SUMMARY

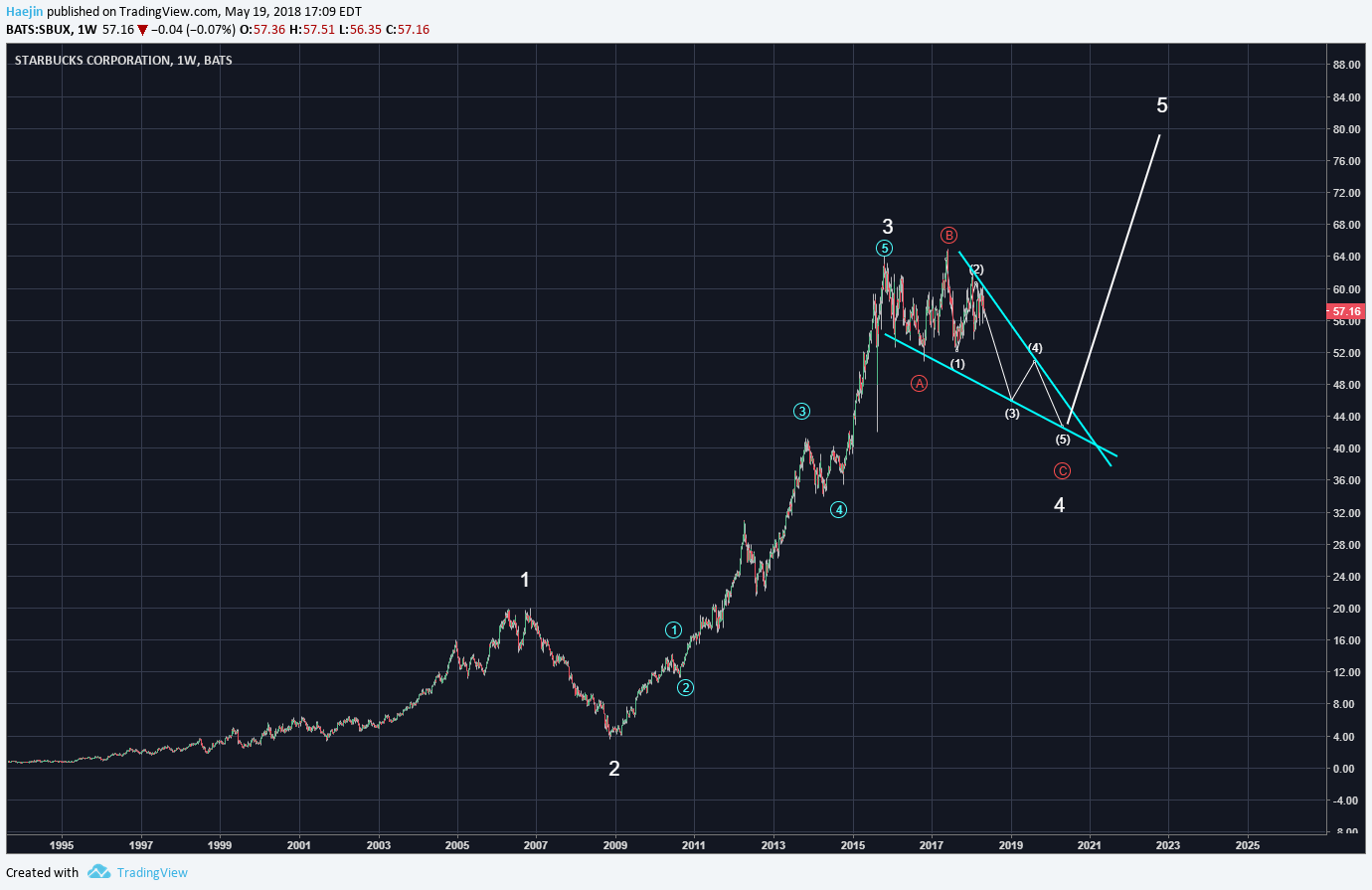

Starbucks (SBUX) has been on a tear since the Financial crisis and has delivered 1,631% in profits to shareholders. That represented the whole wave 3 (white) move. Likely, wave 4 correction is probable.

The subwaves of wave 3 qualify the label and the red ABC represents a projected correction price pathway. IF this is correct, then it's likely an expanded flat with B wave higher than the origin of red A. The subwaves of red C always consist of five subwaves. The correction pattern is also likely to be a downward pointing symmetrical triangle. Once wave 4 correction completes, the bull rise should rage on to complete wave 5. So, no, the bull run isn't done yet!

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Originally his ethos was ‘opt out of fiat and into crypto’

Crypto is an opportunity for larger groups of people to benefit, these types of companies do the opposite.

Don’t get me wrong I enjoy his analysis and appreciate it but crypto only for me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wouldn't buying shares in a public company be similar to buying bitcoin? In both situations you're transfering dollars (opting out of fiat) for assets that are not fiat currency. Also, how do you figure that "these types of companies do the opposite"? Can't anyone benefit from buying shares in a public company?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit