When I was younger the magical amount was always 1 million $. It felt like when you have 1 million you don't have to worry about money ever again.

Some times later I got to speak also with a friend who said~: 1 million is not bad, but if you really don't want to worry about money at all and have a comfortable live without to have to work you need at least 2-3 million $.

Without any doubt - the more the better ^^

it is said to be Polynesia - wonderful image from Pixabay

How much is actually needed?

First of all there are only a few important points which matter:

- yearly expenses

- average yearly return

- inflation rate

- time - or better for how long time you need it

Lets make some assumptions about them:

Yearly expenses

It highly depends on where someone lifes and about the own lifestyle. It is possible to life in a high cost country like Switzerland with as much as 2000 € a month and it is as possible that this amount isn't enough in a low cost country like Vietnam. So in short words it highly depends on each own preference. As a medium value I think 2.000 $ can be seen as a comfortable monthly average if you don't life in a highly expensive place. I think it is also around the amount by what I can afford to life in my home.

Average yearly return

There we have already the first main problem. We can not expect future returns. Based of the past the S&P 500 had a yearly return of 9.8 %. Before taxes. So the net return depends than a lot on your personal tax situation - and again where you life. Some indices like US small caps made even a higher return. In my case I would have to pay 26% of taxes so the net return would be around 7% (well, it would be a bit higher, but lets calculate conservative).

Inflation rate

There we have the second big problem. Inflation is quite unexpectable and it is very, very important. The higher the inflation rate the more expensive our yearly costs get and it has a massiv impact in the long run. The only good thing is the higher the inflation rate will be the higher our returns should be.

If we consider the past and try to make an estimate for the future I would guess 2% can be around the average yearly inflation rate. If we consider that europe has an aging society we can even expect a lower inflation rate. Economies with an elderly society tend to have a lower growth and with that a lower inflation rate. We see such tendencies also in Japan. Without any doubt migration can have a big impact, but as it looks nowadays most probably we will see an aging society.

So, since we want to make a conservative calculation lets expect an inflation rate of 3%.

Time

The earlier we begin to take out funds the more money we need. I am now 31 years old (well, young :P), so in best case the calculation considers that there is always enough money. If we calculate more tight it should last at least for 60 years.

lets see some calculations

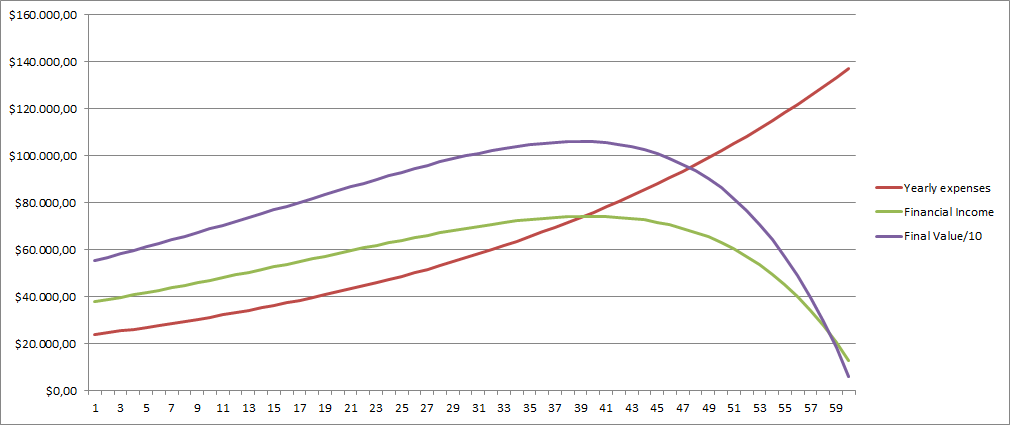

The final value is divided by 10 so that it can seen easier in the graph.

Starting portfolio value: $540.000

Yearly expenses: $2.000 / month - so $24.000 a year

7% of average annual return

3% inflation rate

With this assumptions I would need exactly $540.000 to life without to work and only with a financial income.

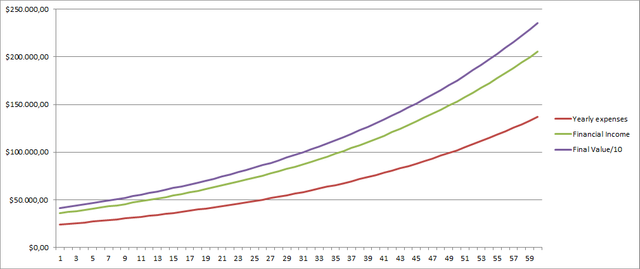

The final value is divided by 10 so that it can seen easier in the graph.

Starting portfolio value: $400.000

Yearly expenses: $2.000 / month - so $24.000 a year

if you are able to save on taxes and manage to get a 9% of average annual return (as US stocks had in past)

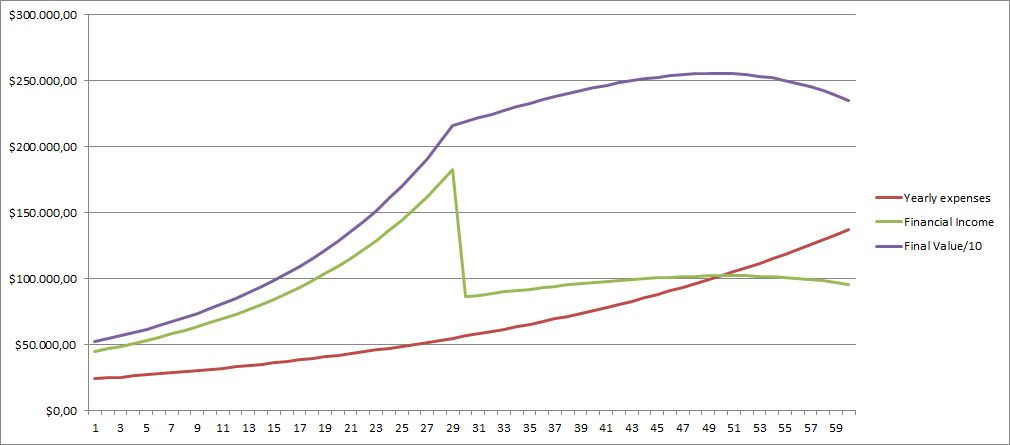

The final value is divided by 10 so that it can seen easier in the graph.

Starting portfolio value: $500.000

Yearly expenses: $2.000 / month - so $24.000 a year

if you are able to save on taxes and manage to get a 9% of average annual return and reducing it to 4% a year after getting 60. The older we get the less risk we should take

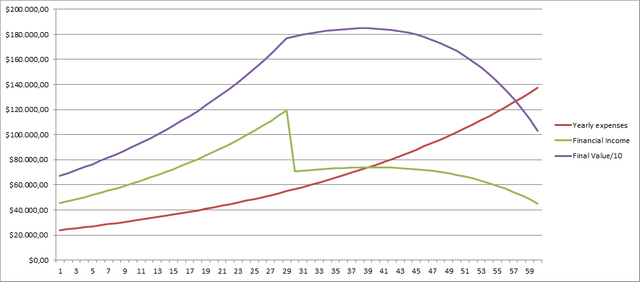

Final assumption

The final value is divided by 10 so that it can seen easier in the graph.

Starting portfolio value: $650.000

Yearly expenses: $2.000 / month - so $24.000 a year

if you are able to save on taxes and manage to get a 7% of average annual return and reducing it to 4% a year after getting 60. The older we get the less risk we should take

inflation rate as always at 3%

Compound interest

Those examples show us also how powerful compund interest is. Only a small change in the percentage of either the yearly return or also inflation rate have a massive impact on the value.

Summary

As we have seen at the end there is much less money needed than many think - at least on the paper - lol.

Requirements for it are a not to expensive lifestyle and even more important a good annual return. We can not know future returns.

For me I think 650.000$ would do it. Although I really like my job I think I would begin already at a lower level to consider to spent more of my time for other things than working.

At the end financial independance "buys" us basically one thing - time. When there is no need to worry about future incomes there will be a lot of time for hobbies and other fields of interest. Maybe there can be another way to get some small income from some hobby.

@originalworks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Vow, you seriously calculated with graphs etc. I think 500,000 would be enough for me. Are you gonna give? But my grandma passed away at the age of 106. So I'm not sure... :(

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit