You know what really grinds my gears? Paying interest. In any amount. To anyone.

Unfortunately, I don’t think many of us understand or even think about how the interest on our debt really affects our lives.

I found this statistic from credit.com that figured the typical American will pay $279,002 in interest over the course of their life. I imagine this statistic is similar in many other countries as well.

$279,002

Let that sink in for a moment.

Then figure out that they would have to earn more to pay the taxes on their income, at a tax rate of 25% that is an additional $69,750.

All this doesn’t even count the years you will have to work to pay off the principle borrowed.

It’s basically $350,000 and at an average income of 50K a year it would take seven years to pay off.

SEVEN YEARS of your life working to pay the banks. Seven years.

I took this definition of slavery straight from Wikipedia. ”While a person is enslaved, the owner is entitled to the productivity of the slave's labour, without any remuneration.” Remuneration is the compensation that one receives in exchange for the work or services performed

So the owner of a slave is entitled to its productivity (income), without compensating the slave.

Debt seems similar to slavery, but a closer comparison would be indentured servitude. An indentured servant signed a contract for the debt and could at least become free after paying it off, unlike a slave. (Coincidentally, the normal contract for an indentured servant was seven years as well)

That’s why I hate it. That's why I avoid it. I want to be free. If you want an easier road to financial freedom you should be aware of the dangers of paying interest. Currently, the only interest I pay for is on my home, but I want that gone too.

I am sure some of you will tell me that in the future you will be paying off that debt with inflated money thereby making it cost less. $1000 today is way more than what $1000 will be in 30 years.

True, but do you think banks are giving you the loan to their detriment? Additionally, in an installment loan most of the interest is at the beginning of the loan – when the money is still at full power.

Still, paying interest has the benefit of you being able to use the item right away. That’s why I have a mortgage, the benefit of purchasing my home was more than the cost of the interest. Of course I chose to have a 15 year loan instead of the more common 30 year.

Still, I hate seeing that interest accumulate.

Since interest is a powerful thing, what if you could get it to work FOR you?

You could have your own force of indentured servants going out there and working to pay you back for the privilege of using your money.

One way I have done that is by funding loans on Lending Club. You could also buy bonds, government or corporate, if you wanted.

You could even take loans out to buy productive assets, like rental properties, if you can make the numbers work. Thereby paying interest on the loan, but using the borrowed money to cash flow more into your pockets than you pay out.

By using the power of interest for your own good, you can drastically decreased the time it takes you to reach your own point of financial freedom.

Imagine a day when you earn enough from your investments that you don’t have to work if you don’t want to. You have enough coming in to support your lifestyle. You have all your needs covered, forever.

Buy assets that pay you. Anyone can do this because you don’t need a fortune, you can start with very small amounts.

Small things done consistently will become large things eventually. The Great Pyramids of Egypt were built block by block over time. You can do something more to your own scale. You just have to start.

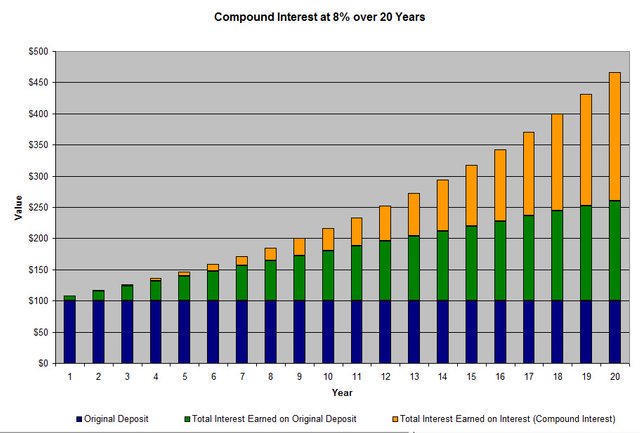

Soon you will see another magical thing happen – compound interest.

Your interest has little interest babies. The babies have babies. It starts to get out of control. People who have earned their first million after 20 years of working report getting their second million 7 years later, and their third million 3 years after that. It’s how the rich get richer.

Thanks for the article. Gave some inspiration to start looking into the situation :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Once you start looking, you will see areas where you can improve your situation. Stop making someone else rich, and get moving on areas to lessen your burden. You can do it, because anyone can!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent tips about not making anyones else rich. One step at a time to get rid of the mortages is needed here.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I may have it wrong now but I seem to remember on a 25 year repayment mortgage at 5% interest you will pay back double what you borrow. Endowment or interest only mortgages are even worse, as you dont pay off the principal, your investment must return enough to pay off the whole proncipal or you dont own your home, and then the banks can sell you more debt!

Always get out of debt as quickly as possible, if you can find a mortgage that allows you to overpay they are great, every time you have even a little spare money you can reduce your time to be debt free.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well, with your numbers it won't be quite double, my back of the envelope calculation shows it closer to 75% of the loan amount. Still, a huge amount! And you are right about the interest only, that is just selling yourself to interest hell as if you don't do anything about it. Banks sure do love them though.

A pretty good rule of thumb when you are buying a house is to not have a payment larger than 25% of your take home. I am at around 15% on a 15 year mortgage, so I have plenty of extra money that I can throw at it. I take a split way of going about it, I pay a little extra and throw the rest in a brokerage account with good dividend paying companies. When that dividend account reaches my mortgage payoff I can pay it off full.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I looked at investing but that investment needs to consistently return more (after tax) than the mortgage rate.

Its better in my humble opinion to throw it all at reducing the mortgage amount; guaranteed return in avoided interest. No tax burden.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The only problem with that is if you lose your income source and can't make the payments the bank doesn't care that you have been paying extra, they will foreclose.

If you put it aside until you have the full amount, yea you are paying mortgage interest, but you will knock it out in one swoop without any risk of foreclosure.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Life is risk; otherwise you arent truly living :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted and resteemed!!!!!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're the best @riosparada!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great write up! It is shocking how much interest people pay over a lifetime. It isn't fun to owe people or companies money. It is really tough to get on the other side of the fence and get to a point that you have enough money to live off the interest that it produces. That is the goal. Earning enough to live the dream 100% passively from investments. It is tough to do.

Resteemed!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Definitely, the best goals are hard, but if they were easy everyone would obtain them.

You have to think of when you are debt free paying no interest. Other than your normal bills and food ALL your income is free to be invested. Break it down into manageable pieces. Pay off this credit card. Then that one. Then your car. Then your student loan. Then your house. Then you have this huge amount of free cash flow. You build wealth.

Thanks for the resteem!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are right it is a huge hurdle.

Sometimes I wonder what the right balance is. Sacrificing one's 20's and 30's to pay off everything worries me in a lot of ways. It is understandable why people want to live in the NOW. You could have an ATV, a Boat, a nice car, and a nice house on payments NOW or you could actually own that stuff when you are 60. It is a tough thing to deal with.

Not to sound negative but having your own business is the true path to wealth but access to capital is almost always an issue. But then some people get rich off of businesses that have no revenue or profit. It is a weird world and the way things are valued.

Hopefully we can find a path to freedom in a shorter time frame than 30 or 40 years.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Every time I drive by some house in Tucson that has a boat I think to myself that they must be bad with money. Where is the closest place that you could even use the thing?! Then calculate the extra gas to haul it there and back, and yearly registration or other fees.

It's not like Arizona is loaded with lakes you need boats for.

When I bought my house two years ago, my neighbor had a boat. They aren't my neighbor anymore because they got foreclosed on.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I know what you mean with the boats. Originally being from Indiana we wouldn't pull boats more than about 30 to 40 minutes. These people are pulling them a hard 3 hours of highway driving. They make more of a weekend out of the situation rather than a day thing like we would do in Indiana. I was blown away last year when I found out one of the guys I played basketball had 3 snowmobiles here in Tucson. I was like WHAT??? It seemed so ridiculous but I figured he would take them up to Flagstaff or something. He takes them to a place called Happy Jack, Arizona. It ended up being some of the best riding I have ever done. The way the snow was up there A person could have went every weekend for about 2 months. There were endless miles of trails and amazing views off the rim. I couldn't believe it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I've heard of Happy Jack, even spent some time exploring the area on google street view, but haven't been. Seems like my type of place though. You take any pics from that trip?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's been a hot topic for millennia! The name for the thing you're against here is usury. I'm not surprised @creatr posted that bible verse, many world religions have at their core a strong stance against usury. I did a search and came up with this article, which I skimmed at it looks pretty interesting, you might like it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey @personz, thanks for the article. It brought together a lot of good information from many different sources and some good quotes that I might be able to use in future articles.

The ancients figured it out long ago, it is pretty simple actually. Sort of like the question to how do you lose weight? You exercise more and eat less. Yet we get new books on the subject every year.

I actually did an article about two weeks ago about the timeless wisdom of ancient philosophers and am planning on writing volume 2 this upcoming week. Hope you are able to read it.

I'm not actually against usury, I am against being on the paying end of it. :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Haha, yea about the weight loss books, right!? But I guess we like it reinterpreted for some reason.

Can't wait to read volume 2, there is certainly a lot of timeless wisdom there. Currently my favourite is Marcus Aurelius' The Meditations 😁

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice article, the very soul of wisdom. Long ago, a wise king said this:

😄😇😄

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah, this wisdom has been figured out long, long ago. Yet so many are still falling for it. Love seeing you down in the comments @creatr! :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank You! I enjoy interacting with you! 😄

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Any system with interest destroys itself after 30 cycles. Whatever such cycle may be. Shared on twitter.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Disclaimer: I am just a bot trying to be helpful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey thanks for the tweet VG!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very nice article about an issue that affects so many of us. Here in the UK, people have gone mortgage crazy by taking advantage of the ridiculously low current interest rates.

Well, nothing ever stays the same. Especially where financial institutions are concerned. The bear trap has been set, it's only a matter of time....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Low rates cause the prices to increase as more can 'afford the payments'. When the rates rise, fewer people can afford the payments leaving property owners trapped. It is a game that has been played many times, but most people are blind to it. I wonder how long until they haul in the traps to profit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good and high valuable article😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Much thanks @tanemahuta! :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I feel the same about interest as you do. Here in Sweden I’m a member in the ‘alternative’ bank, called JAK. It doesn’t charge interest on loans, nor does it pay interest on saving deposits. Moreover, it has educational activities to spread the word on the negative effects on rent to the general population and the politicians.

And, just like you, I love Lending Club. I also really love Kiva.org, which doesn’t practice interest either. And now we even have a Steemit Lending Team on Kiva, check it out: https://www.kiva.org/invitedto/steemit/by/oleg326756

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Education of the dangers of debt and interest is a worthy cause. I fear that the pull of having that shiny new thing here and now will still catch so many people - even with someone telling them the dangers.

I just spent 15 minutes looking through the loan requests on Kiva - very cool!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thought provoking! really great read, thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey! no problem - thanks for the comment :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit