Starting balance: $50,274

Current balance: $51,597

+$1,323 +2.63%

Current Allocations:

Btc: 37.54 = 45%

Eth: 1250 = 28%

Cash: $13,958 = 27%

Summary of Trades since last update:

buy ETHBTC

300 @ 0.019

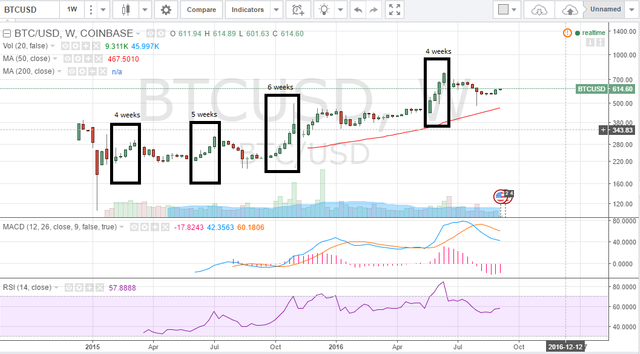

Previous rallies in BTCUSD have lasted from 4 to 6 weeks in the accumulation/up trending phase since January 2015. If this pattern holds, then we could see upward movement into late September through mid October. If this is a strong bull, I would expect an exponentially rising phase to finish the rally, most likely well above the all time high. If not, then we could see a rollover and a new down trend phase start, possibly making new lows below 160 as some EW technicians have suggested. For now, the up trend is intact and looking decent, albeit a little sloppy.

Price has moved above the 50 dma, which can be considered bullish. The upper trend line shown below was my original buy-back level if the down trend breakout from the July triangle had failed. A clean break above this will be my last scale-in buy if this line is breached to the upside. As long as the 50 dma stays above the 200 dma, then I will consider this up trend intact.

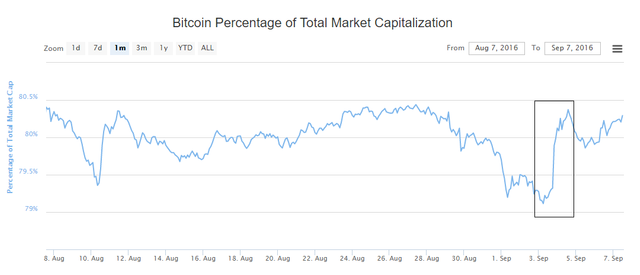

Bitcoin dominance made a strong, bullish-engulfing, impulsive rebound, which weakens my case for a collapse in bitcoin dominance.

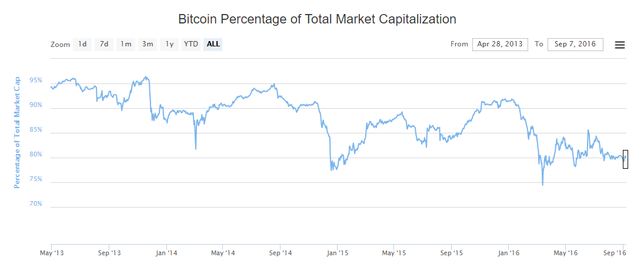

However, the downtrend is still intact from a longer term perspective. The next few weeks will be telling as to which direction this goes. A full retrace of this bullish move would be bearish. A continuation of this up trend above the 80% level would be bullish, especially a sustained move above the resistance around 80% to 81%.

Fundamental news of the VIA BTC mining pool gaining ground and testing bitcoin unlimited along with the looming hard fork for larger blocks may be aiding in bitcoin sustaining its strength. Also, segwit and lightning network continue to make progress in the scaling department. Right now, bitcoin dominance is in limbo as other legitimate projects are clearly vying for a seat at the table.

Disclaimer: This is not advice of any kind. I am merely posting a track record and commentary of my personal portfolio.

I was surprised when they halved bitcoin mining, the price didnt move that much.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There was about a 1 month delay after the 2012 halving before price started to move... and then the 2013 mega-rally started. Perhaps we could see something similar this time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit