From Zerohedge just now.

http://www.zerohedge.com/news/2017-05-26/all-hell-breaks-loose-torontos-house-price-bubble

In Canada, the theory has spread that real estate values can never-ever go down in any significant way – on the theory that they always go up – because they didn’t take a big hit during the Financial Crisis, and because the prior declines have been forgotten. So optimism about rising home prices had been huge. Now weekly polling data by Nanos Research for Bloomberg is showing the first signs of second thoughts. Two weeks ago, the share of people saying home prices would rise in the next six months was a record 50.1%. The following week, it dropped to 47.7%. In the most recent poll, it dropped to 46%.

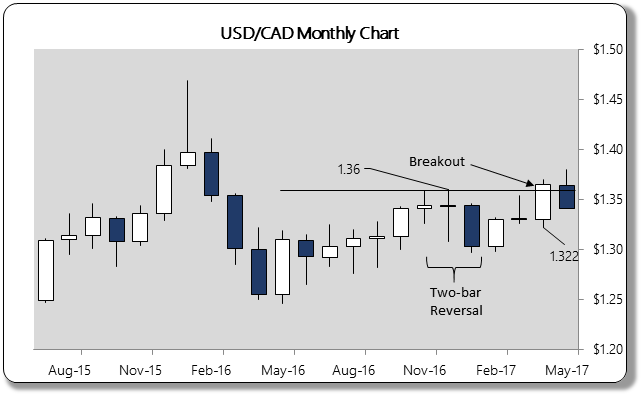

I have an article up on Seeking Alpha currently which covers the state of the Canadian Dollar and why I feel the selling pressure in it is just beginning.

It's pretty clear that, technically, weakness in the Loonie is the dominant trend. If the buyers are drying up because sub-prime borrowers can't flip bi-levels in a Toronto suburb then the whole market is teetering on the verge of collapse. As the prices drop more people will be upside down on the note. The likelihood of job loss rises since most of Canada's GDP growth has been because of this housing bubble fueling consumption brought on by capital inflows from Europe and China.

Once both the Chinese and the Europeans are forced to let their currencies drop Canada will look less attractive and the whole thing comes crashing down. And with the rise in cryptocurrencies we're seeing the first stage of some of that capital flight moving out of the debt system.

Young Canadians have been priced out of the market for a long time in most of Canada. Housing never corrected in Canada through 2008 this is long overdue.

Pension funds are bailing out sub prime lenders....going to brutal when the piper must be paid.

http://www.zerohedge.com/news/2017-04-27/crashing-canadian-mortgage-lender-bailed-out-321000-retired-ontario-healthcare-worke

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit