Every time there is a spike in prices for Bitcoin or Ether (upwards or downwards), it seems like Coinbase freezes up. They still have not figured out how to deal with the volume of traffic! Coinbase freezing up is potentially costing you money!

Before I explain how this costs you money, you have to understand the basics of market vs limit orders. A market order is buying/selling at the current market price. A limit order is where you specify the exact price where you want to buy/sell. In a limit order your order will only go through if price hits your target. In a market order, it's going to go through.

Coinbase allows only market orders on their website and app. This is a big disadvantage because you are buying/selling at the current price. If the price is $300 now, and you want to sell if price goes to $475, you would have to use a limit order, which Coinbase doesn't allow on their website/app. I say website/app because it's possible their API lets you do it, but not for the average person using the website.

How does this cost you money?

You're watching the prices and see a sharp dip and think, Buy Buy Buy! You login to the website, it's frozen. You try the app, it gets hung up. Once the app or website recovers and lets you login, the price has magically recovered from the sudden and sharp dip. And let's suppose you are able to login during the sharp dip, the dips last a few seconds so the odds are very much against you.Here is the one hour chart of Ether/USD for the last 3 days.

For the most part prices don't move very fast. In the high volatility period, you can see two sharp dips of over 15%. If you were to try to login to Coinbase and buy on the dip, goodluck with that! As I mentioned, the dips are quick. The dip could even be just one seller selling a large amount.

How to buy during that dip?

The answer is GDAX.com. GDAX is the sister company to Coinbase. Your Coinbase login will work on GDAX also. There are no fees to move fiat or cryptocurrency between Coinbase and GDAX and vice versa. And why would you want to go through that hassle of moving your money to GDAX? Limit orders!

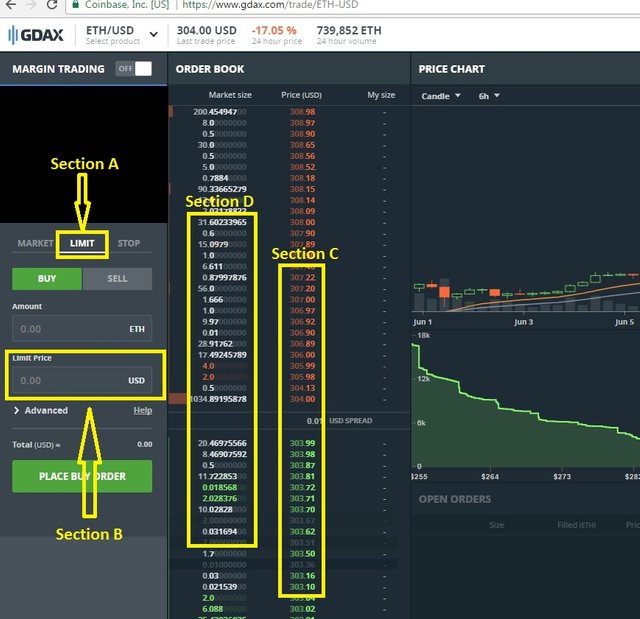

One you're logged into GDAX, find the Ether/USD or which ever currency you want to buy or sell.

- Section A: The default option is Market orders, so make sure you click on Limit

- Section B: This is where you would put in the price target per Ether that you want to buy or sell. Even if you are buying 20 Ether, this is the price for 1 Ether.

- Section C: This is the current buy and sell orders on the market from other users. Red are the sell orders, green are the buy orders. The sell orders are higher, with the lowest in this snapshot being $304. The highest buy order in this example is $303.99. You can set your target (in Section B) to whatever price you want and it will appear in this list.

- Section D: This is the quantity in Ether for that particular price.

How to profit?

As I mentioned earlier, the 2 large dips were 15%. You can go back and look at the flash crash from 3 weeks ago and see the sharp dips are about the same size. I set my buy limit orders at 15% below current price. I do stay active and look at the price roughly every 2-3 hours. As the price moves lower or higher, I'll adjust my limit order to stay 15% below whatever the current price is. With the exception of the sharp dips, prices haven't dropped 15% in such a short period of time. If my buy orders goes through on a sharp dip...I immediately put a sell order in at the pre dip price and wait for the dip to be over. Why don't I just hold onto the Ether? I have a pretty good Ether position in my portfolio already, so this is just some trading that is outside of my normal portfolio. But you could certainly buy the sharp dip and just hold on for the longer term.Sometimes I know I won't be able to monitor the price every 2-3 hours. In those cases, I'll put a buy limit order in for 35-40% lower than current price. I've done that if it's family time or when traveling.

