SUMMARY

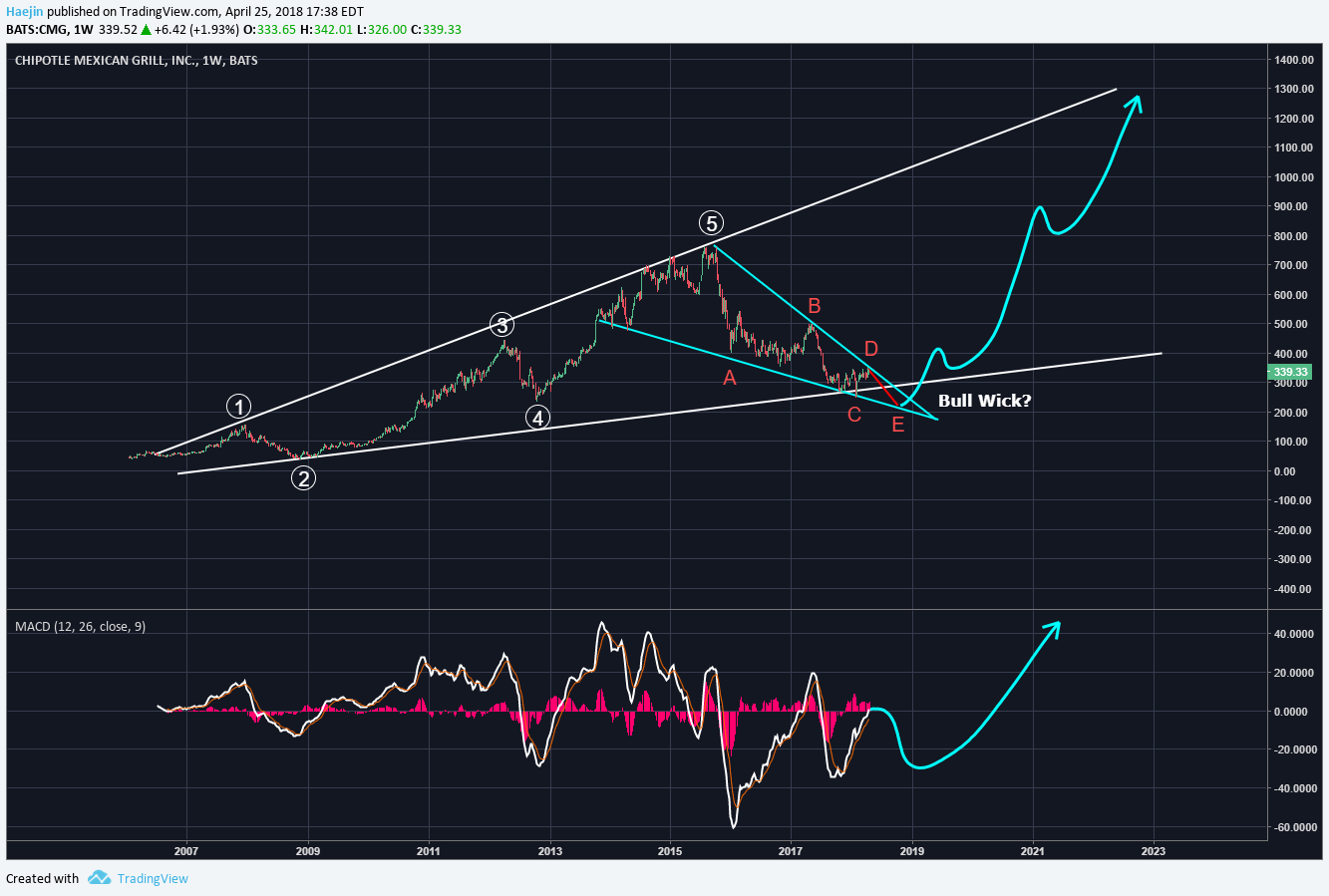

Since Chitpotle's (CMG) food contamination issues; the bane of any restaurant chain, and quarantined restaurant closures; its stock price has taken a walloping as shown in below chart. However, when viewing the trend, which should be any investor's friend, there is a broadening pattern that can be defined. CMG also put in a very beautiful five up sequence and its currently doing its requisite correction. As Elliott Waves states, news or events shall arrive to justify the need for the requisit correction...sure enough, the food contamination event arrived!

The primary analysis is shown below. There is a strong potential for a Jaws of Wealth opportunity and the blue arrow shows the attraction price can have towards the upper trendline.

However, the Alternate analysis of the scenario isn't convinced that the correction is done yet. The blue downward wedge is counting as an ABCDE and clearly, the E wave could provide a bull wick event. Now, the primary analysis would represent a price breakout at the wave D scenario; which does occur.

So, does it matter whether it's the primary or the alternate scenario? No, because the destination would be about the same.

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--

For more in-depth analysis on Chipotle...

https://steemit.com/money/@harpooninvestor/in-hot-brandname-stocks-out-cryptocurrencies

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice your prediction, knowledge, and research thank post

plz update on ELECTRONEUM AND BITSHIRE .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your confidence in corrections landing around wave 4 are impressive. #experience

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you! please continue to do smaller coins and things.

Electroneum update?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit