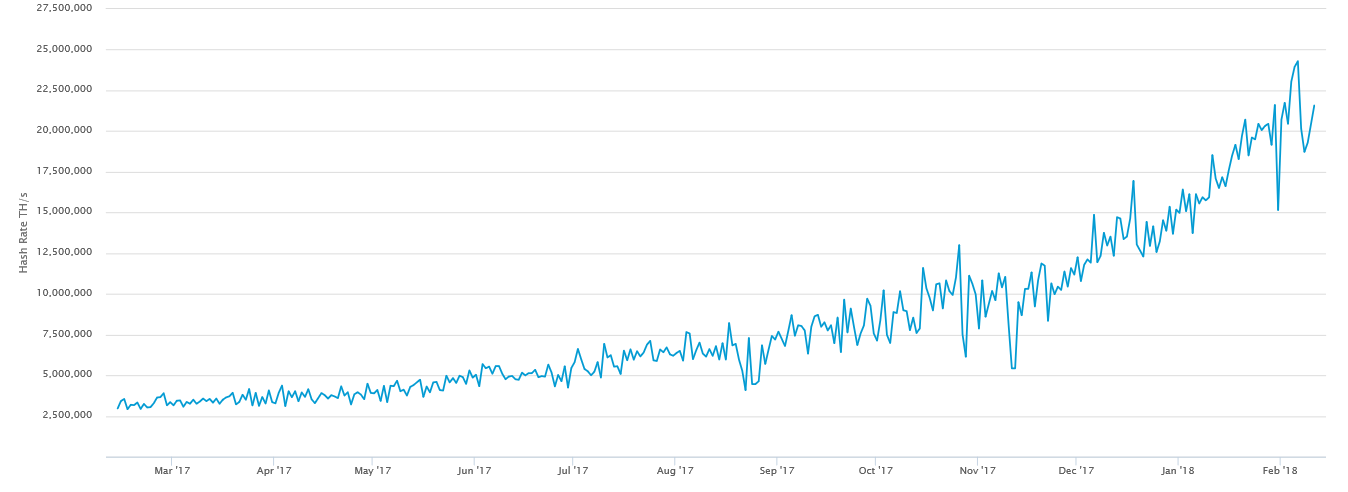

This mechanism has been brilliantly emulated in Bitcoin through the difficulty adjustment, which guarantees the continuation of the network even under extremely adverse price action.

A massive drain in the hash rate securing the network, would cause the difficulty to adjust downwards, and allow for hobbyist miners to pick up where large-scale industrial operations in China left off, bringing back stability to the market.

This mechanism only applies to the network hash rate, though, and not to the block reward emission schedule.

Since the rate of emission follows a Poisson distribution, with a new block being mined every ten minutes on average, no reasonable amount of hash power can realistically allow opportunistic miners to speed up the emission rate to scoop up the remaining supply in a matter of hours, or days.

Even if such a computational feat could be achieved by a cartel of governments with virtually unlimited resources, they'd ultimately reach the 21 million unit ceiling, after which the total supply would remain stagnant.

The market for Bitcoin will thus never experience supply shocks like those caused by the gold rush of the 19th century in South Africa, or by say, a technologically-feasible implementation of asteroid mining.

As a result, deflation would almost assuredly be the norm in a world where Bitcoin reigns supreme.

The $1,000,000 question, then is: Would such a system be feasible on a macro scale?

Unfortunately, I don't have a definite answer. My gut tells me such a world would at least be preferable to the reigning fiat paradigm, but I'd be interested in seeing a more rigorous attempt to model the dynamics of the world I just outlined in this article.

As always, thank you for taking the time to read this article. I'd ask you to give it an upvote if you enjoyed it, and follow me if you haven't already. See you next time!