If you are strictly looking to buy for long term, I would still suggest using the limit purchase option on GDAX instead of doing a market order on Coinbase. It will save you money.

Another useful tool

This is the middle chart on the GDAX Ether/USD page. This is really helpful to see where the buy and sell walls are at any given moment. You can use the - and + buttons to zoom in and out. The green blob on the left represents the buy orders, the red blob on the right represents the sell orders. In this snapshot, you can see that in the +/- $20 range (from $282 to $322), the red blob is bigger. This represents pressure to drive Ether price lower assuming no new buy or sell orders come in. If you zoom out to +/- $50 range ($252 to $352), you can see that the green blob is rising and there is a nice sized buy wall around the $255 price.

This chart is a good way to see where the open orders are at any given time, especially during big moves in Ether price. Keep in mind that this only represents what's happening on GDAX/Coinbase, it does not represent what's happening on Poloniex, South Korean exchanges, or any other exchanges.

Why am I sharing this?

Sharing this information isn't going to reduce any profits for me on these dips. I'm not a professional trader and this is not my job so the amount of money I would be buying/selling with is irrelevant to the huge Ether volume. Secondly, if more people started putting in buy/sell orders, it would improve the liquidity of the cryptocurrency market. If the sharp crashes and spikes smooth out a little bit more, it would help me sleep better at night. Hopefully, it'll help you sleep better at night too. In the mean time, you can make some money while the volatility lasts.Please upvote and follow me if you found this helpful!

If you don't have a Coinbase account, please use this referral link to sign up so both of us can get $10.

Happy trading!

This post received a 34% upvote from @randowhale thanks to @financialcritic! For more information, click here!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Everyone needs to read this!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree @violator. Research is key and this is some great advice from @financialcritic and an angle I hadn't considered. I encourage all my follower to also follow @financialcritic. Some excellent insight.

With ICO's, huge volatility in the overall and individual market caps, and FOMO playing a big part in driving up a lot of less than promising cryptos. I believe we have a social responsibility to work together, and collaborate our research efforts to avoid another "dotcom bubble".

What most people forget about this "bubble" is it wasn't really a "bubble" at all. This period in technological history bought us and continues to bring us some of the biggest companies we know today (Apple, Google, the soon to be replaced Facebook, Go steemit!).

There were a lot of shit "ideas" with poorly managed teams which cost a lot of uninformed investors a lot of money. We can prevent a "bubble" in all our investments by continued efforts to raise awareness of the "real world" application of blockchain technology and why, like steemit.com, blockchain tech is here to stay.

I will be releasing an article in the coming days including an exclusive "Steemit.com press release" with David Koepsell (CEO & Founder Encrypgen). David had an important meeting for the future of this promising ICO yesterday and I will be interviewing David today for the scoop (exclusive to Steemit.com).

I'm not sure how the meeting went, or even the finer details of the meeting's agenda. But I can tell you one thing. Follow me @beachbuminvestor and you will be the first to know. I really hope we can work together to get ahead of the market. The whales are coming and we need to be well positioned together. "Collaborative Approach Theory" Isn't that what the steemit.com movement is all about?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Always appreciated when one is willing to share ones experience. Am on Poloniex, Kraken, and Bittrex but

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well written but personally I prefer www.Kraken.com. Less expensive and much better charts.

Best,

@altcoinusa

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I haven't tried a USD deposit on Kraken yet, will give it a try. Thanks for the resteem!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Kraken has 4 tier levels and it takes months to get through them. I would start now, much cheaper than GDAX! I have used them a lot, so now I can withdraw/deposit $500k/daily

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I emailed Coinbase if they would support BIP148 and they have yet to respond. I assume they have countless emails just like mine and I am beginning to lose faith in them so I removed all my coins from there ✌🏽💻💸

Does anybody recommend a solid phone app for buying altcoins? Poloniex unfortunately doesn't allow you to sign into your account on the (seemingly unofficial) mobile app. It's just for prices and charts 😏

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Part of why I got out of all bitcoin as well. I still use them for Ether though.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Awesome read. Also refreshing point at the end regarding why you shared, too many people feel if it isn't a secret it must not be valuable. What you describe is simply an old trading strategy of anything with extreme short term volatility. That being said you have applied it really well and I wish you the best.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah, definitely not reinventing the wheel!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great advice.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Always happy to see new ways to work the system :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting. Good read.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Try Gemini too.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting....looks like a legit competitor to Coinbase. Will register and try it out. Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have found that GDAX is often offline when Coinbase is down because they share the same login page.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah...have to use limit orders ahead of time. So even if they go down, your order is active.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit