SUMMARY

NOTE: I will go to monthly rotation mode for this portfolio instead of weekly. Therefore, the first day of each month will be the day for the rotation selection based on the same rolling 3 month performance of each ETF.

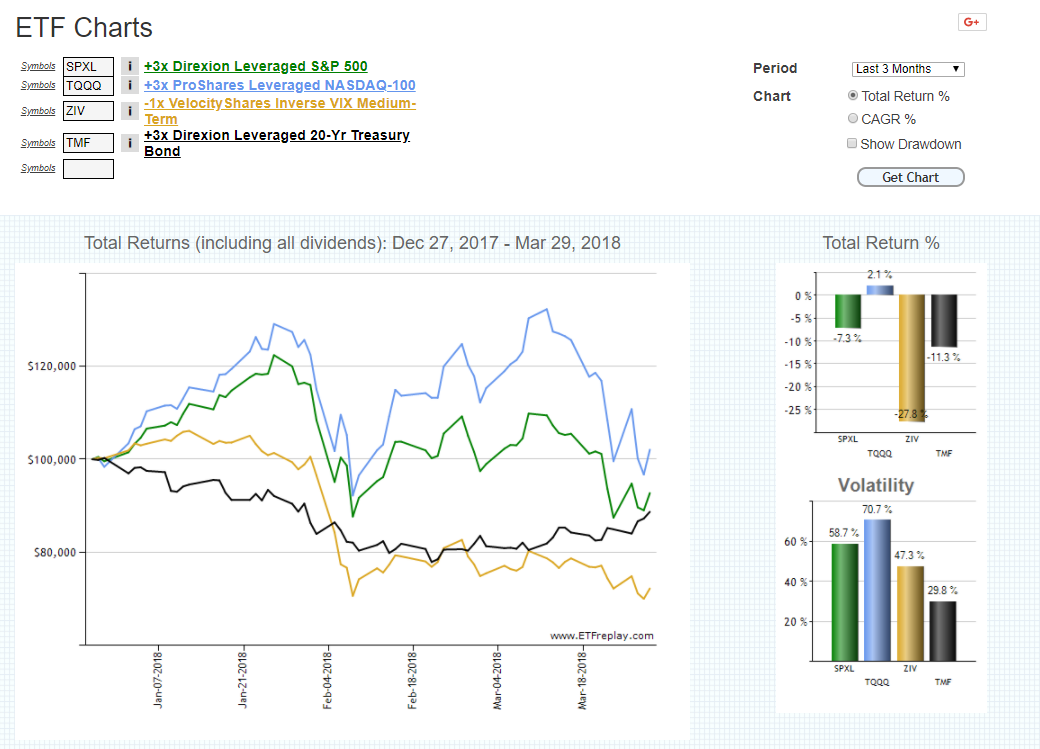

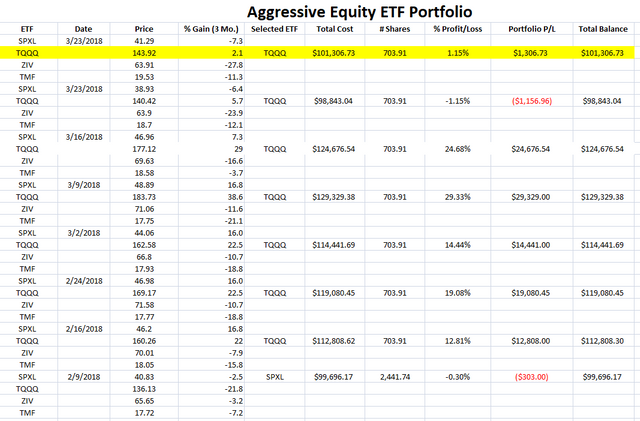

The below chart shows the 3 month % rolling performance of each of the four ETFs; SPXL, TQQQ, ZIV and TMF. All are negative except for TQQQ and so, all funds will remain in this ETF. Next month, let's see which ETF might outperform the rest.

Since inception, the portfolio has returned to positive return at 1.15%. TQQQ has a 2.1% rolling 3 month performance compared to SPXL's -7.3%. ZIV and TMF are also quite negative.

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--

Hi,

I can't buy those funds with my trader.

Any advice about there can I find them or any criteria for good alternatives for follow a similar strategy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You can use spy and edv or any combination that gives a technology, treasury and general exposure etf.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Can we please get an analysis on #KBR88? It is a new coin & looks very interesting.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

you are doing well

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

very good info here

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We are going higher. Called the lows yesterday and this morning gap down and explosion up confirms it.....

https://steemit.com/money/@heyimsnuffles/newsflash-btfd-markets-are-holding-where-they-need-to-bullish

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Happy Easter @Haejin & Friends!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit