Dear Steemians / Friends, today I’d like to present you an idea from a particularly interesting product: USD Senior Corporate Perpetual bonds from Asia

The opportunity here is earning a 5% yield in USD in relatively short duration bonds from systemic and strategically important Asian issuers that are high rated

The bonds’ family I like: Chinese IG rated Corporates, mostly with Government backing and / or of strategic importance, which have relatively short dated first call dates and that have a very high coupon step-up

Let alone the strong fundamentals (such Government backing, strategic importance etc), I especially like the mechanics of the bond structure, as well as its valuations.

In terms of mechanics, let’s take an example.

Huarong Senior Perpetual bond, currently paying a coupon of 4.5%, should the company decide not to call the bonds on its first call date in 2022, its yearly coupon going forward would be impacted by a huge step-up therefore they would be paying a coupon of roughly 10.5%, depending on where will the 5yrs Treasury trade at that point, as you can see there extension risk is practically inexistent as the economic incentive is huge.

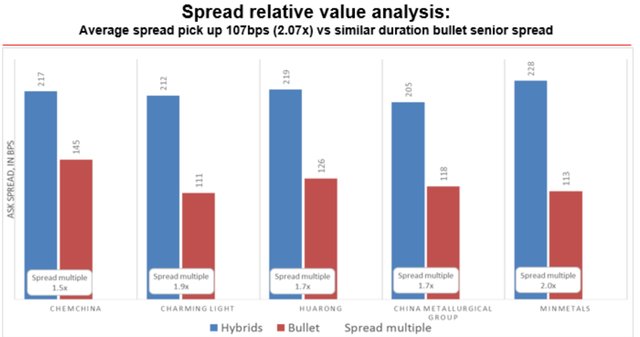

Thence, in terms of valuations I see at as a no-brainer, absolute spreads are above 200bps over treasuries, yields are above 5% in USD for short duration risk, and even more evident is the appeal of those when we compare those Perpetuals vs its outstanding Bullet bonds (the bonds that have a defined maturity), the multiple of extra spread we can get is as much as 2.0x, which is roughly 107bps more spread, more basically the same risk. Check out the graph below

Best Regards

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @fedescolari! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit